E-Way Bill Penalty – Guide on How to Avoid E-Way Bill Mistakes

India generated the highest number of e-way bills in September 2023, with a total count of 4228618, which reflects the overall growth of the government’s digital e-way bill campaign and the drastic growth of India’s logistics sector.

But at the same time, we see an ever-increasing number of mistakes being made while generating e-way bills, causing hefty losses to businesses.

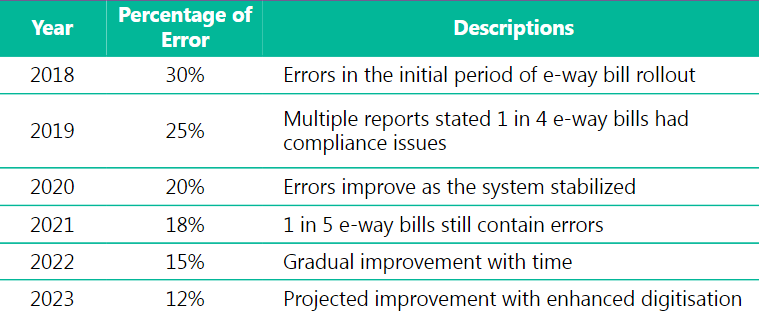

20% of all e-way bills generated have some error, leading to revenue leakage and e-way bill penalties of Rs 30,000 crore (around $4.35 billion).

Note:- A Mint report in late 2022 cited around 15-20% of e-way bills still have some compliance issues.

The matter becomes concerning with the onset of the government’s and GST law’s changing regulations.

The businesses and logistic departments need to be equipped with the proper training to understand the law modifications, leading to them facing consequences of e-way bill mistakes and resulting in incorrect e-way bill penalties.

Consequences of Incorrect E-Way Bill

While the paramount reason to generate e-way bills correctly for a business entity is to avoid incorrect e-way bill penalties, there are many other reasons why having a streamlined e-way bill system in place becomes essential. Here are the significant consequences of incorrect e-way bill generation:

1. Confiscation of Goods and Vehicle

An e-way bill is a mandatory document a transporter must carry while the movement of goods happens across the country, whether interstate or intrastate. The enforcement authorised officers can stop any vehicle for e-way bill document verification at any check post. And, if they get any tax evasion information, they can even carry on the vehicle’s physical verification.

In case the transporter is found sans e-way bill during travel, the inspection officer has the right to confiscate or detain the goods along with the vehicle.

2. Unnecessary Delays

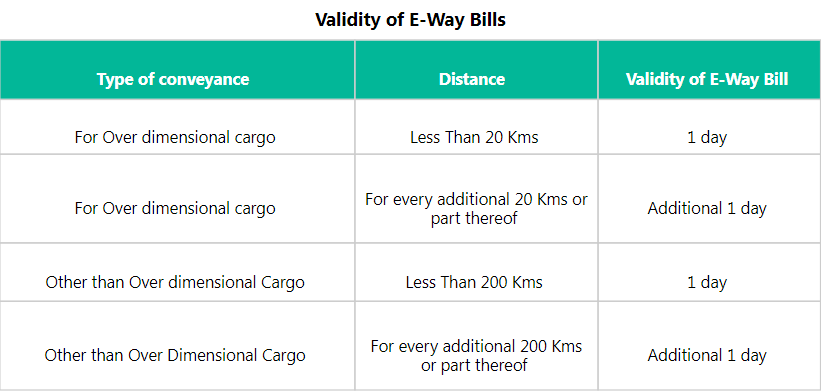

There is a legal validity period for an e-way bill after the vehicle starts the journey. If the journey incurs delays, one must pay a penalty for the wrong e-way bill due to the bill expiry.

A mistake in the e-way bill is bound to cause these delays and slow the process.

3. Loss of Input Tax Credit (ITC)

If e-way bill compliance is not managed correctly, there may be a risk of losing eligibility for claiming Input Tax Credit. This can lead to increased costs for the business, impacting profitability.

