How to Track GST Payment Status?

GST payments can be made through authorized banks either online or offline. The taxpayer must first enter into his or her GST account and generate a GST payment challan before making a GST payment. At various levels, keeping track of payments is necessary since it provides users with a record of the entire transaction. Follow the steps below to keep track of the entire payment. You can submit a ticket for GST payment problems if you have not received credit for your GST payment after 24-48 hours.

Who Can Track the GST payments Status?

GST payment status can be tracked by any taxpayer who is registered under GST.

How to Track GST Payment Status Online Without Logging?

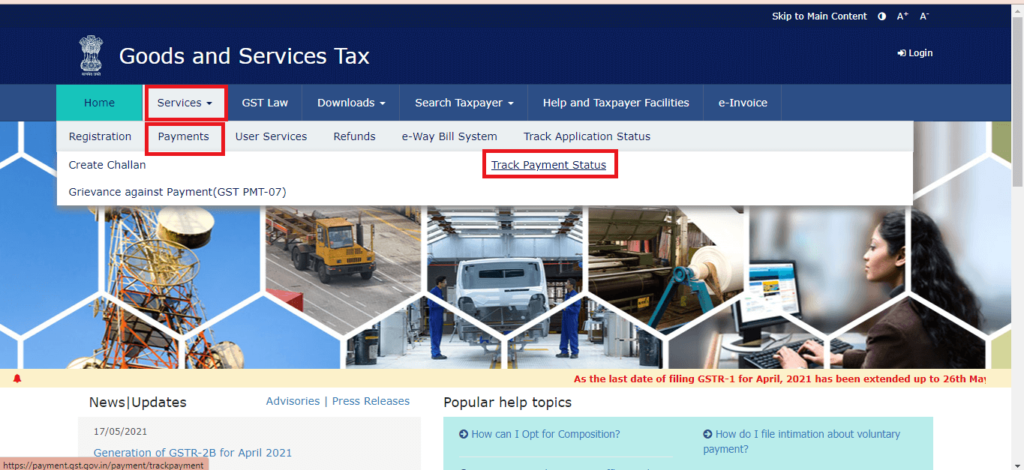

Step 1: Visit the GST Portal.

You do not need to log in to track your payment. Go to the Services tab>>Payments>>Track Payment Status on the Dashboard.

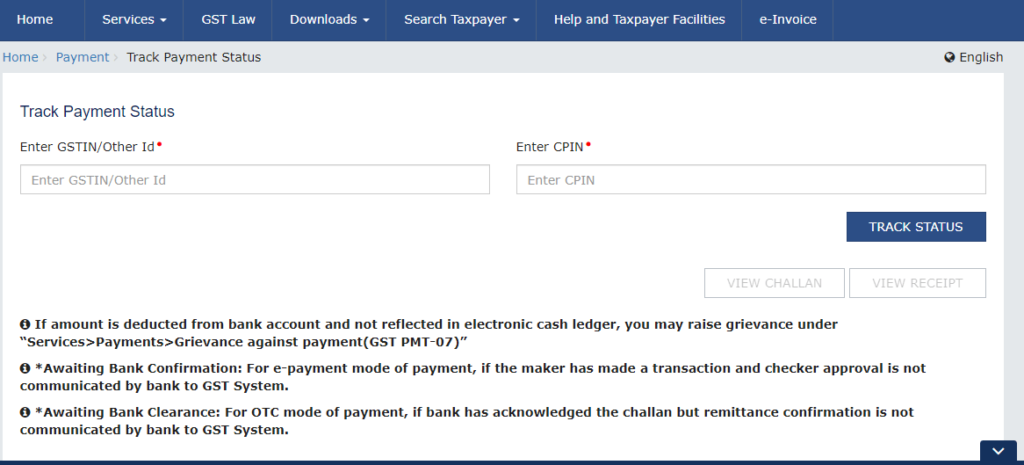

Step 2: Enter your GSTIN as well as your CPIN. After you’ve entered these two pieces of information, you will be prompted to input the captcha code and continue. Select Track Status from the drop-down menu.

The status of the payment is displayed as Paid or Not Paid.

Step 3: The challan’s status is provided for you to take action on.

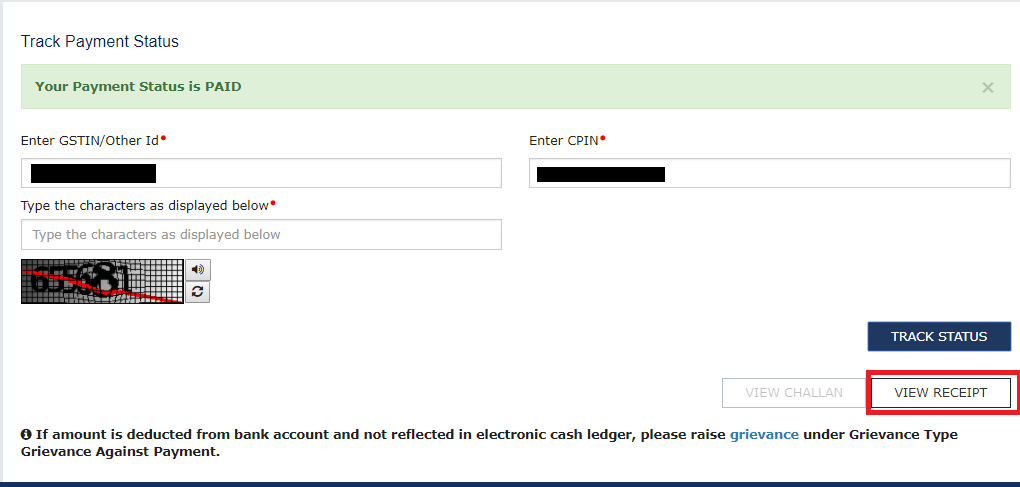

1st Case – If the status is ‘PAID.’

