How to Check e-Invoicing Eligibility on IRP?

From April 1, 2022, all businesses with an aggregated turnover of INR 20 crores or more would be required to use electronic invoicing, according to the recent mandate issued by CBIC of recent notice. Every business/taxpayer is obliged to submit GST invoices, debit/credit notes, reverse charge invoices, and export invoices on IRP. Following that, the IRP will evaluate the information contained in these documents and assign each one an IRN and QR code. It will digitally sign the invoice and send the taxpayers an e-Invoice.

Who Are all Eligible for e-Invoicing?

Every taxpayer must follow the e-Invoicing process if they:

- Have a turnover of INR 20 crores or more (based on PAN card) in the previous financial year.

- B2B Issued GST invoices, debit/credit notes, reverse charge invoices, and export invoices.

- Those who supply goods or services or both to registered taxpayers.

Pro Tips for Taxpayers

- Taxpayers engaged in Exports and Deemed Exports also need to generate e-invoices

- Suppliers of SEZs will also qualify under e-Invoicing.

- SEZ developers must create e-Invoices if their turnover exceeds a certain threshold.

- If all the rules are followed, DTA units must issue e-Invoices.

Taxpayers Exempted from Generating E-Invoices

Taxpayers in the following groups are excluded from the e-Invoicing process:

- Any insurance firm.

- A banking company that also includes a financial institution or a non-banking financial company (NBFC).

- Goods Transport Agency (GTA) provides products and transportation services via road.

- Any agents of transportation service providers who provide passenger transportation services.

- An authorized provider of – admission to a cinematograph film exhibition on multiplex screens.

- Units of the Special Economic Zone (SEZ).

- Free Trade and Warehousing Zones (FTWZ).

Important Notes

- Currently, B2C invoices issued by notified persons are not covered by e-Invoicing.

- Import Bills of Entry and B2C are not eligible for electronic invoicing.

- Invoice issued to Input Service Distributors.

- When notified, people get supplies: e-invoicing is not applicable when supplies are received from an unregistered person under GST (attracting a reverse charge) or through import services.

Step-by-Step Guide to Know e-Invoicing Eligibility on IRP?

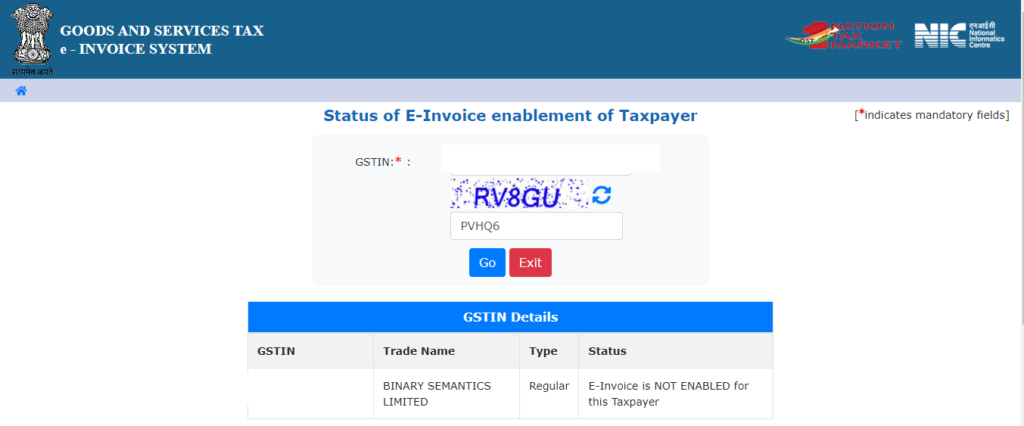

On the e-invoice portal, taxpayers may check if a GSTIN is valid. Follow the methods below to achieve the same result:

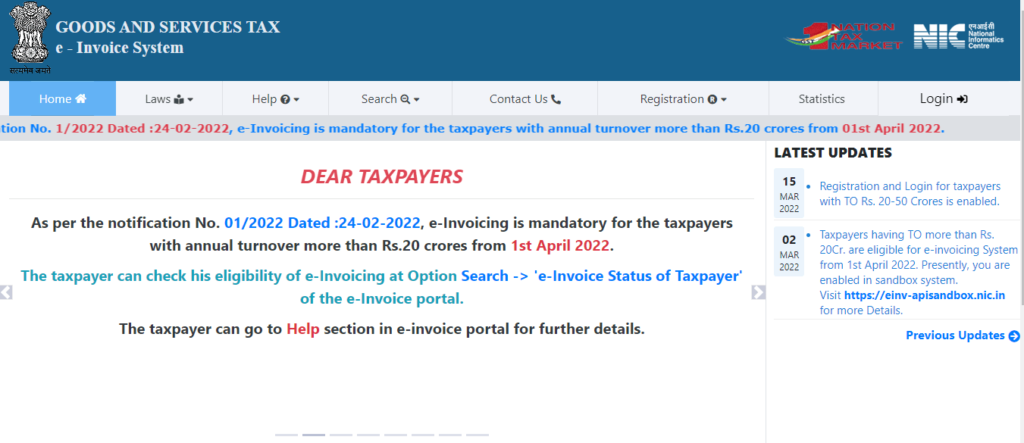

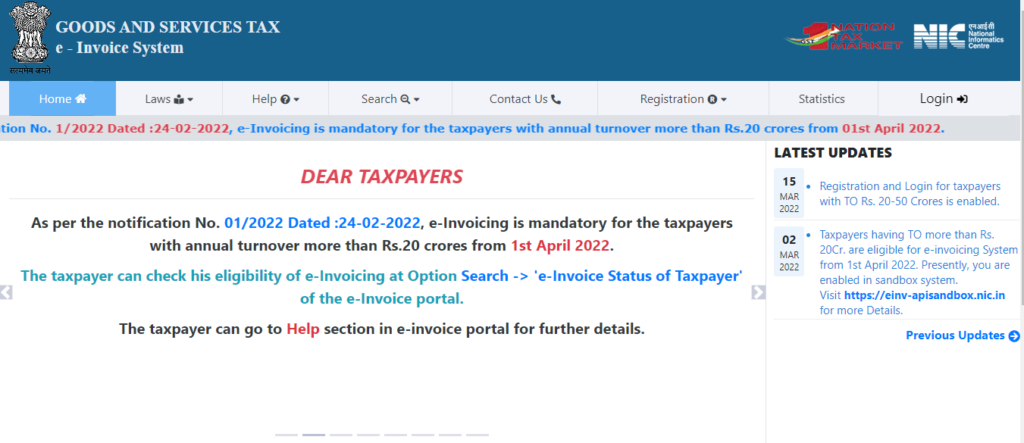

Step 1: Go to https://einvoice1.gst.gov.in/ and fill out the form.

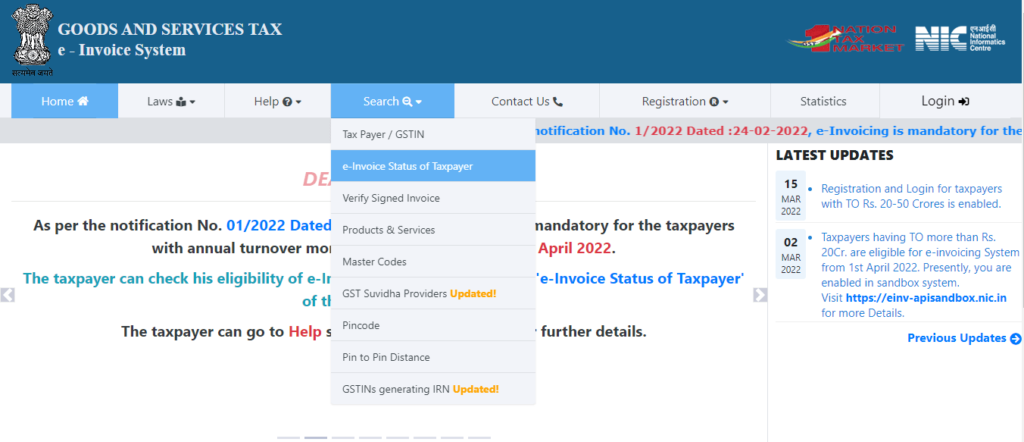

Step 2: Select ‘e-Invoice Status of Taxpayer’ from the ‘Search’ menu.