4. Penalties and Fines

One of the immediate consequences of e-way bill errors is the imposition of incorrect e-way bill penalties and fines by tax authorities. The amount of the GST e-way bill penalty can vary based on the nature and severity of the e-way bill non-compliance.

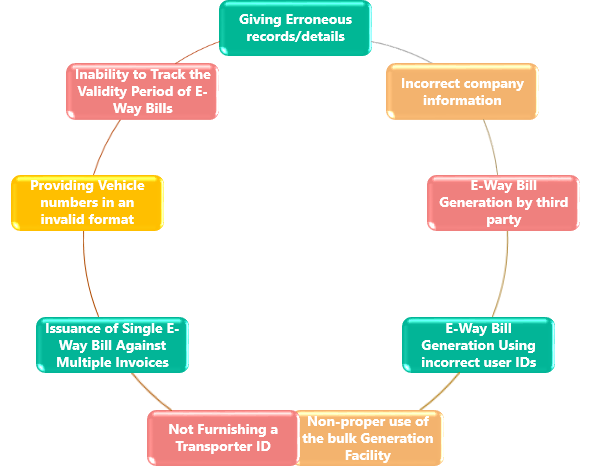

Common Errors in E-Way Bill

Several common errors can occur during the generation and management of e-way bill compliance. Businesses need to be aware of these errors to avoid potential consequences. So, the question is – how to avoid an e-way bill penalty? Here are some common e-way bill errors to avoid:

1. Incorrect Invoice Details

- A mismatch between the details on the e-way bill and the actual invoice.

- Incorrect invoice number, date, or value.

2. Mismatch in Goods Description:

- There are discrepancies between the description of goods on the e-way bill and the actual goods being transported.

- Incomplete or inaccurate information about the goods.

3. Incorrect Vehicle Details

- Errors in providing the vehicle number, mode of transport, or transporter details.

- Failure to update vehicle details in case of a change.

4. Invalid GSTIN

Providing a correct Goods and Services Tax Identification Number (GSTIN) for the supplier, recipient, or transporter is essential information for e-way bill compliance.

5. Mismatch in the HSN Code

Incorrect Harmonized System of Nomenclature (HSN) code for goods transported causes e-way bill penalties.

6. Inconsistent Unit of Measurement

When there are inconsistencies in the unit of measurement used for quantity, weight, or volume on the e-way bill, causing penalties.

7. Late Generation of E-Way Bill

Failure to generate the e-way bill within the prescribed timeframe leads to delays and potential penalties.

8. Multiple E-Way Bills for the Same Shipment

If one generates multiple e-way bills for the same consignment, it causes confusion and potential legal issues.

9. Failure to Update E-Way Bill

Only update the e-way bill with relevant information if there are changes during transit, such as a change in the mode of transport or vehicle.

10. Non-Compliance with Distance Rules

Not adhering to the distance rules for e-way bill generation, especially over-dimensional cargo.

11. Incomplete Transportation Documents

Missing or incomplete supporting documents are required for certain types of goods during transportation.

12. System Glitches or Technical Errors

Errors arise from technical issues, such as system glitches or connectivity problems during the e-way bill generation process.

What is The Penalty and Fine on E-Way Error?

When dealing with e-way bills and the subsequent fines and penalties, what should be the right way to derive the fee or penalty amount has always been a topic of argument. The law has set a certain minimum threshold for such fines, but the maximum threshold is open-ended.

There is always a discussion regarding what the intent of the taxpayer and the transporter is when a specific error has occurred and whether a minute or ignorable error should invite such hefty penalties.

While there are plenty of cases where a genuine human error is not considered big enough to be liable for a hefty fine for an e-way bill error.

Case in point – Rai Prexim India Private Limited Vs State of Kerala (High Court Kerala) WP(C)

The high court held that if a human error that the naked eye can see is detected, such human error cannot be capitalised for penalisation. In this case, the taxpayer has wrongly mentioned the amount as Rs.388220 instead of Rs.3882200 with all other correct information.

