What is GSTR-9 – The GST Annual Return Filling

GSTR-9 is the GST annual return filling that a taxpayer is required to file on or before 31st December of every year. It is a consolidated summary of the year’s financial statement where the taxpayer compares the purchase and sales registers and compares and reconciles their GSTR-9 and GSTR-9C with the GSTR-1 and GSTR-3B.

Subsequently, by doing so, one avoids any penalties and interests and claims the correct and complete Input Tax Credit for that year. Therefore, GSTR-9A, GSTR-9C, and GSTR-9 filling become substantial returns for an organization or company.

In this article, we will discuss in detail everything related to GSTR-9, the GST annual return filling.

Who is Exempted from GSTR-9 Filling?

As already mentioned, GSTR-9 is required to be filed by a registered taxpayer in order to file an annual return, with some exceptions. For each financial year, the annual return must be filed in GSTR-9 by regular taxpayers subsuming SEZ developers and SEZ units.

Details Included in GSTR-9 Filling

While filing the return, the taxpayer must furnish all the details regarding the ITC claim, purchase, sales, refunds claimed, demand created tax paid, and other significant information mandated in the GSTR-9 form. These details will be related to a specified period.

Taking an example, to file F. Y. 2022-23 annual return GSTR-9, the details will be related to the period of April 2022 – March 2023.

It gathers the summary of all business transactions that occurred during one specific financial year and carries details such as supplies received and made under several tax heads like SGST, IGST, CGST, etc. On a yearly basis, the information is comprised of a monthly or quarterly return basis.

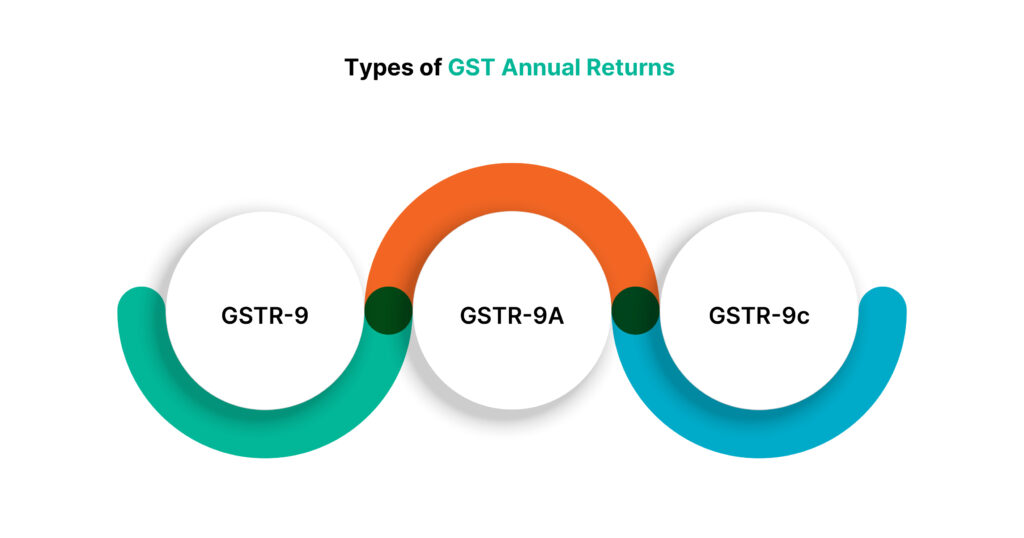

Types of GST Annual Returns

The annual GST returns are of three types. Have a look:

- GSTR 9: The taxpayers filing GSTR 3B and GSTR 1 are required to file GSTR 9.

- GSTR 9A: Those who are registered under the composition scheme of GST are obliged to file GSTR 9A.

- GSTR 9C: GSTR 9C is specifically a reconciliation statement for those whose annual income crosses Rs. 2 crores in the financial year. To file this return, all taxpayers must audit their accounts.

What is GSTR 9 Due Date

The last date to file and submit the details of GSTR-9, GSTR-9A, and GSTR-9C is 31st December every year. Post the GSTR 9 due date, any delays will cause GSTR 9 late fees, and this is the most common mistake in GSTR 9 filing.

