Comparison of Liability Declared and ITC Claimed

New functionality is available on GST Portal where one can Compare the Input Tax Credit taken in GSTR-3B and that available in GSTR-2A.

Through this functionality Reconciliation is done by Government itself between liability as declared in GSTR-1 and against it amount paid against it in GSTR-3B along with how much ITC claimed in GSTR-3B by taxpayer and how much ITC available in GSTR-2A.

It is available in view & download format only taxpayer cannot edit the same as it is system generated

How to see comparison Report on Government portal?

- Access www.gst.gov.in URL. The GST Home page is displayed

- Login to the Portal with credentials

- Click on Return Dashboard >> Select financial year and return filing month and then Search

Following Screen Will Display:

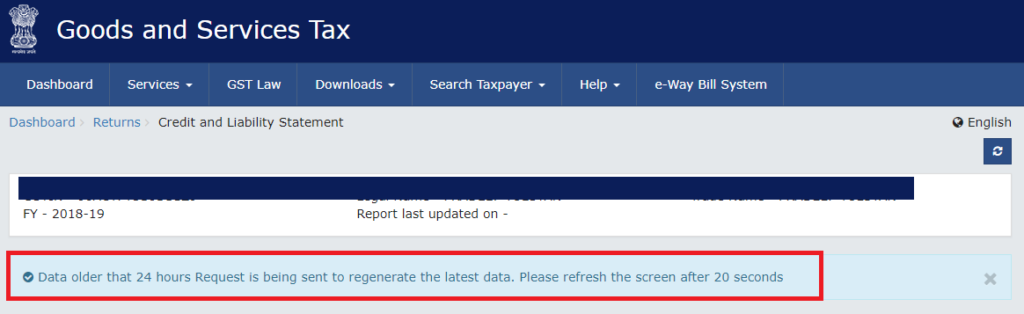

Comparison report will be calculated on the basis of last 24 hours updated details.

Here you can see data comparison, month wise between tax liability reported in GSTR-1 and GSTR-3B as well comparison between ITC claimed in GSTR-3B and accrued as per GSTR-2A

Here, you can see in September month tax liability as per data filed in GSTR-1 is Rs. 9,708.12 but in 3B that was paid in august itself only, here difference was in month but overall year wise no difference is there.

In case of ITC, overall claimed in GSTR-3B for full year is 41,834 but available in GSTR-2A is 45,339 means you are missing ITC worth Rs. 3505. You can check again your invoices if you have skip any invoices on which you were eligible to claim but forgot.

That’s how Government provide comparison facility to help taxpayers for proper GST compliance.