The ‘View receipt’ button is enabled in this situation, as shown below. After clicking the ‘View receipt’ button, the taxpayer can view and download the receipt. The receipt can be downloaded by clicking the ‘Download’ button.

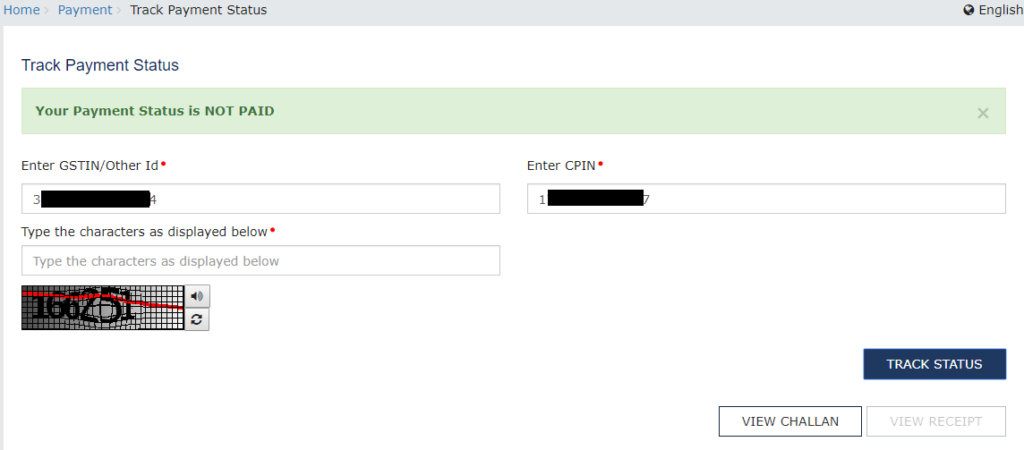

2nd Case – If the status is shown as ‘NOT PAID.’

You can save an offline copy by clicking the ‘Download’ option. To view the challan, select ‘View Challan’ from the drop-down menu. The challan will open and by choosing “Download,” you can save an offline copy.

Note: If the status of Challan is FAILED / NOT PAID and the mode selected is E-Payment, Taxpayer can click on the VIEW CHALLAN button, select the Bank, accept Terms and Conditions and click on the MAKE PAYMENT button, to make the Payment again for the Failed/ Not Paid challan.

How to Track GST Payment Status Online After Logging?

Step 1: Go to the GST Portal and Log in using the valid credentials.

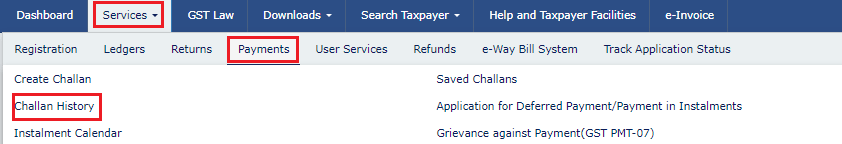

Step 2: Go to the ‘Services’ tab, then to the ‘Payments’ section, then to the ‘Challan History’ option. A list of challans is given, along with their payment status.

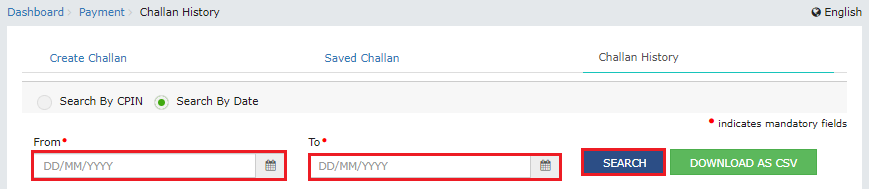

Step 3: You can search the GST payment status using Either the Date or CPIN filter.

What is CPIN? And How CPIN is Different from CIN?

CIN stands for Challan Identification Number, and CPIN is for Common Portal Identification Number. The 14-digit CPIN number is generated prior to GST payment, while the 17-digit CIN number is issued upon GST payment.

When you generate a GST tax challan online, you’ll be given a CPIN. Before generating the final challan, an online GST tax challan can be temporarily saved and changed.

You can now submit the challan after cross-checking it. GST Portal creates a challan with a 17-digit unique identity number after submission. This is the CIN number. Every CIN is a 17-digit code that is unique. It included the 14-digit CPIN as well as a three-digit Bank Code.

Points to Note

- You may file a complaint under “Services>Payments>Grievance against payment (GST PMT-07)” if an amount is deducted from your bank account but not reflected in your electronic cash ledger.

- Awaiting Bank Confirmation: In the case of e-payments, if the maker has completed a transaction but the checker confirmation has not been notified to the GST system by the bank.

- Awaiting Bank Clearance: For the OTC mode of payment, if the bank has acknowledged the challan but has not communicated the remittance confirmation to the GST system.