Shape Your Business Brand Image with GSTR-9

Public relations or PR activities assist a company in marketing and presenting itself to the industry more effectively. However, many seldom forget the relevance of managing compliance and leveraging it to a company’s brand advantage. You might not need to spend lakhs on PR activities but rather keep your compliance game straight to put up a clean and perfect brand image for your company. Filling timely and accurately following GSTR-9 returns does just that for your organization.

Rounding up the entire year with this return it shows how your organization has followed all GST and Indian tax laws and been vigilant while doing business operations all year round. will In addition, it also prevents your company from the burden of penalties and aligns your year-round operations with the relevant government authorities. The GSTR-9 annual return assists businesses in various ways, including helping them understand their current position and make strategic decisions… It would accomplish much more. Let’s look into how it will affect your business:

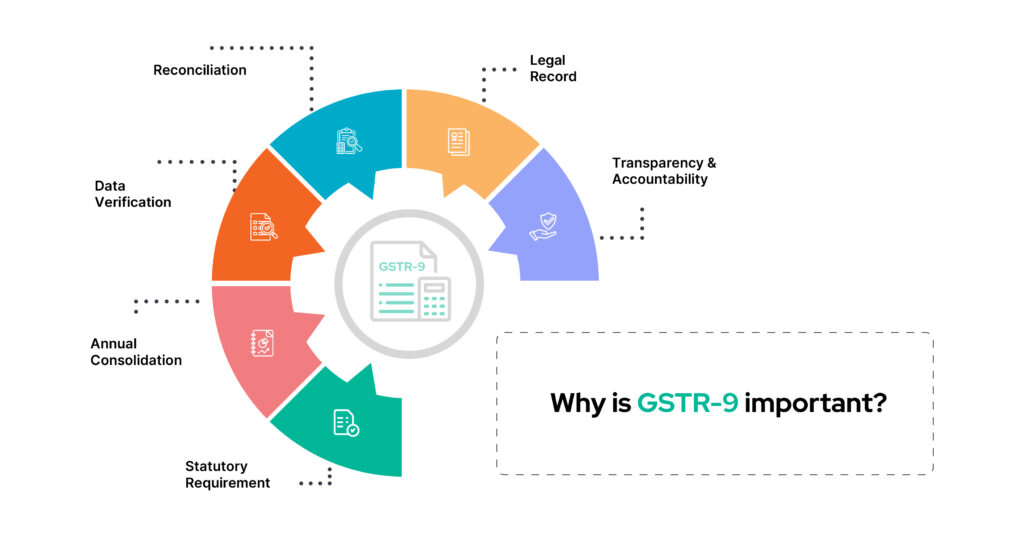

Why is GSTR-9 important?

The importance of GSTR-9 in GST compliance can’t be overstated. GSTR-9 is an annual return filing that plays a pivotal role in ensuring that businesses and taxpayers comply with India’s Goods and Services Tax (GST) regime every year. Here are several key reasons highlighting its importance:

- Statutory Requirement:

Filing GSTR-9 is a mandatory statutory requirement for all businesses registered under GST, except for a few specific categories. Non-compliance can lead to penalties and legal consequences. Therefore, it is a fundamental aspect of adhering to GST laws.

- Annual Consolidation:

GSTR-9 is an annual consolidation of all the monthly or quarterly GST returns filed during the financial year. It provides a comprehensive overview of a taxpayer’s financial activities and tax liabilities over the year. This consolidation helps tax authorities assess the taxpayer’s compliance with GST laws and helps the taxpayer to ditch legal complications while GST audits..

- Data Verification:

GSTR-9 annual return filling allows the tax authorities to cross-verify the details provided in various GST returns, such as GSTR-1 (outward supplies) and GSTR-3B (summary returns). This cross-verification is essential to ensure the accuracy and integrity of the data submitted by taxpayers, maintaining the integrity of one’s organization.

- Reconciliation:

Did you know Indian enterprises lose up to 7% of profits on non-ITC claims? GSTR-9 reconciliation of Input Tax Credit (ITC) is a critical component of GST compliance. It ensures that the ITC claimed by a taxpayer in their returns matches the ITC available as per their books of accounts. Any discrepancies discovered during this GSTR-9 reconciliation can lead to corrective actions and prevent potential tax liabilities.

- Taxpayer’s Responsibility:

Filing GSTR-9 annual return is the taxpayer’s responsibility, and it reflects their commitment to compliance. It is an opportunity for businesses to review their GST transactions and rectify any errors or discrepancies before the authorities conduct audits or investigations.

- Legal Record:

GSTR-9 is a legal record of a taxpayer’s GST activities for the financial year. It can be used as evidence in case of disputes, audits, or investigations. Maintaining accurate and complete records in GSTR-9 is crucial for defending a taxpayer’s position in such situations.

- Transparency and Accountability:

GSTR-9 promotes transparency and accountability in the GST system. Providing a consolidated view of a taxpayer’s GST activities helps build trust between businesses, tax authorities, and consumers. It also ensures that businesses are held accountable for their tax obligations.

How Does GSTR-9 Help Your Business?

Now that you understand the importance of GSTR-9 annual return filling, let’s see how it can help you drive a better and more sustainable way of doing business operations and improve your company’s brand.

- Compliance and accuracy:

Non-compliance with GST norms can put a heavy dent in one’s enterprise image. On the contrary, following proper compliance throughout the year gives you a positive brand image. GSTR-9 is a consolidated annual reconciliation return allowing businesses to cross-verify data reported in their GSTR-1 and GSTR-3B against the actual transaction during that fiscal year. GSTR-9 reporting ensures that companies adhere to the GST regulations and comply with the tax authority requirements. This document will save you from any penalty or interest.