How to Avoid GSTR 9 Late Fees

The best way to avoid late fees for GSTR-9 filling and never miss the GSTR 9 due date is to be well-prepared with all the documents and details of transactions and returns of the financial year well in advance. It would help if you also determined any discrepancies in the reconciliation of your books of accounts with transactions and corrected them beforehand.

GSTR 9 Late Fees Amount of GSTR-9 Annual Return

Taxpayers (whose Annual Aggregate Turnover exceeds Rs 20 Crores) must pay Rs. 200 per day as a penalty for the late filing of the GSTR-9 annual return. Of this amount, Rs. 100 consists of SGST and Rs. 100 for CGST. Also, it is to be noted that the total penalty cannot exceed 0.50% of the turnover on which the said penalty is being levied. However, for IGST, there is no GSTR 9 late fee at all. For taxpayers having turnover more than 5 crores & less than 20 crores, late fee is Rs. 100 (Rs. 50 each under CGST and SGST Act).

Can taxpayers revise GSTR-9 Once Filed?

No, the GSTR-9 annual return cannot be revised, or the details cannot be altered once submitted. The taxpayer is advised to carefully examine and match all the details of the auto-populated values of their books of accounts, inward and outward supplies details, ITC amount claimed, or refunds taken before they enter the same in the GSTR-9, the GST annual return. Be very careful while following our detailed GSTR-9 filing instructions as you can’t alter the GSTR-9 once filed and submitted.

Who is eligible to file GSTR 9?

Each registered person under GST is required to file this form, GSTR 9, except the following persons:

- Casual taxable persons

- Non-resident taxable persons

- Persons selecting the Composition scheme and filing GSTR 9A

- Persons under section 51 of Goods & Service Tax paying TDS

- Persons under section 52 of Goods & Service Tax collecting TCS

- Input service distributors

What details are you supposed to fill in the GSTR 9 form?

The GSTR 9 form is divided into six parts with 19 tables, and in each part, you need to fill in the required information as specified in the columns. For instance, in Part I, the basic details, like their name, financial year, etc., must be filled in. In Part II, details about outward and inward supplies are required to be filed and so on. Each part is easy to understand and fill out while avoiding common mistakes in GSTR 9 filing process, all you have to do is follow the below-mentioned GSTR 9 filing instructions.

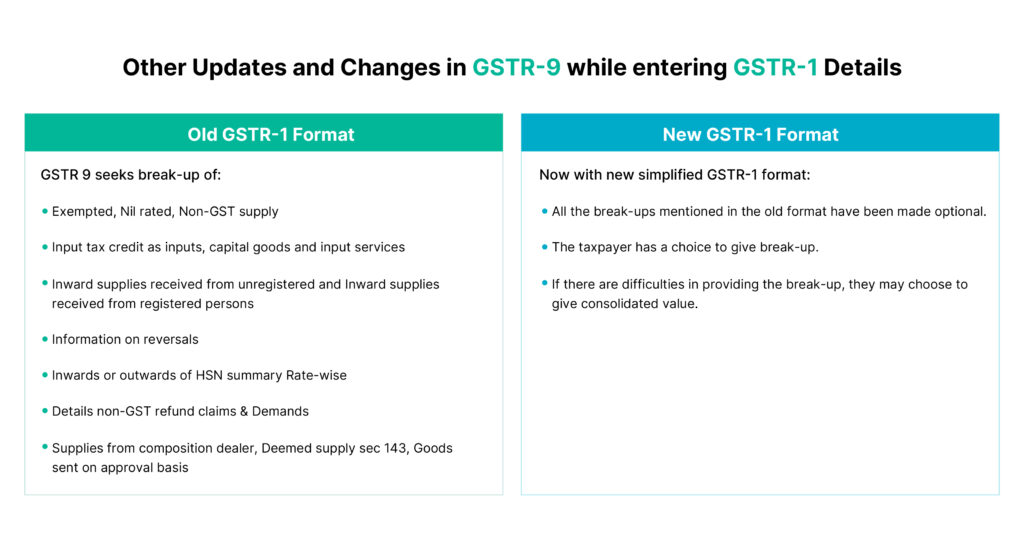

GSTR 9 Updates and Changes

GST amnesty scheme was introduced as an GSTR 9 latest updates and changes

The CBIC notified vide 07/2023 dated 31st March 2023, a waiver of late fees in excess of Rs. 20,000 (i.e., 10,000 each under CGST and SGST Act) for delayed filing of GSTR-9 for years 2017-18 up to 2021-22 if filed between 1st April 2023 to 30th June 2023.

