GST Notice Survival Guide: Prioritizing, Tracking, and Documenting Interactions

What are GST notices?

Under the GST regime, GST notices represent a pivotal communication channel initiated by GST Authorities towards taxpayers. These GST notices are diverse and cater to specific purposes, aiming to caution or remind taxpayers about deviations from GST laws or to request additional information. Instances triggering these GST notices often encompass transactions occurring beyond the tax radar or raise suspicions about a taxpayer’s operations. The genesis of these notifications can stem from clues discovered during GST Return audits, insights shared by other governmental entities, or tips provided by third parties.

A few of the types of GST notices include show cause notices (SCNs), scrutiny notices, or demand notices. Each of them is designed to address different levels of seriousness or to elicit specific actions from taxpayers. Common triggers for these GST notices involve taxpayer lapses, such as failure to register under GST when mandated, delays or lapses in filing GST returns, underpayment or non-payment of GST dues, or erroneous claims of excessive Input Tax Credit.

Urgent and decisive responses to these GST notices within specified timelines are mandatory. Any delay in acknowledgment could invite legal repercussions, which can lead to prosecution or imposition of penalties because of deliberate negligence on the taxpayer’s part. Proactive and timely response to GST notices is crucial for taxpayers to avoid legal actions and to comply with GST regulations.

Why are GST notices issued?

A few of the reasons for GST notice issuance are:

- Discrepancies in the details provided between GSTR-1 and GSTR-3B prompt a scrutiny notice.

- Variances in Input Tax Credit claims stated in GSTR-3B compared to GSTR-2B/2A.

- Delays in consecutively filing GSTR-1 and GSTR-3B for over six months.

- Conflicting declarations between GSTR-1 and the e-way bill portal.

- Failure to lower prices in line with reduced GST Rates, constituting a default by the taxpayer, is known as profiteering. GST authorities implement anti-profiteering measures to address this.

- Non-payment or underpayment of GST liability, with or without fraudulent intent, leading to a show cause notice (SCN).

- Misappropriation in GST refunds, whether intentional or unintentional, leads to an SCN.

- Incorrect availing or utilization of Input Tax Credit.

- Businesses are liable for GST but fail to obtain registration and fulfill tax obligations under the GST Act.

- Discrepancies in reporting exports in GSTR-1 compared to the information available on ICEGATE (e.g., unreported Shipping Bill or Bill of Export lodged on ICEGATE).

- Failure to provide information related to prescribed records for taxpayer maintenance.

- Conducting audits by tax authorities.

- Failure to submit required information returns to tax authorities within specified time limits.

Types of GST notices:

Here’s a comprehensive breakdown detailing various types of GST notices, along with the expected actions from taxpayers and the specified time frames for response:

GSTR-3A

Description: Default notice for non-filing of GST returns (GSTR-1/3B/4/8).

Action Required: File pending returns with late fees and interest.

Response Time: 15 days from notice.

Consequence of Non-response: Tax assessment; Penalty up to Rs. 10,000 or 10% of tax due, whichever is higher.

CMP-05

Description: Show cause notice questioning composition dealer eligibility.

Action Required: Justify eligibility continuation.

Response Time: 15 days of receipt.

Consequence of Non-response: Penalty as per section 122; Denial of composition scheme.

REG-03

Description: Notice during GST registration verification, seeking clarification.

Action Required: Respond with clarification or information.

Response Time: Within 7 working days.

Consequence of Non-response: Application rejection (REG-05).

REG-17

Description: Show cause notice for potential GST registration cancellation.

Action Required: Explain reasons against cancellation.

Response Time: Within 7 working days.

Consequence of Non-response: GST registration cancellation (REG-19).

REG-23

Description: Show cause notice for GST registration cancellation revocation.

Action Required: Respond with reasons for revocation.

Response Time: Within 7 working days.

Consequence of Non-response: Cancellation of GST registration.

REG-27

Description: Notice for VAT regime migration issues with GST registration.

Action Required: Respond and appear before the tax authority if needed.

Response Time: As required,

Consequence of Non-response: potential provisional registration cancellation (REG-28).

PCT-03

Description: Show cause notice for GST practitioner misconduct.

Action Required: Reply within the specified time.