The law allows a few minor issues with a lesser GST e-way bill penalty of not exceeding Rs.1000/-. The circular provides specified situations that do not cover the error in the value. Therefore, if any other errors are ‘minor’ in nature, then a decision can be relied upon

Monetary Implications

It is necessary to carry an E-way bill while transporting goods from one spot to another, which is clear proof that you have paid tax. However, if you do not carry it, it is considered an offence, and the respective authorities may penalise you for the evaded amount of tax or Rs. 10,000 (whichever is higher).

Non-Monetary Implications

GST penalty for e-way bill mistakes can be monetary or non-monetary, dependent on your point of contravention of the law. The authorities can seize the vehicle carrying and transporting goods without an E-way bill. The vehicle would only be released after payment of a penalty or tax amount as navigated by the concerned officer. So, here, two situations arise:

If the goods’ owner willingly comes forward to pay off the penalty/ fine for e-way bill error and tax, then the applicable tax and penalty thereon would amount to 100% of the tax payable.

If the goods’ owner does not willingly pay off the penalty and tax, then in such a case, the tax and GST e-way bill penalty would equalise 50% value of the total goods value deducted by tax already paid under UTGST Act (State/Union Territory Goods & Services Tax) and CGST Act (Central Goods and Services Tax Act) calculated separately.

So, carrying important documents like a bill of entry/ bill of supply/ invoice/ delivery challan along with an E-Way bill, in either physical or electronic form, is necessary while carrying a consignment of goods.

How could you save yourself from these penalties?

There is always a solution for any adverse situation, and an E-way bill is no exception. You need to adopt these precautions while filling Part B of the E-way Bill, which we have mentioned below, and you will be saved from the unnecessary burden of GST penalty for the e-way bill mistake.

5 Precautions that You Must Follow to Bar the Penalties

1. Never Skip Your E-Way Bill Generation

E-way bills are compulsory to be created by either the supplier or transporter of goods. They will face heavy penalties and fines for e-way bill errors if none of them generates it. Quickly generate e-way bills in compliance with regulations via GSTrobo, an e-way bill software that ensures seamless and penalty-free transactions.

2. Real-time Updates for Unforeseen Circumstances

If, within the valid time period mentioned in the Eway bill, the goods do not get transported because of unforeseen circumstances, then the concerned person can update the transportation details by generating a new Eway bill. Do real-time and hassle-free transportation updates of Part-B of e-way bill through GSTrobo e-way bill software, adapting to unforeseen circumstances and avoiding GST penalties for e-way bill mistakes.

3. Efficient Management of Multiple Vehicles Invoicing

If multiple vehicles are involved in goods transportation, then before the first consignment gets completed, the supplier must issue the invoice. Plus, there must be an invoice copy and delivery challans copies for further consignments. An original invoice will only be forwarded along with the last consignment.

Streamline invoicing for multiple vehicles with GSTrobo – e-way bill software, ensuring each consignment is correctly documented for e-way bill compliance.

Tip- If you change the mode of conveyance between transportation, you do not need to generate several e-way bills for each mode. You just need to update it on a single e-way bill, and you are done. You can easily do it on GSTrobo® E-Way Bill Software. No need for multiple e-way bills; simply update the information on a single e-way bill online and stay penalty-free.

4. Consolidation of Multiple E-Way Bills

For multiple consignments, multiple e-way bills are required. For each invoice, a separate e-way will be generated. However, if all consignments are going in one vehicle, then after generating multiple e-way bills, you can consolidate those into one final e-way bill.

Effortlessly consolidate multiple e-way bills into one final bill using our e-way bill software, simplifying the process for consignments in a single vehicle.

5. Document Verification and Validity Check

Ensure all documents necessary for the e-way bill have been properly checked and valid. Otherwise, the transaction will be void, and you will be held guilty of paying a GST e-way bill penalty.

Mitigate risks of void transactions by utilising GSTrobo e-way bill software’s document management and validation tools, ensuring all necessary documents are accurate and valid.