ICEGATE – Functions and Salient Features

ICEGATE is an acronym for Indian Customs Electronic Data Interchange (EDI) or Electronic Commerce (EC) Gateway. ICE GATE is a government site that allows trading partners to file documents electronically.

ICEGATE Vision

ICEGATE’s vision is to provide an efficient means of collecting indirect taxes and administering cross-border controls, with the goal of increasing voluntary compliance through ICEGATE payment.

ICEGATE Mission

ICEGATE’s purpose is to flawlessly implement and create Customs and GST legislation and processes. ICEGATE’s other missions are as follows:

- Realization of revenues in a fair and efficient manner.

- Providing help to Trade Industry

- Administration facility to the government’s economic, taxes, and trade policies.

- Controlling the flow of products, services, and intellectual property across international borders.

- Increasing the competitiveness of Indian companies.

- Preventing tax evasion, social hazard, and commercial fraud

What Exactly is ICES?

The Indian Customs EDI system is abbreviated as ICES. ICES currently manages 134 major customs stations, accounting for about 98 percent of India’s international trade in terms of export and import consignments, as well as ICEGATE bill of entry status.

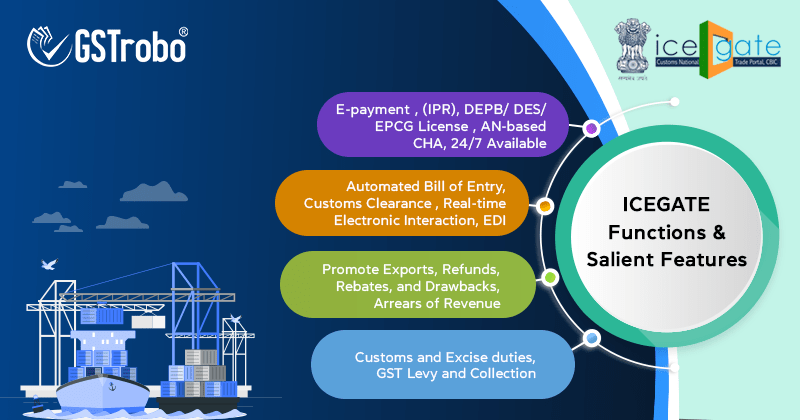

ICEGATE Salient Features

- With the use of the ICEGATE bill of entry, customs clearance may be automated to make it more efficient and transparent.

- ICEGATE provides real-time electronic interaction with import and export regulatory bodies.

- Customs clearance using ICEGATE duty payment via real-time Electronic Data Interchange (EDI).

ICEGATE’s Functions

- Customs and Excise duties, as well as the GST Levy and Collection

- Unit registration and monitoring for manufacturers of excisable goods and service providers

- Examination of submitted returns and declarations received by the department

- Preventing and combating unethical practices such as tax evasion and customs duty evasion

- Measures to Promote Exports

- Implementation of Border Control on Goods and Conveyances

- Imported and exported items are cleared, as well as examined.

- International luggage and passenger clearance

- Using Administrative and Legal Means to Resolve Disputes

- Audits are conducted to guarantee that tax compliance is met.

- Sanctioning for refunds, rebates, and drawbacks

- Arrears of Revenue

Additional Services Provided by ICEGATE

ICEGATE also offers the following additional services in addition to e-filing:

- E-payment

- Online registration for Intellectual Property Rights (IPR)

- Document Tracking Status at Customs EDI

- Online Verification of DEPB/ DES/ EPCG License

- Import Export Code Status

- PAN-based CHA data

- Links to Other Important Websites or Customs Business Information

It also offers a “24/7 available” helpdesk to answer concerns that trading partners may encounter

What Banks Have Been Approved To Accept E-Payments Through ICEGATE?

Through ICEGATE, a payer can electronically pay for all customs locations using the services of any of the authorized banks listed below:

- State Bank of India (SBI)

- Punjab National Bank (PNB)

- Bank of India (BOI)

- Indian Bank

- UCO Bank

- United Bank of India

- Union Bank of India

- Bank of Maharashtra (BOM)

- Corporation Bank

- IDBI Bank

- Bank of Baroda (BOB)

- Canara Bank

- Indian Overseas Bank

- Central Bank of India

- Vijaya Bank

- Syndicate Bank

- Andhra Bank

- Dena Bank

- Oriental Bank of Commerce (OBC)

- Allahabad Bank

Trading Partners of EDI Customs

| EDI Trading Partner | Type of Information Exchanged |

| Importers or Exporters | BOE or Shipping Bills and Related messages |

| Airlines/Ships/ Shipping Agents | Messages Related to Manifests and Cargo Logistics |

| Air Custodians | Messages Related to cargo logistics |

| Sea Custodians | Messages Related to cargo logistics |

| ICDs | Messages Related to cargo logistics |

| Banks | Financial messages Disbursement of duty Refund Payment of customs duty |

| DGFT | License, shipping bills, and IE Code data |

| RBI | Data Related to Foreign Exchange Remittance |

| DGCIS | Trade statistics |

| Directorate of Valuation | Data Valuations |

The Bottom Line

To promote “ease of doing business” in India, the Customs Department has implemented different programs such as ICEGATE and E-Sanchit, which will automate different operations and eliminate paper processing. Less paper processing means less human intervention and increased transparency.