How to Unblock E-Way Bill Generation Facility?

According to the rules, the e-way bill system now has a new facility that allows the taxpayer’s GSTIN to be blocked or unblocked. That is if a GST registered taxpayer has not filed GSTR-3B and CMP-08 in the GST Common Portal for the last two consecutive months or quarters, that GSTIN would be blocked from generating e-way bills as a Consignor, Consignee, or Transporter in the future. And, in this manual, we will know how to unblock the e-way bill generation facility.

How to Know The Block/Unblock Status Of GSTIN?

When the e-way bill is blocked, taxpayers may find themselves in one of two situations:

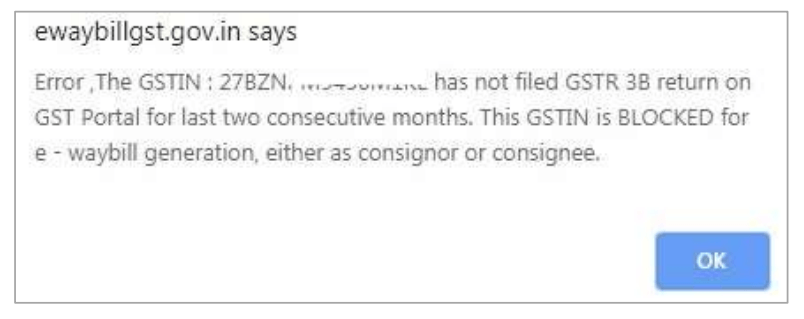

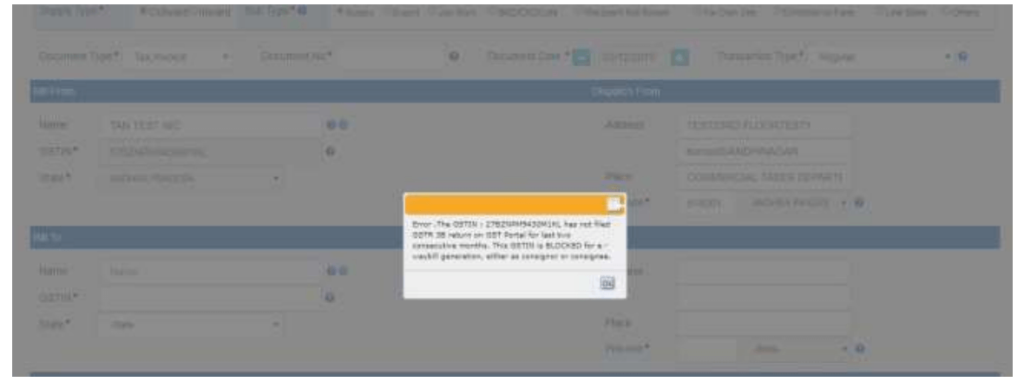

1. Every time a block taxpayer attempts to generate a new e-way bill for a bulk generation, a pop-up notification will show.

2. Similar pop-up notification will show if any taxpayer/transporter inserts the blocked GSTIN for another party during e-waybill generation.

How to Unblock the E-Way Bill Generation Facility?

1. Unblocking the e-way bill generation facility via EWB Portal

The taxpayer’s GSTIN will be instantly unlocked after the GSTR-3B and CMP-08 for the defaulting period is filed. Following the instructions below, a taxpayer can produce an e-way bill shortly after filing his GSTR-3B and CMP-08:

Step 1: Go to the e-way bill portal and select the ‘Search Update Block Status’ option.

Step 2: Fill in the GSTIN and CAPTCHA Code, then click ‘Go.’

Step 3: Select ‘Update Unblock Status from GST Common Portal’; this will update the status of the most recent filing.

Step 4: If none of the above methods work, a taxpayer can contact the GST Help Desk for assistance.

Previously, the Jurisdictional Officer might unlock GSTIN online based on the taxpayer’s manual representation. Another approach to unblock an e-way bill was to fill out an online application in EWB-05, which provided a suitable reason for the non-filing of GSTR-3B and CMP-08. Both online application facilities are currently unavailable.

2. Unblocking the e-way bill generation facility via GST Portal

According to the rule, the authorized taxpayer/transporter can change previously created and valid e-way bills using vehicle and transporter details. If a taxpayer wants to generate an e-way bill right after filing his GSTR-3B, he can do so through the GST Portal.

Step 1: Go to the e-way bill portal and select the ‘Search Update Block Status’ option.

Step 2: Check the status by entering the GSTIN.

Step 3: If the e-way bill is blocked, he or she can choose the update option to acquire the most recent filing status from the GST Common Portal and unblock the e-way bill.

If the system has not yet unblocked the GSTIN from being used to generate e-way bills, the taxpayer can contact customer service and file a complaint to have his or her issue resolved.

Impact of This New System on the Taxpayer

With this new blocking system of e-way bill generation, the biggest concern for a taxpayer is that he or she will be unable to deliver or receive items without an e-way bill. If the items are carried without an e-way bill, the authorities will issue a fine equal to the tax amount due. Moreover, the goods will be confiscated or detained, and will only be released if the tax amount is paid in full, plus a penalty. If goods are not delivered on schedule, business operations would grind to a standstill. To avoid being blocked, the taxpayer must file the returns on time. As a result, taxpayers must understand the significance of issuing an e-way bill in order to ensure seamless operations.