HSN Reporting Changes in GSTR-1

Certain changes have been introduced in HSN Reporting in GSTR-1 from May 2021. So, in this blog, we will discuss all the HSN reporting changes introduced in GSTR-1.

HSN Reporting Changes in GSTR-1

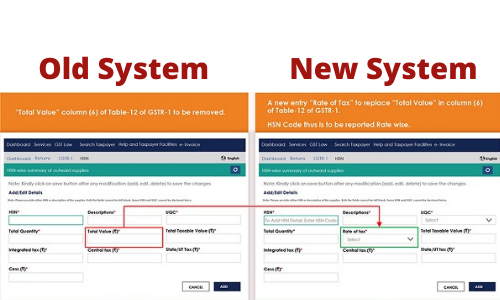

As per the new change, total taxable value excluding levies and rate of GST needs to be furnished in Table-12 of GSTR-1 instead of total value including levies and total taxable value excluding levies. Let us understand the HSN reporting changes in GSTR-1 by comparing the old system with the new one.

Table 12- Reporting in GSTR-1

Substitution of Words Total Value

As per Notification, No 79/2020 Central Tax, “Total Value” in the form GSTR-1 has been substituted with the words “Rates of Tax”.

Changes in the HSN Code Digit

As per Notification No 78/2020 Central Tax, the taxpayer needs to mandatorily report a minimum 4 or 6 digit HSN code in Table-12 of GSTR-1. However, changes in HSN code digit depend on the aggregate turnover (PAN-based) of a taxpayer in the preceding financial year.

| Aggregate Turnover up to INR 5 Crores | Minimum 4 digit HSN Code Compulsory reporting of both B2B and export supplies including SEZ supplies HSN code for B2C supplies optional |

| Aggregate Turnover exceeding INR 5 Crores | Minimum 6 digit HSN Code Compulsory reporting of all supplies (B2B, B2C and export supplies including SEZ supplies) |

Conclusion

All taxpayers ought to update and revamp their ERPs or accounting/billing software to generate HSN Codes based on the above notifications. Moreover, a taxpayer shall mention 8 digit HSN codes (if available) so that later on, no further system changes would be required from an HSN Reporting point of view.