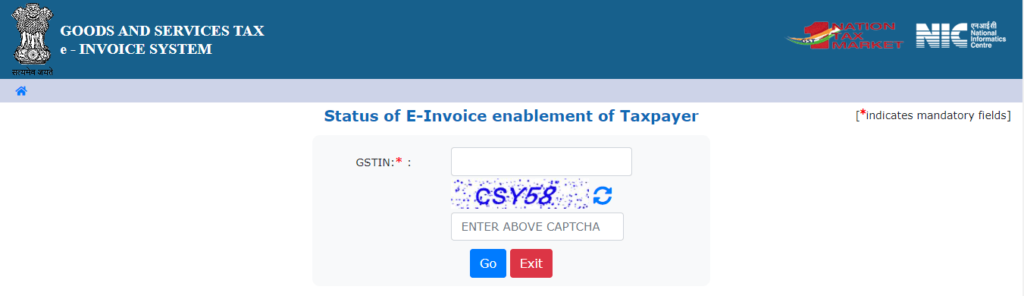

Step 3: After entering your GSTIN and Captcha code, click ‘Go.’

Step 4: Go to the IRP and look at the details that have been supplied.

Note: If a person is not registered with the e-invoice portal, they must first complete the registration process.

How to Register on the IRP?

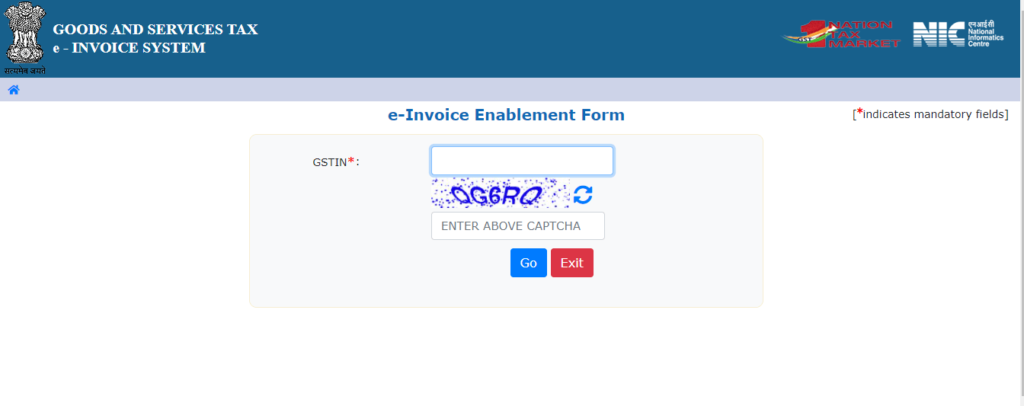

Step 1: Go to https://einvoice1.gst.gov.in/ and fill out the form.

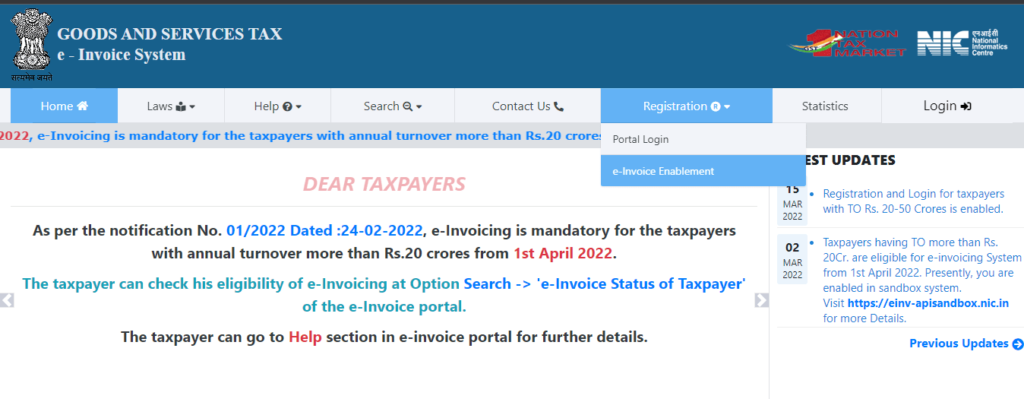

Step 2: Select ‘e-Invoice Enablement’ from the Registration tab.

Step 3: Fill in the blanks with the necessary information and continue.

• Mention the GSTIN as well as the captcha code.

• Then press the ‘Go’ button.