All Details of GSTR-9 Annual Return

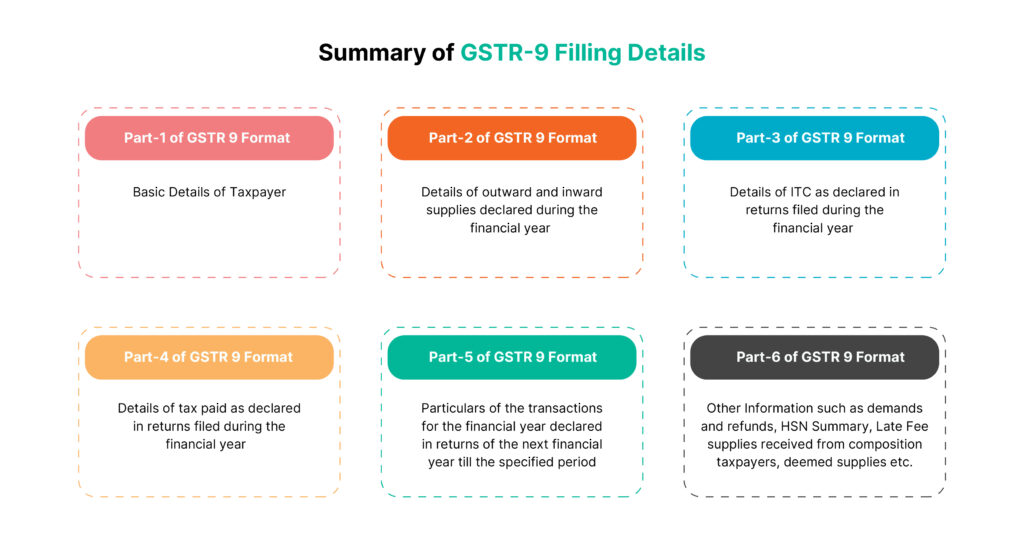

To file a GSTR-9, the GST annual return, the taxpayer must fill 6 parts and 19 tables to complete the filling process. Let’s understand the details required in all 6 parts and 19 tables in detail:

Part – I: Basic Details

1. Financial Year for which the return is being filed.

Note: FY 2022-23 will contain details for April 2022 to March 2023.

2. Taxpayer’s GSTIN

3. 3A Registered person Legal Name and 3B Registered business’ Trade Name (if any)

Part – II

Part 2 of GSTR-9 requires meticulous details of both Inward and Outward supplies made during the specified financial year. This is where the taxpayer mentions important details like GSTR 9 for export and import transactions and other important taxes paid. This section is pivotal, consolidating data from all returns filed for the entire financial year. This helps the taxpayer to streamline their GSTR 9 reconciliation with other GST forms. Let’s delve into the sub-sections:

4. Inward Supplies (4A to 4N):

– 4A: Supplies to unregistered persons (B2C)

– 4B: Supplies to registered persons (B2B), including e-commerce transactions

– 4C: Zero-rated supply (Exports) on tax payment

– 4D: Supply to SEZs on tax payment

– 4E: Deemed Exports

– 4F: Advances with tax paid but invoices not issued

– 4G: Inward supplies with reverse charge tax payment

– 4H: Sub-total of (A to G)

– 4I: Credit Notes for transactions in (B to E)

– 4J: Debit Notes for transactions in (B to E)

– 4K: Supplies/tax declared through Amendments

– 4L: Supplies/tax reduced through Amendments

– 4M: Sub-total of (I to L)

– 4N: Advances and Supplies on which tax is to be paid (4H + 4M)

5. Outward Supplies (5A to 5N):

– 5A: Zero-rated supply (Exports) without tax payment

– 5B: Supply to SEZs without tax payment

– 5C: Supplies with recipient’s reverse charge tax payment

– 5D to 5F: (Exempted)/(Nil Rated)/(Non-GST) supplies

– 5G: Sub-total of (A to F)