Response Time: As per notice timeline.

Consequence of Non-response: License cancellation as GST practitioner.

RFD-08

Description: Show cause notice for withholding GST refund.

Action Required: Reply within 15 days.

Response Time: Within 15 days of notice.

Consequence of Non-response: Refund application rejection (RFD-06).

ASMT-02

Description: Seeking additional information for provisional GST assessment.

Action Required: Respond with documents.

Response Time: Within 15 days.

Consequence of Non-response: Possible rejection of provisional assessment.

ASMT-06

Description: Additional info for final assessment (for provisional assessment applicants).

Action Required: Reply within 15 days.

Response Time: Within 15 days of notice.

Consequence of Non-response: Assessment without taxpayer views (ASMT-07).

ASMT-10

Description: Scrutiny notice for GST return discrepancies.

Action Required: Respond with reasons for discrepancies.

Response Time: As specified or a maximum of 30 days.

Consequence of Non-response: Potential assessment, prosecution, penalty.

ASMT-14

Description: Show cause notice for assessment under section 63.

Action Required: Respond and appear before authority.

Response Time: Within 15 days of notice.

Consequence of Non-response: Unfavorable assessment order.

ADT-01

Description: Notice for tax audit under Section 65.

Action Required: Attend in person or produce records.

Response Time: As per notice.

Consequence of Non-response: Proceedings initiation for lack of records.

RVN-01

Description: Revisional authority notice before order revision.

Action Required: Reply/appear within the specified time.

Response Time: Within 7 working days.

Consequence of Non-response: Decision based on available records.

Anti-profiteering Notice

Description: Proceeding initiation for benefit non-passing.

Action Required: Cooperate & provide evidence.

Response Time: As specified.

Consequence of Non-response: Proceedings based on available evidence.

DRC-01

Description: Show cause Notice for Tax Demand.

Action Required: Reply for payment with interest/penalty.

Response Time: Within 30 days.

Consequence of Non-response: Higher penalties or prosecution possible.

DRC-10 & DRC-17

Description: Notice for auction of goods for recovery.

Action Required: Ability to pay outstanding demand as per notice.

Response Time: As specified in the notice.

Consequence of Non-response: Proceed to e-auction and sale.

DRC-11

Description: Notice to the successful bidder.

Action Required: Pay the full bid amount within 15 days of the auction.

Response Time: Within 15 days of auction.

Consequence of Non-response: Possible re-auction by proper officer.

DRC-13

Description: Recovery notice from a third party.

Action Required: Deposit the specified amount and reply in DRC-14.

Response Time: Not applicable.

Consequence of Non-response: Deemed defaulter, liable to penalties.

DRC-16

Description: Notice for attachment and sale of immovable/movable goods/shares.

Action Required: Compliance with the prohibition on transfers.

Response Time: Not applicable.

Consequence of Non-response: Possible prosecution for infringement.

