Dynamic Quick Response (QR) Code Concept Under GST

The concept of dynamic Quick Response (QR) Code under GST was introduced by CBIC through Notification No. 14/2020 – Central Tax on 21st March 2020. Moreover, the government has decided to launch the dynamic QR code concept from 1st December 2020. So, in this blog, we will try to explain the dynamic QR code concept under GST and how it is different from the e-invoicing QR code.

| Recent Updates Update 1: On the recommendation of the GST council, the government has decided to waive the penalty for non-compliance to dynamic QR code provisions for the period between 1st December 2020 to 31st March 2021 provided that the notified taxpayer complies with its provision from 1st April 2021. Read the whole notification here. Update 2: As per the notification (No. 06/2021-Central Tax dated 30.03.2021), CBIC seeks to waive off the penalty for non-compliance with the provisions related to the dynamic QR code till 30th June 2021. |

What is a Dynamic Quick Response (QR) Code?

To promote digitization and digital payment, Dynamic QR code is brought into the picture by the government. As most enterprises are clueless about the newly launched concept of dynamic QR code under GST, we have tried to compile all the basic differences between Static and Dynamic QR code.

| S.no. | Static QR Code | Dynamic QR Code |

| 1. | In a static QR Code, the customer needs to fill the amount he/she needs to pay to the enterprise. | In Dynamic QR Code, the payment amount is auto-filled and the customer just needs to initiate the transaction by entering the UPI PIN. |

| 2. | The invoice number is not prompted when the customer makes the payment through the Static QR Code. | The invoice number is prompted when the customer makes the payment through the Dynamic QR Code. |

| 3. | Order specific information such as order ID, order amount cannot be passed using Static QR code. | Order specific information such as order ID, order amount can be passed using Dynamic QR code. |

Benefits of Dynamic QR Code

- Every dynamic QR code generated is unique.

- Control on the supply value.

- The payee cannot change the value.

- The amount can be paid easily by using any UPI app.

| Note: The Dynamic QR code concept under GST is not at all related to the QR code under the e-Invoicing system. |

Data embedded in Dynamic QR Code

- Merchant’s UPI Id.

- Merchant’s Name.

- Merchant Code, if any.

- Merchant ID, If any.

- Reference number that may consist of an order number, subscription number, Bill number, booking number, etc.

- Short Description.

- Invoice Value.

- Minimum Amount Payable.

Dynamic QR code applicability

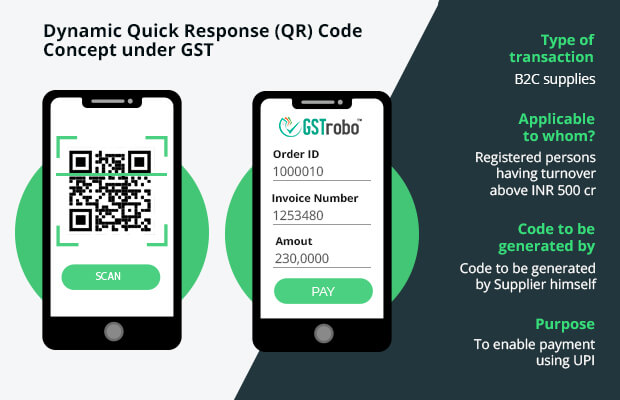

Any supply made by the registered taxable person to the unregistered person (also known as B2C supplies). It shall be noted that the concept of dynamic QR code applies to those registered taxable persons whose turnover exceeds INR 500 Crores in a financial year.

Who needs to generate a Dynamic QR code under GST?

A registered supplier whose turnover exceeds INR 500 crores needs to generate the dynamic QR code either on the Point of Sale (PoS) machine or the Invoice issued.

Purpose of Dynamic QR code

The main purpose of the introduction of dynamic QR code in the GST system is to enable payment using any UPI.

How Dynamic QR Code is different from the e-invoicing QR code?

| Type of Code | Dynamic QR Code | E-invoicing QR Code |

| Type of transaction covered | B2C supplies | B2B and Export supplies |

| Applicable to whom? | Registered taxable persons having aggregate turnover above INR 500 crore in an FY. | Registered taxable persons having aggregate turnover above INR 500 crore in an FY. |

| Code to be generated by | Supplier himself either on the Point of Sale (PoS) machine or the Invoice issued. | Generated by the Invoice Registration Portal (IRP) against the e-invoice details reported to IRP. |

| Purpose | To enable payment using UPI by scanning the dynamic QR Codes. | To embed key data from a reported invoice. To verify whether an invoice has actually been reported to IRP. The digital signature is intact and not tampered. |

How can we help you with Dynamic QR code generation?

GSTrobo is a new age GSP appointed by GSTN providing solutions and APIs enabling taxpayers with GST compliances. We can help you stay dynamic QR code compliant by generating the same either by integrating an API or by developing code on your existing PoS machine or mobile app/website i.e., used for generating B2C invoices. Once a dynamic QR code is generated customers can instantly pay by scanning the same using UPI-based payment apps.

One Reply to “Dynamic Quick Response (QR) Code Concept Under GST”

Dynamic Code Topic Updated by Govt, So Plzz upate this also as well as that was help to me thanku