– 5H: Credit Notes for transactions in (A to F)

– 5I: Debit Notes for transactions in (A to F)

– 5J and 5K: Supplies declared/reduced through Amendments

– 5L: Sub-Total of (H to K)

– 5M: Turnover on which tax is not to be paid (G + L) T

– 5N: Total Turnover which includes advances (4N + 5M – 4G)

Part III: Input Tax Credit (ITC) Details

Part III of GSTR-9 is dedicated to the meticulous reporting of Input Tax Credit (ITC), which is declared in returns filed during the financial year. Let’s break down the intricate sections:

6. Details of ITC Availed:

– 6A: Total ITC availed through FORM GSTR-3B, auto-populated from Table 4A of FORM GSTR-3B.

– 6B: Inward supplies (excluding imports and reverse charge), including services from SEZs.

– 6C: Inward supplies from unregistered persons liable to reverse charge on which tax is paid & ITC availed.

– 6D: Inward supplies from registered persons that are liable to reverse charge. Ensure tax is paid and ITC availed on these supplies.

– 6E: Import of goods that includes supplies from SEZs.

– 6F: Import of services that exclude inward supplies from SEZs.

– 6G: ITC received from the Input Service Distributor (ISD).

– 6H: Amount of ITC reclaimed under the provisions of the Act.

– 6I: Sub-total of (B to H).

– 6J: Difference (I – A).

– 6K: Transition Credit through TRAN-I that includes revisions, if any.

– 6L: Transition Credit through TRAN-II.

– 6M: Mention any other ITC availed but not specified above.

– 6N: Sub-total of (K to M).

– 6O: Total ITC availed (I + N).

7. ITC Reversed and Ineligible ITC Details:

– 7A to 7H: Various categories of ITC reversed as per specified rules.

– 7I: Total ITC Reversed (A to H).

– 7J: Net ITC Available for Utilization (6O – 7I).

8. Other ITC-related Information:

– 8A: Auto-populated ITC as per GSTR-2A (Table 3 & 5 thereof).

– 8B: ITC as per the sum total of 6(B) and 6(H) above.

– 8C: ITC on inward supplies received during 2022-23 but availed from April to November 2023.

– 8D: Difference [A-(B+C)].

– 8E and 8F: Eligible ITC amount but not availed or ineligible (out of D).

– 8G: IGST paid on import of goods that includes supplies from SEZ.

– 8H: IGST credit that’s taken on the import of goods (as per 6(E) above).

– 8I: Difference of 8G-8H.

– 8J: ITC that can be taken but not availed on the import of goods.

– 8K: Current financial year’s total ITC that will lapse (E + F + J).

Part IV:

Tax already paid as declared in returns filed while in the financial year.

Part V: Details of Transactions for Previous FY

In Part 5, meticulous reporting is essential for transactions pertaining to the previous financial year but declared in the returns of next financial year till the specified period, whichever is earlier.

10. Supplies/Tax Declared through Amendments (+) and

11. Supplies/Tax Reduced through Amendments (-):

12. During the Previous Financial Year, Reversal of ITC Availed:

The aggregate value of ITC availed in the previous financial year but reversed in returns filed in the previous financial year but availed in the next financial year till the specified period, shall be declared here. Utilize Table 4(B) of FORM GSTR-3B for accurate reporting.

13. Previous Financial Year’s ITC Availed:

Details of the previous financial year’s ITC for goods or services received in the previous financial year but availed in the next financial year till the specified period, shall be declared here. Utilize Table 4(A) of FORM GSTR-3B for precise details.

14. Differential Tax Paid as declared in points 10 & 11 above:

Report the differential tax paid on account of declarations made in sections 10 and 11.

Part VI: Other Information

15. Particulars of Demands and Refunds:

– 15A to 15D: Aggregate value of refunds claimed, sanctioned, rejected, and pending processing.

– 15E to 15G: Aggregate value of demands of taxes, taxes paid, and demands pending recovery.

16. Information related to Supplies acquired by Composition Taxpayers.

Mention the deemed supply under Section 143 and Goods Sent on Approval Basis:

– 16A: Supplies received from Composition taxpayers.