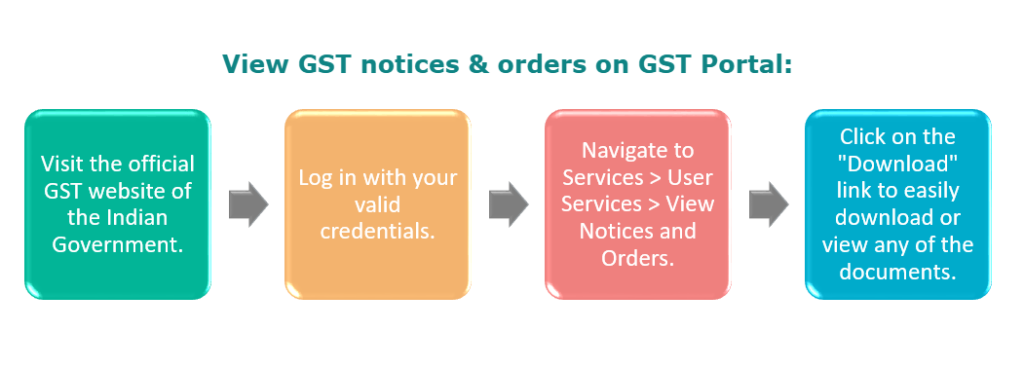

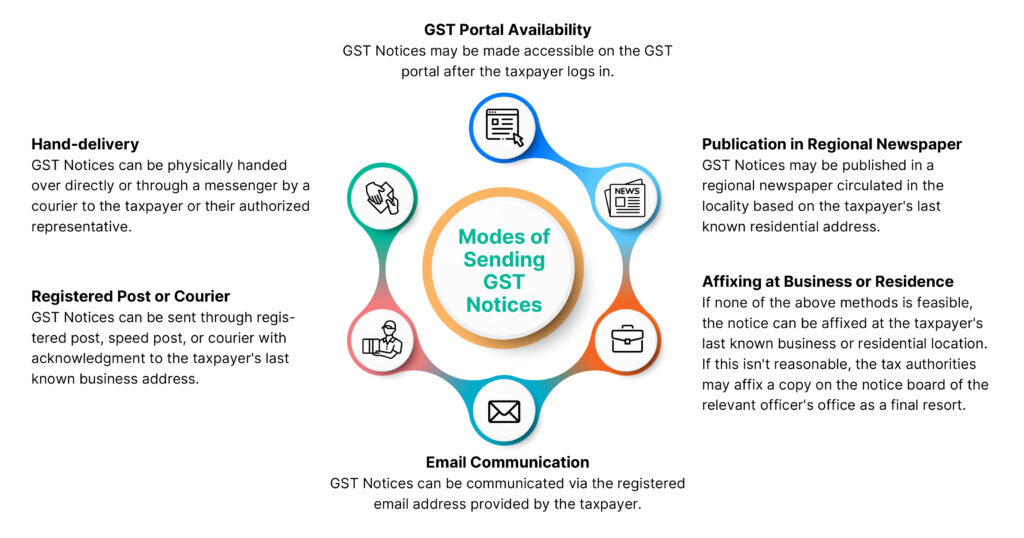

What are the modes of sending GST notices?

Section 169 of the CGST Act delineates the approved methods for delivering GST notices under GST, highlighting their validity under the law. Taxpayers should be aware of the various recognized modes through which GST notices can be served:

Taxpayers need to recognize that GST notices or communications received through any means other than those specified by GST laws may not be considered valid. Therefore, taxpayers aren’t obliged to respond or take action based on such GST notices not conveyed through the approved modes specified by GST regulations.

How to deal with multiple GST notices?

Organize Records: Start by establishing a systematic record-keeping system. Ensure all GST-related documents, returns, and communications with tax authorities are well-organized and easily accessible. This saves time when responding to GST notices.

Understand Notice Details: Thoroughly comprehend the content of each notice before responding. Understanding the reason behind its issuance and the required actions is crucial to avoid incorrect responses.

Track and Categorize: Efficiently track and categorize GST notices. Use a structured system like a tracking sheet or notice management software to segregate GST notices based on their types and origins, especially when they relate to multiple states or GSTINs.

Review and Rectify: Use GST notices highlighting discrepancies to review and rectify records. Correct any errors and ensure future filings are accurate to prevent recurring issues.

Timely Responses: Respond promptly to GST notices, acknowledging receipt and seeking extensions if needed. Delayed responses can lead to penalties and legal repercussions.

Document Interactions: Document all interactions with tax authorities—calls, emails, letters—as crucial evidence if disputes arise. Retain copies of responses and submitted documents.

Prioritize Urgent GST Notices: Prioritize GST notices based on urgency and provided deadlines. Show cause and demand notices usually demand immediate attention, while others may allow more time for response.

Professional Guidance: Seek guidance from tax consultants or legal experts if different types of GST notices overwhelm you. Their expertise ensures proper responses within legal bounds.

Transparent Communication: Maintain transparent communication with tax authorities. Inform them promptly of difficulties or extension requests; transparency often leads to a more flexible approach.

Enhance Compliance Procedures: Regularly review and enhance GST compliance procedures to prevent future GST notices. Ensure teams stay updated on GST regulations and handle transactions accurately.

Conclusion:

Receiving a GST notice might seem daunting, but it’s an opportunity to rectify any discrepancies or misunderstandings. A proper understanding of the types of GST notices and a proactive approach to dealing with them can mitigate potential issues, foster compliance, and maintain a healthy relationship between taxpayers and tax authorities.