GSTR-11: Applicability and Due-Date

GSTR-11 is the return that needs to be filed by the taxpayer who holds a Unique Identity Number (UIN) and claims a refund of the taxes paid on their internal supplies. In this blog, we will discuss GSTR-11 like filing eligibility, its due-date, and sections involved in GSTR-11:

What is GSTR-11?

GSTR-11 is a type of GST return that needs to be furnished by the Unique Identity Number (UIN) holders to get a refund for the goods or/and services they have rendered/purchased in India.

What is UIN?

UIN is a unique identification number that is given to those persons who are not liable to pay GST in Indian Territory. So, to refund the GST amount paid by them on inward supplies, GSTR-11 was introduced.

Who can Obtain UIN to file GSTR-11?

Here is the list of departments/agencies or persons who can apply for a UIN to file GSTR-11:

- Any agency specified by the United Nations Organization (UNO).

- Any Multilateral Financial Institution and Organization specified under the UN (Privileges and Immunities) Act, 1947.

- Embassy/Consulate of foreign nations.

- Any individual or class of people as notified by the Commissioner.

Note: The above departments/agencies or persons need to file GST REG-13 form to obtain UIN.

Due Date to file GSTR-11

UIN holder needs to file GSTR-11 by 28th of the following or next month from the month in which goods or/and services are purchased/rendered by him/her. For example, if the US Ambassador paid INR 1 Lakhs GST on hotels during his visit to India during the month of December 2021, then he/she needs to obtain UIN and file GSTR 11 by 28th January 2022 to get a refund of such taxes paid.

GSTR-11 Sections

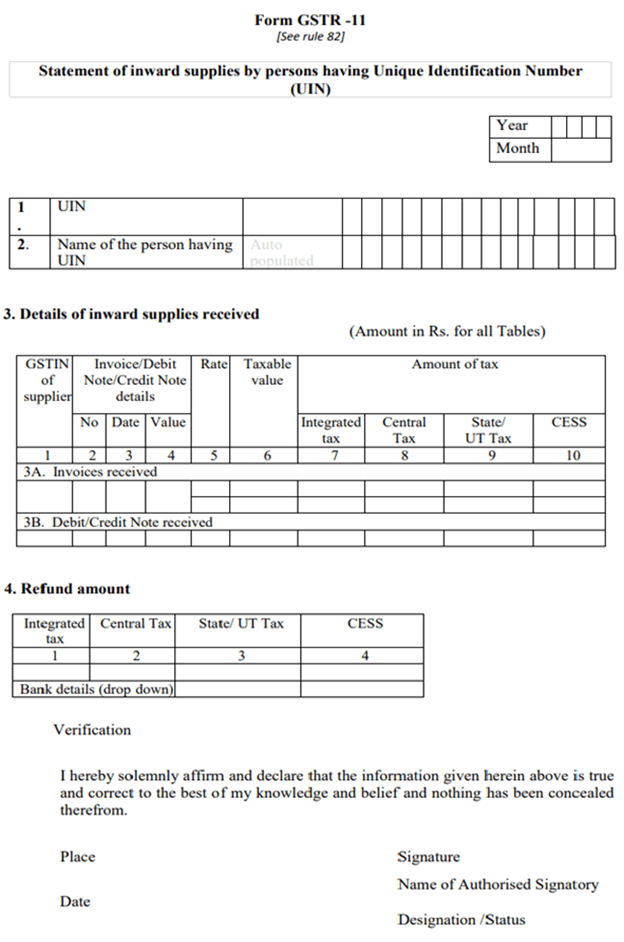

There are 4 different sections in GSTR-11 and they are:

- UIN: In this column, the person needs to fill UIN in here.

- Name of the UIN Holder (Auto-Populated)

- Inward Supplies Details: This column will get auto-populated once the taxpayer enters the GSTIN of the supplier. Moreover, the UIN holders can’t amend or add any details in this column.

- Refund Amount (Auto-Populated): The taxpayer just needs to provide the bank details in which he/she needs to get the amount refunded.

When all the columns of GSTR-11 are furnished accurately, the taxpayer needs to sign it carefully either through a DSC or Aadhaar based OTP to verify the return.

Format of GSTR-11

As through the snippet given below, we can see that the format of GSTR-11 is short and simple when compared to other types of GST Returns. This is because the main purpose of GSTR-11 is to fill all the inward supplies so that the person filing can easily claim the GST Refund for the taxes paid.

How Can GSTrobo® Help You?

GSTrobo® (a division of Binary Semantics) is an authorized GSP and enlisted SDA with GSTN. GSTrobo®. We provide all the GST compliance software such as E-Invoicing, GST Software, and E-Way bill that has helped many organizations to automate all their GST process. The industry leaders are relying on the ease and simplicity of GST compliances for requirements ranging from Cloud-based solutions to Integrated Distributed Computing Solution utilizing powerful APIs and connectors from GSTrobo®.