– 16B: Aggregate value of deemed supply under Section 143.

– 16C: Aggregate value of deemed supplies for goods sent on approval basis but not returned.

17. HSN Wise Summary of Outward Supplies

18. HSN Wise Summary of Inward Supplies:

– Enter the summary of supplies affected and received against a particular HSN code.

– Optional for turnover up to ₹1.50 Cr, mandatory for turnover above ₹1.50 Cr.

– Utilize Table 12 of FORM GSTR1 for details in Table 17.

19. GSTR 9 Late Fees Payable and Paid:

– Report the GSTR 9 late fees payable for the GST annual return that’s filed after the GSTR 9 due date.

Process of Filing GSTR-9

Here is a detailed guide to How to file GSTR 9 online:

Note: You can file GSTR-9, the GST annual return both online and offline. Here we mention the procedure to follow while filling GSTR-9 online by a taxpayer.

1. Use your credentials and log in to the GST portal.

2. Navigate to Services > Returns > Annual Return.

3. Select the Financial Year 2022-23 and click on Search.

4. Scroll down to the page where two tabs are displayed. Click on “Prepare online” under the Annual Return GSTR-9 tab.

5. Choose “No” and click on the Next button.

6. Fill in the details for all the tables of GSTR-9 as outlined in Step 3.

7. Save each table by clicking the save button within the respective sections.

8. Note that Form GSTR-9 is a summary, and Input Tax Credit (ITC) cannot be claimed through this form.

9. Declare any additional liability not reported earlier during the filing of Form GSTR-3B.

10. The system will compute GSTR 9 late fees automatically during liability computation. Click on “Compute Liabilities.”

11. The “Proceed to File” button will be enabled if GSTR 9 late fees are applicable. Click on “Proceed to File” to pay liabilities and file the return.

12. Review the details by clicking the ‘Preview Draft GSTR-9 PDF’ button.

13. Confirm the declaration by checking the designated box and selecting the authorized signatory details from the drop-down list.

14. Additional details can be added even after initiating the liability computation but before filing GSTR-9.

15. Choose to file Form GSTR-9 using either the Digital Signature Certificate (DSC) or Electronic Verification Code (EVC) of the Authorized Signatory.

16. An Acknowledgment Reference Number (ARN) is generated upon successful filing.

17. The filed GSTR-9 form is available for viewing and downloading in both PDF and Excel formats.

Important Tip

Be careful while filing the GST annual return and be sure about what you are entering. Anything found wrong may be subject to penalties and interest, resulting in long-term litigations.

So, this was all about GSTR 9, the GST annual return. We hope you have thoroughly gone through each aspect and have much clarity about its terms. Still, if you are perplexed and want your queries resolved, then tell us about it by commenting below. Thank You for visiting us!

Role of GSTR 9 Filling Software

GSTR-9 filling software has emerged as an indispensable tool for businesses navigating the complexities of Goods and Services Tax (GST) compliance. Specialized solutions of GST software like GSTrobo streamlines the process of filling GSTR-9, the annual return form required under the GST regime. Equipped with intuitive features, GSTR-9 filling software, GSTrobo offers a user-friendly interface that guides you through each section of the return, ensuring accurate and efficient completion.

The tool incorporates data validation checks, minimizing errors and discrepancies. Advanced functionalities of GSTrobo include automated calculations, real-time updates based on regulatory changes, and seamless integration with other financial systems and any ERPs. Businesses using GSTrobo benefit from the time saved and enhanced accuracy provided by our GSTR-9 filling software, allowing them to focus on core operations while maintaining compliance with GST regulations. Whether for small enterprises or large corporations, adopting and using GSTrobo for efficient GSTR-9 filling proves instrumental in achieving a smooth and hassle-free GST annual return filling process.

2 Replies to “What is GSTR-9 – The GST Annual Return Filling”

This is very attention-grabbing, You’re an excessively professional blogger.

I’ve joined your feed and sit up for searching for more of your great post.

Additionally, I have shared your web site in my social networks

Thanks for posting. I really enjoyed reading it, especially because it addressed my issue. It helped me a lot and I hope it will help others too.