GSTR-9 filing process on Government Portal

GSTR-9 is Annual return filed once for a financial year by all the registered person who registered themselves in normal category. Annual return filing is compulsory in case of Nil-turnover also.

In the Annual Return for F.Y 2017-18, the details pertaining to the period from July 2017 to March 2018 are to be reported. In case, the taxpayer is registered after 1st July 2017, in such case, details for the period from the effective date of registration till 31st March, 2018 is to be provided in Annual Return.

For filing GSTR-9 on Government portal following steps needs to be followed

1. Access www.gst.gov.in URL. The GST Home page is displayed

2. Login to the Portal with credentials

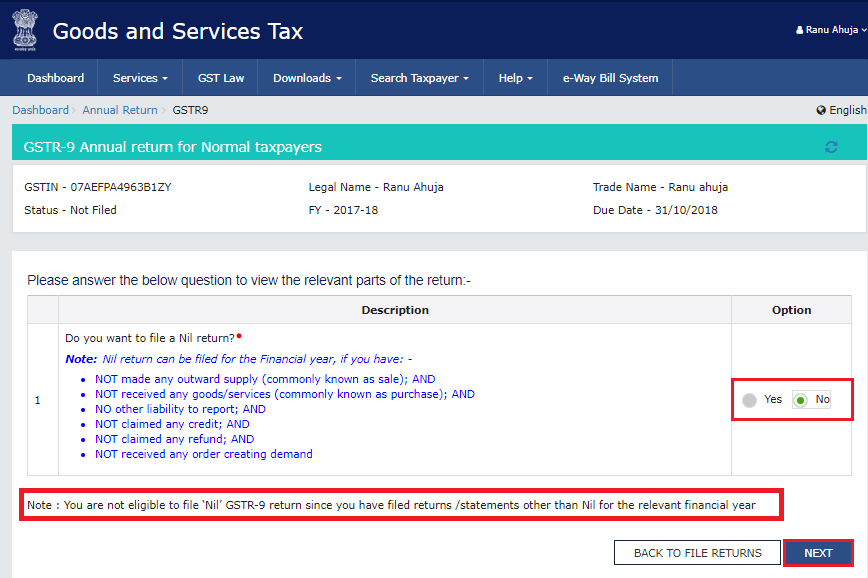

3. Click on Services > Return > and Annual Return

or you can click on Annual Return link available on Dashboard. On clicking Annual return, Annual

Return page will be displayed.

4. Select financial year against which you want to file Annual Return. Click on Search button.

5. File Annual Return Page will open. Here some guidelines for Nil-Return and other important message will display.

Click on Prepare Online

6. Now one question will appear, whether you want to file Nil Annual Return or not. If you are satisfying all the condition mentioned for nil annual return, click on yes otherwise auto-message also populates you are not eligible to file Nil GSTR 9 because you have filed returns other than Nil for financial year.

Click on Next

7. GSTR-9 Annual return for Normal taxpayer page will display. Here, steps to prepare GSTR-9 return online is also mentioned.

GST Portal will calculate Form GSTR-9 values in different tables, based on Form GSTR-1 and Form GSTR-3B filed by you. These are available as download in PDF format.

3 Reports will be available in PDF Format-

(a) Download GSTR-9 System Computed Summary (PDF)

(b) Download GSTR-1 Summary (PDF)

(c) Download GSTR-3B Summary (PDF)

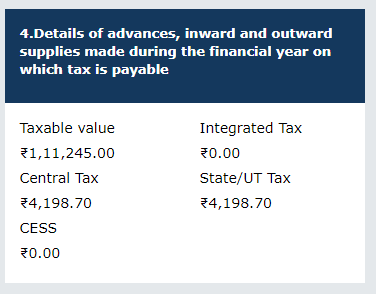

8. Click on Table 4 Details of advances, inward and outward supplies made during the financial year on which tax is payable. Details will be auto filled based on details uploaded by you in Form GSTR-1 and Form GSTR-3B during the said relevant financial year.

9. Table 4. Details of advances, inward and outward supplies made during the financial year on which tax is payable page is displayed.

Here, you can enter details or edit any existing details because GSTN portal calculating Data in editable mode.

If the details provided are +/- 20% from the auto-populated values, then cells would be highlighted in red for your reference and attention.

