AADHAAR Authentication Now Mandatory for Registered Taxpayers

As per Notification No. 38/2021-CT dated 21st December 2021, 1st January 2022 is set as the implementation date for Rule 10B of the CGST Rules, 2017.

So, now the question arises what is Rule 10B of the CGST Rules, and how is mandatory AADHAAR authentication for a registered taxpayer related to the said rule?

Rule 10B of CGST Rules and its Relation to Mandatory AADHAAR Authentication

According to the aforementioned regulation, AADHAAR authentication is required for the following purposes:

- Filing of an application for revocation or cancellation of registration in FORM GST REG-21 as per Rule 23 of the CGST Rules, 2017.

- Claiming a refund by submitting RFD-01 Form in accordance with Rule 89 of the 2017 CGST Rules.

- Claiming Refund of IGST paid on goods exported outside as per Rule 96 of the CGST Rules, 2017.

It shall be noted that if a taxpayer has not yet validated his/her AADHAAR or verified his/her e-KYC, they should do so before completing the aforementioned two applications. This will allow the GST system to approve and transfer IGST refund data from the GST system to the ICEGATE system.

What to Do If a Taxpayer has no AADHAAR Number?

If the registered taxable person’s AADHAAR number has not been assigned for AADHAAR authentication as described above, the person may undertake e-KYC verification by providing the following information:

- She/he will input AADHAAR Enrolment ID and upload the acknowledgment; and

- She/he will also upload any of the following documents:

(i) Bank passbook with photograph; or

(ii) Voter Identity Card issued by Election Commission of India; or

(iii) Passport; or

(iv) Driving license issued by the Licensing Authority as per the MV Act, 1988 (59 of 1988):

Furthermore, once the registered taxable person receives the AADHAAR number, he/she shall complete the AADHAAR authentication process within 30 days.

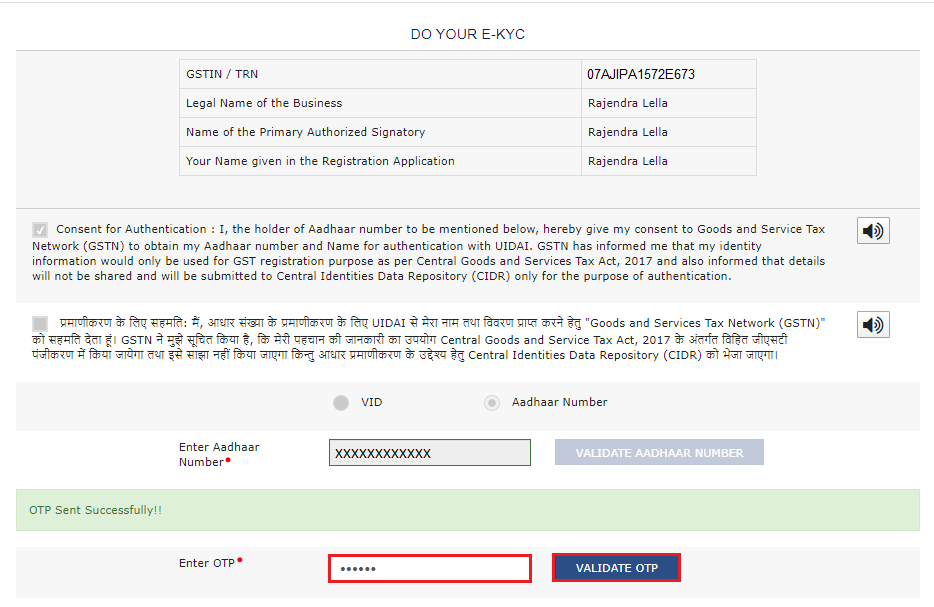

How to Complete AADHAAR authentication or e-KYC verification?

You just need to follow the steps below to authenticate AADHAAR or verify e-KYC

Step 1: Open the GST Portal and log in using valid credentials. Go to the “MY PROFILE” section. To check the status of your AADHAAR, go to AADHAAR Authentication Status. 2 options are available.

