E-Invoicing System Integration with ERPs

Immediate deployment of an ERP-based e-invoicing solution is the most critical need of the hour for businesses with INR 20+ Crores and above turnover.

With the fast-approaching deadline of January 1, 2021, it is becoming a teething problem for businesses who have yet not finalized any e-invoicing solution for them.

To cover-up for this last-minute e-invoice implementation rush and make this process smooth and hassle free for every business, including ones running out of time, GSTrobo™ which is an authorized GSP-ASP and a division of Binary Semantics has extended its arm with excellent customer support and need based customization.

If you are yet not ready for this e-invoice change and looking for e-invoicing integration with ERPs, don’t panic. Our vast team of dedicated professionals will bring make this transformation seamless with SAP, Microsoft Dynamics NAV, Oracle EBS, Tally, and home/in-house ERP integration.

E-Invoicing in Brief

As we are all well aware of the fact that the e-invoicing has already been implemented on the taxpayers

- Who deals in B2B and export supplies and

- Whose aggregate turnover exceeds INR 100 Crores in any of the FY 2017-18, 2018-19, 2019-20.

Moreover, as per the recent notification, the CBIC has decided to implement the e-invoicing system on the taxpayers whose aggregate turnover exceeds INR 20 Crores.

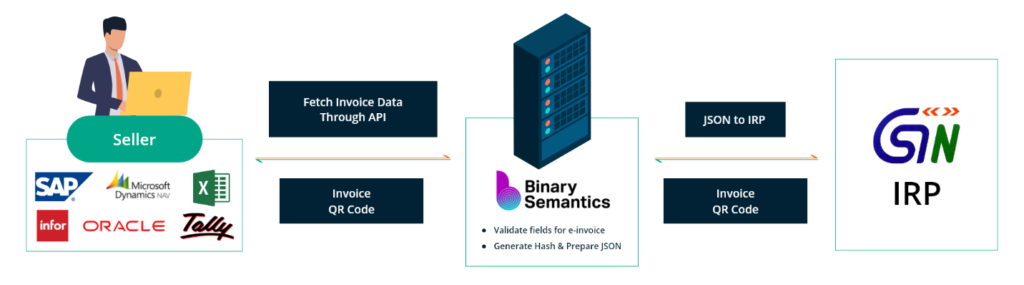

Note: As per the CBIC Clarification, e-invoice generation does not mean generating invoices through a government portal. The business needs to simply generate the e-invoice using the ERP or accounting and billing software and get it registered on the Invoice Registration Portal (IRP).

E-Invoicing Process

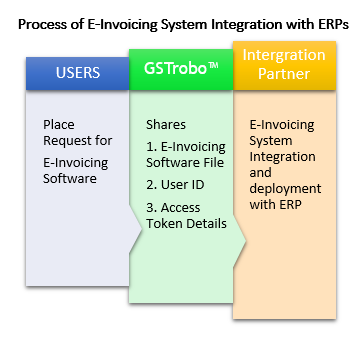

Process of E-Invoicing System Integration with ERPs

Benefits of E-Invoicing System Integration with ERPs

A taxpayer can enjoy the different benefits of E-Invoicing System Integration with ERPs such as Microsoft Dynamics NAV 365, Oracle, SAP, Tally, home/in-house ERPs and etc.

- Generate bulk IRN and QR codes for invoices using ERP.

- Cancel IRN with a single click via ERP.

- Get E-Invoice Details in ERP.

- Capture Error Logs in EPR.

- Save IRN, QR Code, and Digital Signature Data in ERP.

Privacy & Security

We understand that data confidentiality so we ensure data privacy and security by checking all the below-mentioned points.

- Encrypted data sharing

- Quality standard certificates ISO 27001:2013 and ISO 9001: 2015

- No tagging between system

- Cloud based platform

- User based permission

About GSTrobo®

GSTrobo®, a division of Binary Semantics is an authorized GSP and enlisted SDA with GSTN. GSTrobo® has an integrated and collaborative approach between E-Invoice, GST compliance, E-Way bill & telematics which has helped many organizations go completely digital with ease & compliance. The industry leaders are relying on the ease and simplicity of GST compliances for requirements ranging from Cloud-based solutions to Integrated Distributed Computing Solution utilizing powerful APIs and connectors from GSTrobo®.

Call us at +91-9773816111 or mail at info@gstrobo.com to experience the error-free, user-friendly & fastest approach!