GST REG-08 A Form to Cancel GST Registration

Form GST REG-08 is a cancellation order for a TDS deductor or TCS collector’s GST registration. When the appropriate officer determines that the TDS deductor/TCS collector is no longer obligated to deduct TDS or TCS, he or she can cancel the GST registration and notify the TDS deductor/TCS collector in Form GST REG-08.

In this manual, the provisions pertaining to Form GST REG-08 are briefly described.

Provisions Related to GST REG-08 Form

The provisions of issuance/communication of Form GST REG-08 are addressed in Rule 12(3) of the CGST Rules, 2017. The following is a summary of Rule 12(3):

- TDS deductors or TCS collectors get an order from the appropriate officer canceling their registration in Form GST REG-08.

- Before issuing Form GST REG-08, the appropriate officer must be satisfied, based on investigation or proceedings, that the TDS deductor or TCS collector is no longer liable to deduct TDS or TCS.

- The appropriate officer sends Form GST REG-08 to the TDS deductor or TCS collector electronically.

- Before issuing Form GST REG-08, the proviso to rule 12(3) explicitly specifies that the procedure for cancellation of registration outlined in rule 22 of the CGST Rules, 2017 must be followed.

Steps Taken to Issue GST REG-08 Form

As previously stated, before issuing the cancellation certificate in Form GST REG-08, the appropriate officer must complete the cancellation procedure outlined in Rule 22. The following is a description of the technique in question:

- The appropriate officer will first issue a show-cause notice in Form GST REG-17, requesting the individual to explain why the GST registration should not be canceled.

- In response, the aggrieved person has seven days from the date of delivery of the notice to file a defense reply in Form GST REG-18.

- If the person’s response is insufficient, the appropriate officer will revoke the GST registration and notify the TDS deductor/TCS collector in Form GST REG-08.

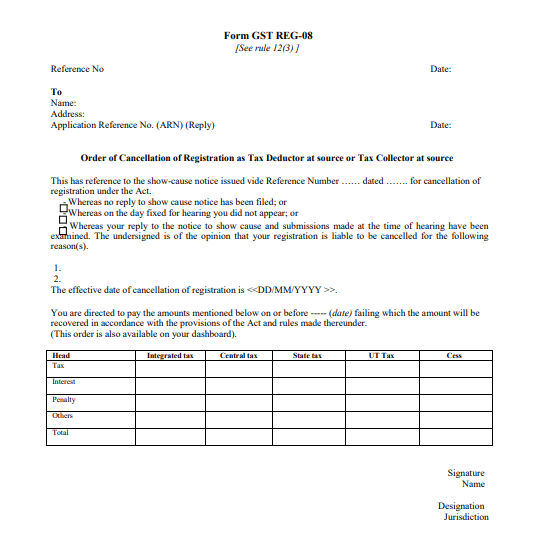

GST REG-08 Form Content

The following vital data are included in Form GST REG-08:

- Reference Number

- Date

- Name, Address, and Application Reference Number of the reply submitted in GST REG-18, if any.

- The reason for the cancellation of registration.

- The effective date on which the registration will be canceled.

- The instruction for payment of tax, interest, penalty, or any other sum, as well as the due date for payment, if applicable.

GST REG-08 Form Sample Template