How to Cancel A GST (OTC) Challan?

GST-registered taxpayers are required to pay taxes regularly. The GST portal offers a variety of ways for taxpayers to pay their taxes. Cash, check, or Demand Draft can be used to pay this amount (DD). OTC payments can also be made at Authorized Banks. Smaller taxpayers who do not have access to internet banking will benefit from this. However, do you know how to erase a GST challan? If not, you’ll learn how to erase created challans on the GST site and cancel e-challan payments in this post.

How Do I Create A GST Challan For Over-the-Counter Payments?

The instructions for creating a GST Payment Challan – GST PMT-06 can be found here.

Note that if Over the Counter (OTC) payment mode is chosen, the taxpayer must print the Challan and make the payment at an authorized bank. We’ll show you how to cancel GST (OTC) challans via the GST portal in the next few steps.

Is it Possible to Modify GST Challan?

It is vital to note that challan cannot be modified once it has been generated online. A taxpayer, on the other hand, can save the challan in the middle and change it afterwards. The taxpayer cannot make any modifications to the challan once it has been finalized and a CPIN has been generated.

What is the Validity of GST Challan?

Yes, the generated challan will be valid for 15 days after being generated before being removed from the system. The taxpayer, on the other hand, can generate a new challan whenever he wants.

It should be noted that some taxes and duties may stay outside the scope of the GST system and will continue to be collected according to existing accounting procedures/rules/manuals, etc. This implies that there are two types of challans.

- GST Challan for all the GST taxable registered persons.

- Non-GST Challan that will be used by the relevant Pay and Accounts Offices (PAOs)/State AGs.

How to cancel GST (OTC) challan?

The processes to erase a challan under GST are listed below:

Step 1: Go to the GST Portal and log in.

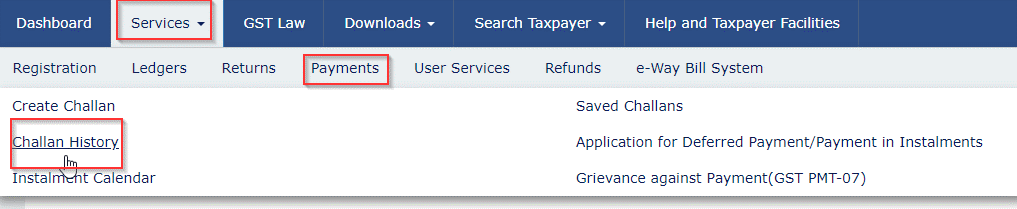

Step 2: Select ‘Payments’ and then ‘Challan History’ from the ‘Services’ menu.

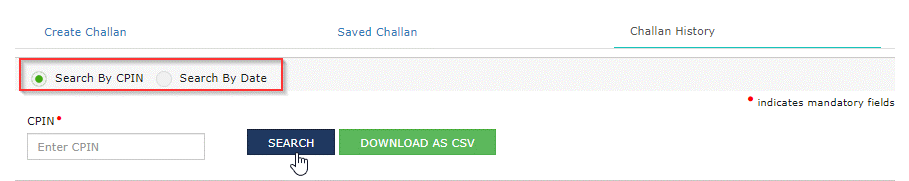

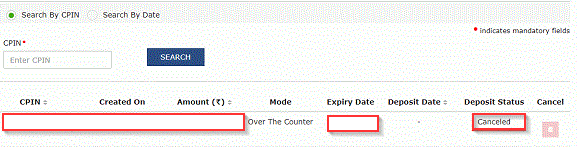

Step 3: Look for the Challan that has to be cancelled. You can search for challans by entering a date range or a CPIN.

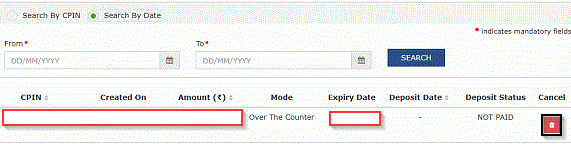

Step 4: When you’ve found the GST (OTC) Challan you want to cancel, click the ‘Cancel’ button. The taxpayer must ensure that no payment has been made against the Challan before it can be canceled.

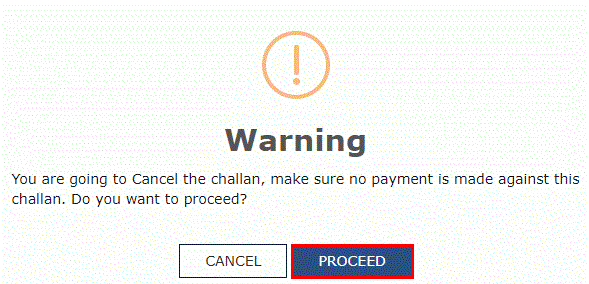

Step 5: To finish the canceling process, click ‘Proceed.’

Step 6: The status of the Challan will instantly change to ‘Cancelled’ after it has been successfully canceled, and no payment can be initiated for it. These are the basic procedures on how to cancel a GST challan.

Points to Consider

- The date of realization is treated as the payment deposit date for OTC payments;

- OTC Challan payments can be made at any branch of the licensed bank.

One Reply to “How to Cancel A GST (OTC) Challan?”

If there is no cancellation option what should we do