- Data Validation:

For businesses, data equals gold. In the new age way of business, it has become the weapon that has the power to make or break any organization. GSTR-9 return filling gives you the upper edge as it requires one to accumulate and compare the data of the whole year, furthering wise financial decisions and taking the right steps for the future. Businesses can use GSTR-9 to validate and reconcile the data reported throughout the year. The report includes invoices, taxes paid, and input tax credit (ITC) claimed. This report helps find any discrepancies or inconsistencies in data and can be rectified before tax authorities initiate audits or assessments.

- Annual Reports:

GSTR-9 will help to generate annual reports from which you can get to know the company’s profit, loss, tax to be paid, ITC to be claimed, etc. These reports will help the business to plan their investments accordingly. It will also help to decide how to optimize their tax planning strategies. It will also guide the adjustment of procurement or sales practices to enhance the growth of the business.

- Future Tax Planning:

GSTR-9 reports provide a historical overview of the business’s GST transactions. This data can be used to forecast future tax liabilities and ITC availability. The company can plan for cash flow accordingly and allocate resources more effectively based on past trends and data. Also, you can evaluate where your finances and planning went wrong and work to better the results for the future.

- Comparative Analysis:

Comparing GSTR-9 reports from different years offers a valuable perspective on a business’s financial health and growth trajectory. It helps to identify positive and negative trends and adapt their strategies accordingly.

- Audits and Assessments:

Tax authorities often refer to GSTR-9 data during audits and assessments to verify the accuracy of GST returns. Well-maintained and accurate GSTR-9 reports can expedite the process of responding to audit queries and reduce the risk of penalties.

- Identifying areas of Improvement:

GSTR-9 annual return will help businesses find any improvement areas for future reference. It reveals areas where companies need to focus or change strategy for the better. This valuable information will allow businesses to move towards smooth GST compliance compliance and other operations. It will also help to know where the business went wrong and what needs to be rectified in order not to repeat past mistakes.

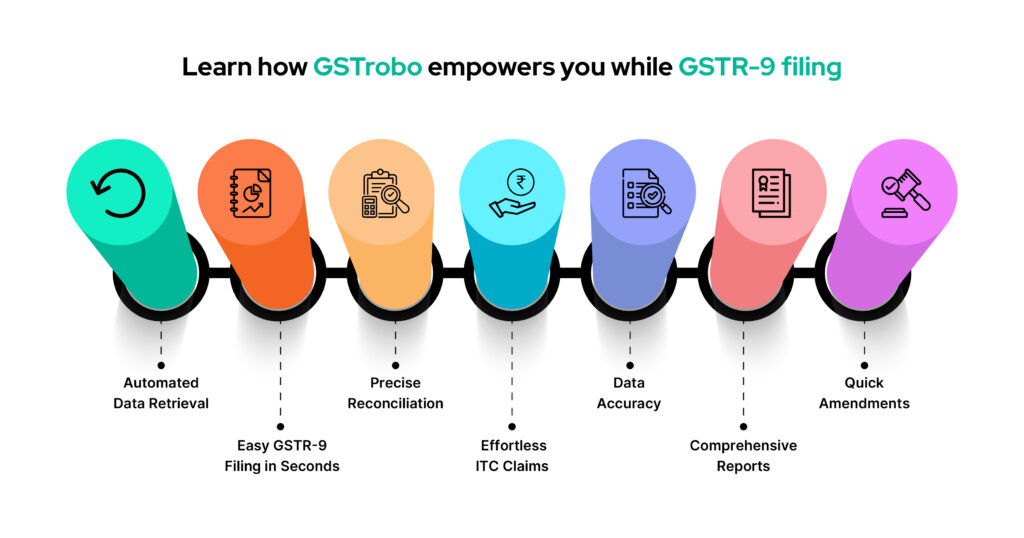

How GSTrobo Makes GSTR-9 Filling Easy For Businesses?

While you understand and manage your annual return filling, GSTrobo makes this journey an easy one for you. Made to deliver with precision and speed, it saves you time and effort with a user-friendly interface that does the job in seconds. Whether it’s data extraction, excel mapping, convenient and quick reconciliation, or prompt error detection. GSTrobo does it all with ease. Use the intuitive CFO dashboard for smart financial decision-making or compare 40+ reports to understand your compliance.

Empowering financial teams to manage legal GST amendments and navigate GST audit procedures effortlessly, GSTrobo is an intelligent tool that drives automation. GSTrobo ensures accuracy in filings and enhances efficiency, allowing businesses to focus on their core operations while building a reputation for prompt and precise GST compliance. Choosing GSTrobo is not just a software decision; it’s a strategic move toward strengthening your brand’s commitment to excellence in financial governance.

Conclusion

By demonstrating a commitment to financial transparency and regulatory compliance, businesses signal to stakeholders, including customers, partners, and investors, that they operate with integrity and accountability. Accurate and timely GSTR-9 filings showcase organizational efficiency, competence in financial management, and a proactive approach to regulatory adherence.

This commitment to compliance fosters trust and credibility, which are fundamental pillars of a positive brand image. Additionally, a transparent and well-documented GSTR-9 filing reflects a company’s dedication to ethical business practices, contributing to a positive perception in the market. As businesses increasingly operate in a scrutinized and interconnected environment, a strong brand image built on adherence to regulatory norms can differentiate a company and instill confidence among its various stakeholders.