Can You Rectify Wrong ITC Claims Done Under Wrong Heading?

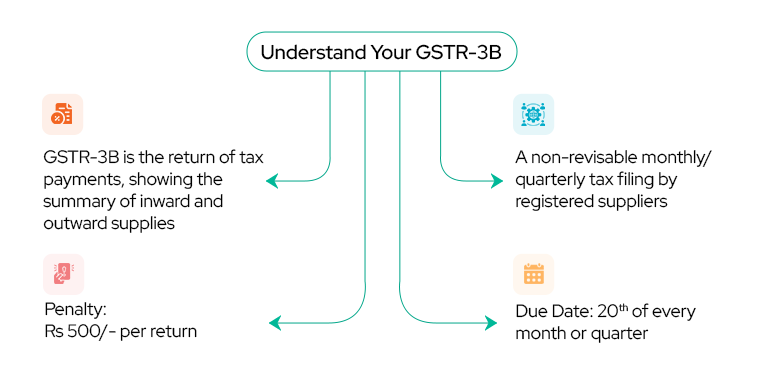

Claiming ITC against the sales is a tedious task in tax compliance and needs utmost attention to detail while filing accurate returns and appropriately reconciling the data. Mistakes in GSTR-3B are common, and once filed, revisions are not permitted in GSTR-3B, and rectify wrong ITC claims is a sure headache.

In this blog, we’ll explore what happens when a taxpayer mistakenly claims ITC under the wrong heading in their GSTR-3 return. We’ll also examine a landmark legal case where rectification was allowed, along with the role of GSTrobo® in facilitating accurate GSTR-3B return filing.

Understanding the Issue – Rectifying The Wrong ITC Claim

Filing accurate returns and reconciling data correctly are essential for GST compliance. But what happens when an unintentional error occurs while filing GSTR-3? Does the taxpayer have the right to rectify such mistakes, or do they face consequences from the tax authorities like assessment orders?

11 Common mistakes while reporting GSTR-3B

Filing accurate returns and reconciling data correctly are essential for GST compliance. But what happens when an unintentional error occurs while filing GSTR-3B? Does the taxpayer have the right to rectify such mistakes under due tax compliance procedures, or do they face consequences from the tax authorities like assessment orders?

1. Incorrect Data Entry:

Errors in entering invoice details such as invoice number, date, and amount can lead to discrepancies in tax calculations.

2. Under or Over Reporting Tax Liabilities

In this scenario, taxpayers must report the outstanding tax amount in the subsequent quarterly/monthly return filing along. For underreporting of tax liability, he shall pay the appropriate interest amount and for over-reported amounts, adjustments can be made subsequently or if not possible then GST refund may be claimed.

3. Missing or Inaccurate GSTIN

Failure to provide accurate GSTIN of the supplier or recipient can result in mismatches and compliance issues.

4. Mismatch in Taxable Value and Tax Amount

Failing to reconcile the taxable value and tax amount with the corresponding invoices can lead to incorrect tax reporting.

5. Omission of Reverse Charge Transactions

Taxpayers may overlook reverse charge transactions, resulting in underreporting of tax liabilities.

6. Late Filing

Missing the due date for filing GSTR-3B can attract penalties and interest, impacting the taxpayer’s compliance rating.

7. Failure to Reconcile with GSTR-1 and GSTR-2A

Not reconciling the data in GSTR-3B with GSTR-1 (outward supplies) and GSTR-2A (inward supplies) can lead to discrepancies and mismatches.

8. Ignoring Amendments and Corrections

Taxpayers may forget to incorporate any amendments or corrections required for previously filed returns, leading to incomplete or inaccurate filings.

9. Incorrect Claim of Input Tax Credit (ITC)

Claiming ITC without proper documentation or for ineligible expenses can lead to disputes with tax authorities and penalties and rectifying the wrong ITC claim becomes a tedious task in this scenario.

10. Non-compliance with GST Rules and Notifications

Ignoring updates to GST rules, notifications, and circulars can result in non-compliance and penalties.

11. Lack of Documentation

Inadequate maintenance of records and documents to support the transactions reported in GSTR-3B can lead to challenges during audits and assessments.

