Signed QR Code under E-Invoicing

As per the recent mandate every taxpayer whose aggregate turnover exceeds INR 20 crores in any FY needs to implement e-Invoicing from April 1, 2022.

In this article, we will try to explain how you will get a Signed QR code under e-invoicing?

Steps Involved in Obtaining Signed QR Code

As per the mandate, the notified taxpayers need to generate invoices using their accounting and billing software or ERP and then upload the same on IRP.

After that, the IRP will verify the details entered in the invoices and return the e-Invoices with a unique IRN along with a singed QR Code as a part of a response to the request made by the taxpayer for e-invoice.

This signed QR code will contain both IRN and other details that will help tax officers to easily verify whether the e-invoice has been reported to the IRP and accepted by it.

Note: The e-invoice will become invalid and the digital signature will fail in case if the signed JSON has tampered.

Information Contained in the Signed QR Code

The signed QR code will contain the following e-invoice information:

- GSTIN of Supplier and Recipient

- Invoice No. assigned by Supplier

- Invoice Generation Date

- Invoice value (taxable value and gross tax)

- The number of line items.

- HSN Code or SAC of the line item having the highest taxable value

- HASH or IRN

- IRN Generation Date

How Signed QR Code will help?

With the help of signed QR code taxpayers and tax officer can

- Validate the e-invoices using any handheld device such as mobile.

- Paperless movement of goods from one place to another.

What is the Size of a Signed QR Code?

Generally, a signed QR code needs to be attached on the top right corner at the time of printing/sharing and the size of the printed signed QR code can be 2 X 2 inches.

However, it shall be noted that the size of the signed QR Code can be adjusted as per the space available on the e-invoice but it should be easily readable by the offline application provided by the IRP.

How does the QR Code Looks Like?

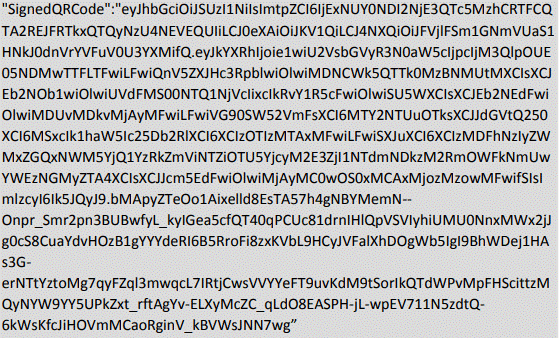

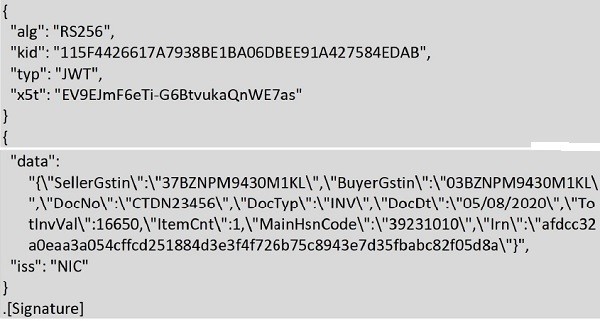

The signed QR code has 3 parts and is in the form of JWT. These three parts include:

- Signature parameters

- Data

- Signature

Sample Signed QR code String File

Decoded Signed QR Code

Printed Form of Signed QR Code

Note: The signed QR code shall not be decoded before printing as the signature of the IRP attached and the very essence of authentication will be lost.

Dynamic QR Code for B2C Invoices

As per the recent notification issued by the CBIC (Notification No. 71/2020-Central Tax dated 30.09.2020) the date of implementation of the Dynamic QR Code for B2C invoices is extended till 01 December 2020.

Unlike signed QR Code, Dynamic QR Code applies to the supplies made by the registered taxable person to the unregistered taxable person where the aggregate turnover of registered taxpayers whose aggregate turnover is more than INR 500 Crores.

Note 1: The concept of Dynamic QR Code is altogether different from the signed QR Code under the e-invoicing system.

Note 2: On the recommendation of the GST council, the government has decided to waive the penalty for non-compliance with dynamic QR code provisions till 31st March 2021. Read the whole notification here.

Author

Devesh Gupta

Content Specialist, GSTrobo®