GST Software in India: Your Essential Tool for Seamless Tax Compliance

The Goods and Services Tax (GST) came into effect in India on July 1, 2017, changing how taxes are managed across the country. This new tax system impacts all kinds of businesses, big and small. For businesses, using GST software in India is just like having a helpful assistant for handling all things related to GST.

In this blog, we’ll talk about why GST return-filling software in India is so important for your business. It will include the different kinds of GST software out there, the good things about using it, and tips for picking the right one for your business. No matter if you’re running a small business or a big company, having GST software can save you time and money, and it also lowers the chances of making mistakes with your taxes. Ready to dive in? Let’s go!

What is GST Software?

GST software is a total game-changer for businesses. It handles billing, making invoices, filing returns, and generating different reports. Ever since GST was introduced, businesses have had to stick to rules like keeping good records, paying taxes, and filing returns on time. GST software makes life easier by putting all these tasks together in one automatic system.

More than 70% of businesses that have to comply with GST regulations do it through GST Software.

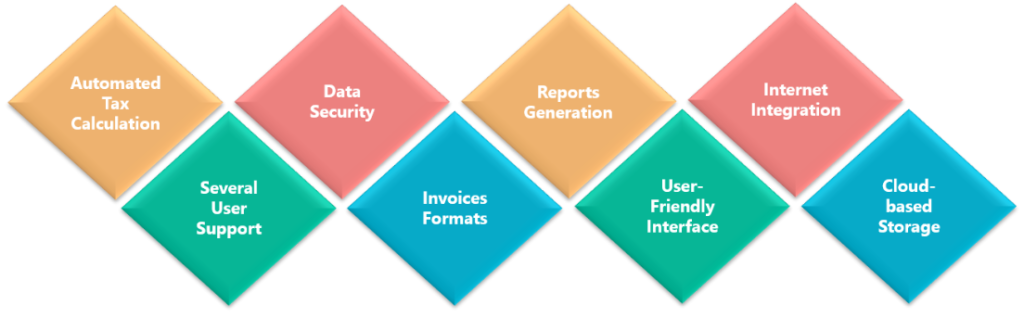

8 Feature of GST Software In India

Here are some key features commonly found in GST software in India:

1. GST Return Filing: This is a fundamental feature that enables businesses to file their GST returns accurately and on time. The software simplifies the process by guiding users through different compliance requirements.

2. Invoice Generation and Management: It allows businesses to create GST-compliant invoices and manage them efficiently. This includes generating invoices with the required GST details, such as GSTIN, HSN codes, etc.

3. Automated Tax Calculations: The software automates tax calculations, ensuring accuracy in determining the amount of GST to be paid or collected on goods and services.

4. E-Way Bill Generation: Many GST software solutions come equipped with e-Way Bill generation capabilities, facilitating the smooth movement of goods by automatically generating valid e-Way Bills.

5. Data Reconciliation: GST software has tools that offer features to reconcile data across different documents, such as invoices and returns, ensuring consistency and accuracy in reporting.

6. Compliance Alerts and Notifications: The software provides alerts and reminders for deadlines to ensure businesses stay compliant by submitting returns and fulfilling other regulatory requirements on time.

7. Integration with Accounting Systems: Integration capabilities allow seamless syncing of GST-related data with accounting software, reducing manual input and errors.

8. Reporting and Analytics: Advanced GST software may offer reporting and analytics features, providing insights into GST liabilities, input tax credit utilization, and other financial metrics, aiding in informed decision-making.

Read in-Depth – The Revolution Brought by GST in India

What are the benefits of using GST software?

Using GST software in India offers several advantages for businesses, streamlining various aspects of tax compliance and financial management:

- Reduces the chances of human errors in tax calculations, ensuring accurate GST liability calculations based on the applicable rates for different goods and services.

- Automates repetitive tasks like invoice generation, return filing, and reconciliation, saving time and allowing employees to focus on other critical business operations.

- Helps adhere to GST rules and regulations by generating GST-compliant invoices and ensuring timely and accurate filing of returns, minimizing the risk of penalties due to non-compliance.

- Frees up resources and workforce by automating GST-related tasks, enabling employees to concentrate on core business activities, resulting in increased productivity.

- Facilitates efficient management and organization of financial records, ensuring proper documentation and easy retrieval of information during audits or assessments.

- Provides comprehensive reports and analytics on sales, expenses, tax liabilities, and other financial aspects, enabling informed decision-making and strategic planning.

- Simplifies the GST return filing process by offering intuitive interfaces and step-by-step guidance, reducing complexities and making the filing process user-friendly.

- Helps generate e-Way Bills accurately and efficiently for the movement of goods, ensuring compliance with transportation regulations and minimizing logistics-related hurdles.

- Seamlessly integrates with existing accounting software, facilitating smooth data flow and ensuring consistency between financial and tax records.

- Some GST software solutions are scalable and customizable, catering to the specific needs and growth of businesses, whether small-scale or enterprise-level.

- Reduces manual labor and potential errors, leading to cost savings in terms of reduced staffing, minimized penalties, and improved operational efficiency.

How to implement GST software in your business?

Implementing GST software in India in your business involves several steps to ensure smooth integration and effective utilization:

- Evaluate your business requirements, considering the size of your business, the volume of transactions, specific GST compliance needs, and the features required in the software.

- Look for software that aligns with your business requirements and offers necessary features, scalability, user-friendliness, and good customer support.

- Train your employees on how to use the chosen GST software. Ensure they understand its functionalities, how to generate invoices, file returns, create e-Way Bills, and perform other necessary tasks.

- If you’re transitioning from manual methods or using different accounting software, plan for the migration of data to the new GST software. Ensure proper integration with existing systems for a seamless flow of data.

- Customize the software settings as per your business needs. Set up GST rates, tax codes, invoice formats, and any specific preferences required for accurate compliance and reporting.

- Before full implementation, conduct thorough testing of the GST software. Validate its performance by simulating various scenarios to ensure accurate calculations, proper data flow, and compliance with GST regulations.

- Implement the GST software gradually across different departments or functions within your business. Gather feedback from users during this phase to address any issues or concerns and refine processes.

- Keep the GST software updated with the latest features and compliance requirements. Regularly review and update configurations to align with any changes in GST laws or regulations.

- Monitor the performance of the GST software regularly. Provide ongoing support to employees using the software, addressing any queries or difficulties they might face.

- Periodically review the effectiveness of the GST software in meeting your business needs. Identify areas for improvement or optimization to enhance efficiency and compliance.

Conclusion

Using top-notch GST software in India is a must for businesses striving for smooth tax handling. These leading GST software options mentioned earlier come with different features, meeting the unique needs of businesses in various fields. Adopting these tools gives businesses the power to handle the complexities of GST with precision and efficiency. This not only encourages growth but also ensures that businesses stay compliant in the constantly changing tax scenario.

GSTrobo® Software Known for its user-friendly interface and comprehensive features, GSTrobo® software stands out as a reliable GST software in India. Its capabilities encompass GST return filing, invoice management, reconciliation, and e-Way Bill generation, ensuring compliance with ease.