It’s essential for taxpayers to carefully review their GSTR-3B filings to avoid these common mistakes and ensure compliance with GST regulations. Using automated software solutions can also help in reducing errors and streamlining the filing process.

Case Law – Rectification of Mistaken ITC Claim in GSTR-3B Under Wrong Heading

In a significant legal case of Divya S.R. Vs Union of India before the Kerala High Court, the issue in hand was addressed. A petitioner is registered under the KVAT Act and presently under the CGST/SGST Act. For the financial year 2017-18, she did some interstate inward supply of goods and so she received IGST tax credit.

The petitioner mistakenly claimed ITC under CGST and SGST instead of IGST in her GSTR-3B return for July 2017. This error led to the issuance of an assessment order.

However, the taxpayer filed a rectification application seeking correction of the accidental claim made in the monthly return. The intention was clear – petitioner tries to rectifying the wrong ITC claim.

The court directed the tax authorities to consider the rectification application and refrain from coercive measures until a final decision was reached.

Legal Implications and Court’s Directive

The court’s directive, issued after careful consideration of the case’s specifics and arguments presented, marked a significant turning point in the proceedings.

In response to the writ petition, the court instructed the 6th respondent to promptly evaluate the Ext.P4 application submitted by the petitioner.

Emphasizing strict adherence to legal protocols, the court underscored the importance of affording the petitioner a fair hearing before rendering a final decision on the rectification application.

Additionally, the court issued a clear directive to refrain from employing coercive measures for tax recovery, as assessed in the Ext.P1 order, until a definitive verdict is reached on the Ext.P4 application.

This landmark judgment by the Kerala High Court highlights the paramount importance of procedural equity. It ensures that taxpayers are given an opportunity to rectify genuine mistakes in their returns. The court emphasized fair hearings and adherence to legal procedures, providing relief to the taxpayer while safeguarding their interests.

Role of GSTrobo® in Effective Return Filing

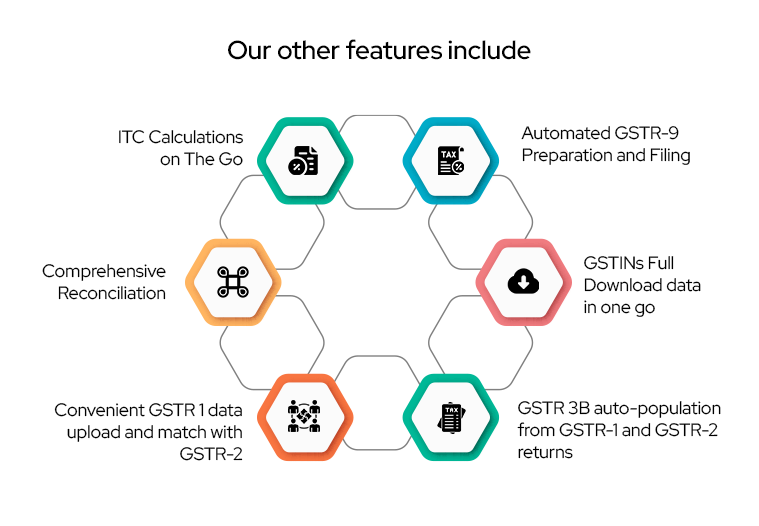

To prevent such errors and ensure accurate GSTR-3B filing, taxpayers can leverage cloud-based technology solutions of GSTrobo®. Trusted by Indian enterprises and even globally, GSTrobo® offers features such as data validation, bulk operations, auto-population of fields, vendor management, and error detection, helping taxpayers file returns correctly the first time.

We provide complete ASP+GSP Solution and our software is 100% Secure and Scalable and collaborative. Get 12*6 complete customer support from our tax experts and leverage the power of our smart reports to make better GST and vendor choices.

Book a demo today and see what’s we have in store for business GST compliance.

Conclusion

Mistakes in claiming ITC under the wrong heading can have repercussions for taxpayers. However, legal precedents like the case discussed highlight the importance of rectification and procedural fairness.

With technology solutions like GSTrobo®, taxpayers can enhance their compliance efforts and minimize the risk of errors in GSTR-3B filing. Ultimately, a combination of legal safeguards and technological tools can empower taxpayers to navigate the complexities of GST compliance effectively.