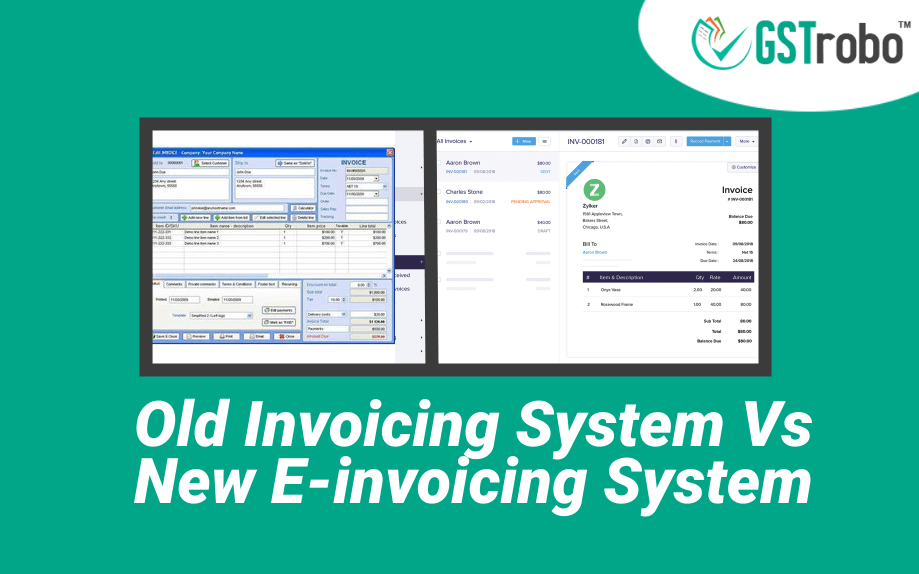

Old Invoicing system Vs New E-Invoicing system

The Government of India is introducing the new e-invoicing system in a phased manner with an objective to ease the compliance burden on the taxpayer, reduce tax evasion incidents and other benefits.

So, in this blog, we will compare both the old invoicing system and the new e-Invoicing system.

Old Invoicing system Vs New E-Invoicing system

| SI. No. | Parameter | Old Invoicing System | New E-Invoicing System |

| 1. | Criteria of Applicability | The old Invoicing System is applicable to all taxpayers. | The new e-invoicing system will be applicable to all those taxpayers whose aggregate turnover exceeds INR 20 Crores in any preceding financial year. |

| 2. | Invoice Reporting Method | Taxpayers need to manually enter the data and upload the JSON file on the GST Portal. | Taxpayers need to create an invoice as per the Schema prescribed and upload it on the Invoice Registration Portal (IRP). The invoice level data then flows to the GST portal. |

| 3. | IRN – Invoice Reference Number | Under the old invoicing system, taxpayers need to only mention the invoice number as the concept of IRN was not there. | Under the new e-invoicing system, taxpayers need to mention both invoice numbers and IRN generate through the hash generation mechanism. This will help the GST authorities to keep a track of each invoice generated by a taxpayer. |

| 4. | E-invoice Validation | Under the old invoicing system, taxpayers cannot validate an invoice. | Under the new e-invoicing system taxpayers receives a validated e-invoice on their registered e-mail ID. |

| 5. | Digital Signature | At time of generating an invoice the taxpayer or his authorized representative needs to digitally sign the invoice. | IRP digitally signs an e-invoice after it is validated on different parameters. |

| 6. | QR code | Under the old invoicing system, there was no such concept of QR code. | Under the new e-invoicing system, the recipient can easily authenticate and validate invoices using the signed QR code generated by IRP. |

| 7. | Possibility of Human Error | In the old invoicing system there was a high possibility of error due to human intervention. | In the new e-invoicing system, there is less possibility of human error as the data uploaded is verified and validated by the IRP. |

| 8. | Amendment or Cancellation of Invoice | The taxpayer used to easily amend or cancel an invoice on the GST portal as per the GST law. | The taxpayer can amend or cancel an e-invoice within 24 hours as the data remains on the IRP for only 24 hours. However, after that, an invoice can be amended or canceled on the GST portal. |

| 9. | Viewing Invoice Details | The taxpayer could easily view e-invoice details on the GST portal. | Under the e-invoicing system, the taxpayer can view data using the QR code scanning app. |

| 10. | Invoice Authentication | In the old invoicing system, it was difficult for the taxpayer to authenticate the details of the invoice. | Under the new e-invoicing system, the taxpayer can easily authenticate e-invoicing by checking the IRN or scanning the QR code embedded on an e-invoice. |