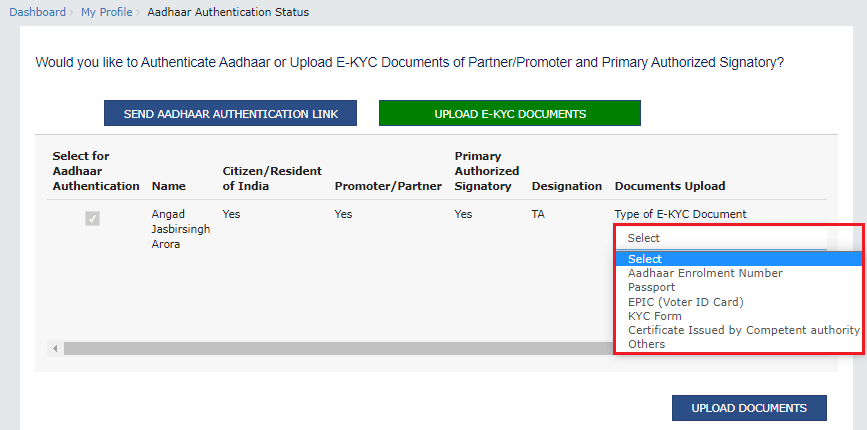

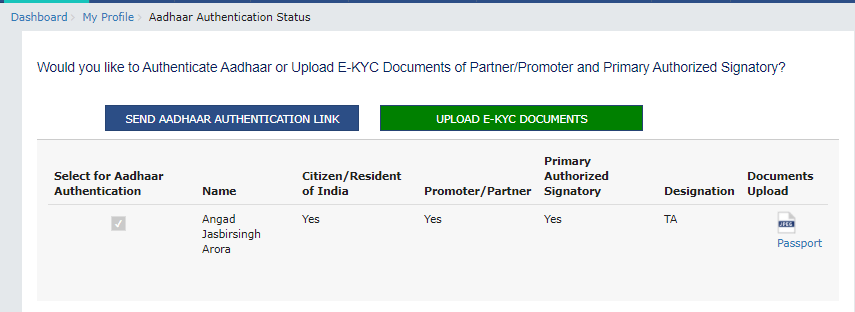

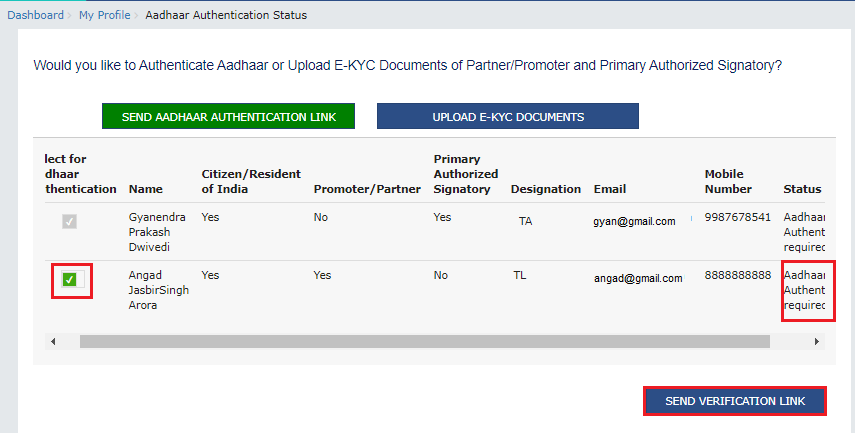

Step 2: Select between sending an AADHAAR authentication link or uploading e-KYC papers.

If you choose the first option, you need to verify the URLs sent to the signatory’s email address and cellphone number and complete the OTP verification.

If the second option is selected, the tax officer can approve or reject the document. The taxpayer will be e-KYC authenticated, rather than AADHAAR authenticated.