10. Click on Save button, one confirmation message will appear (If value entered/edited is more/less than 20% of the system computed value).

11. Click Yes, a confirmation message will displayed that save request is accepted successfully. Click OK button

12. Likewise, you can click on each table, edit/enter details and click on save details will be saved successfully

After entering all the details, you can check preview of GSTR-9 in PDF format before filing by clicking on Preview Draft GSTR-9 (PDF) [bottom right of the page)

13. Click the COMPUTE LIABILITIES button for computation of late fees (if any)

14. After COMPUTE LIABILITIES button is clicked, details provided in various tables are processed on the GST Portal at the back end and Late fee liabilities, if any, are computed. Late fee is calculated, if there is delay in filing of annual return beyond due date.

In case, records (or data as submitted while filing Form GSTR 9) are processed with error or are under processing at the back end, a warning message is displayed. If records are still under processing, wait for processing to be completed at the back end. For records which are processed with error, go back and take action on those records for making corrections.

A message is displayed on top page of the screen that “Compute Liabilities request has been received. Please check the status after sometime”. Click the Refresh button.

15. Once the status of Form GSTR-9 is Ready to File and liabilities are calculated, 19. Late fee payable and paid table gets enabled. Click the 19. Late fee payable and paid table or on “Proceed to File” button.

16. Click on Table 19. Late fee Payable and paid.

If available cash balance in Electronic Cash Ledger is less than the amount required to offset the liabilities, then additional cash required to be paid by taxpayer is shown in the “Additional Cash Required” column. You may create challan for the additional cash directly by clicking on the CREATE CHALLAN button.

17. Now, Click the PREVIEW DRAFT GSTR-9 (PDF) to download the Form GSTR-9 in PDF format. It is recommended that you download this Summary page and review the summary of entries made in different sections carefully before filing Form GSTR-9.

Form will Download in PDF format; you can check it.

18. Now for filing GSTR-9 with EVC/DSC

Select the Declaration checkbox., Select the Authorized Signatory from the drop-down list, Click the FILE GSTR-9 button., Once Form GSTR-9 is filed, you cannot make any changes.

For filing with DSC

Select the certificate and click the SIGN button.

19. For filing GSTR-9 with EVC

Enter the OTP sent on email and mobile number of the Authorized Signatory registered at the GST Portal and click the VALIDATE OTP button.

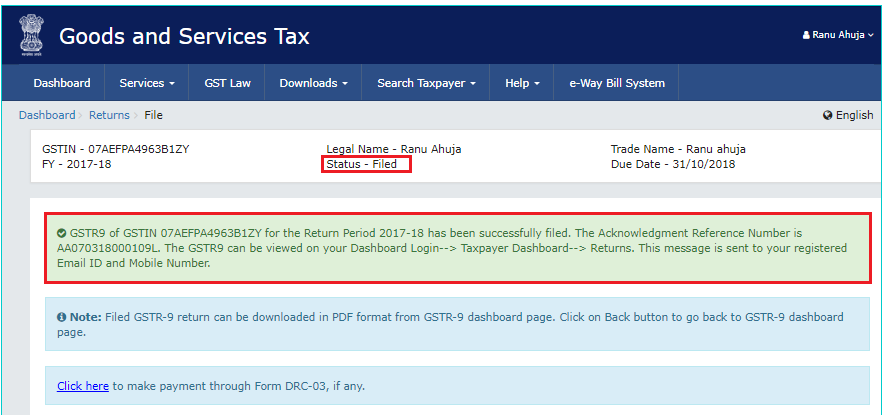

20. The success message is displayed and ARN is displayed. Status of the Form GSTR-9 return Changes to Filed.

After Form GSTR-9 is filed:

- ARN is generated on successful filing of the return in Form GSTR-9.

- An SMS and an email is sent to the taxpayer on his registered mobile and email id.

- Electronic Cash ledger and Electronic Liability Register Part-I will get updated on successful set-off of liabilities (Late fee only)

- Filed form GSTR-9 will be available for view/download in PDF and Excel format.

One Reply to “GSTR-9 filing process on Government Portal”

While going through GSTR9 after login, without entering any data, I have clicked Compute Liabilities. Later it is displayed that it is Ready to file.

Now I have a doubt that at his stage can I edit or enter data and re compute liabilities. You may please clarify.