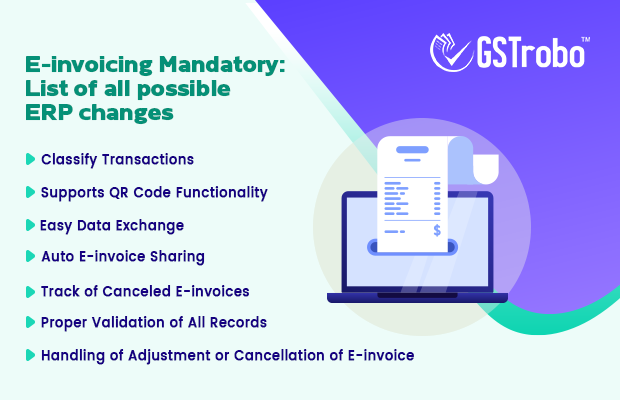

E-invoicing Mandatory: List of All Possible ERP Changes

As per the recent mandate, the new e-invoicing system will be implemented on INR 20+ Crores taxpayers from April 1, 2022. Thus, you might come across several changes in ERPs due to the e-invoicing system. Keeping this in mind I have tried to list all the possible changes in ERPs that you might come across due to e-invoicing:

- Classify Transactions

As we already know the e-invoicing system applies to those taxpayers whose aggregate turnover exceeds INR 20 Crore in any of the previous financial years 2017-18, 2018-19, 2019-20 from April 1, 2022. Thus, under this new e-invoicing system, ERP software needs to classify all the notified transactions and map the same with the schema field prescribed by the government. This will save a lot of time for notified taxpayers as they will not have to sort the different transactions to generate an e-invoice. - Supports QR Code Functionality

It shall be noted that Invoice Registration Portal (IRP) will not provide a QR code image but a string. Invoice Print changes according to the required field also need to be taken care of along with QR code print length format as notified by the government. Hence, ERP should support QR code functionality that can easily read the string and convert the QR code into an image file. - Easy Data Exchange

Under the new e-invoicing system, one of the major overhauls in the ERP should have internet connectivity so that GSP or ASP can easily exchange data between ERP and IRP to generate or cancel the IRN. In the case of offline E-Invoice generation ERP should have incorporated all required fields as prescribed by schema so that it can easily be uploaded on IRP Portal. - Auto E-invoice Sharing

After generating IRN and signed QR code for the invoice generated, the ERP software should be able to auto-share such an invoice with the recipient. This will help the parties involved in claiming accurate input tax credit (ITC) and file GST return. This is the future roadmap of NIC that will be covered under the Standard Invoice Messaging Protocol (SIMPOL). - Track of Canceled E-invoices

In case of a taxpayer cancels an e-invoice it is important for the ERP software that the same invoice number is not assigned to any fresh invoice.

As after 24 hours, the e-invoice cannot be canceled directly from IRP, ERP should redirect the taxpayer to the GST Portal in case if he/she wants to edit the details of the invoice after 24 hours but before GST return filing. - Proper Validation of All Records

There have been instances where the records are not properly pulled by the ERP before generating an e-invoice. Hence, it is important for the ERP to dual validate the records so to ensure that all the transaction required to generate IRN has been included from all ledgers and vouchers. - Handling of Adjustment or Cancellation of E-invoice

Under the new e-invoicing system, the adjustment can only be done either by canceling old e-invoices and generating a fresh one or by issuing credit notes/debit notes. Hence, ERP should support the linking of credit or debit note to the invoice that requires amendment.

Note: The recommended suggestion is to cancel the old invoice and generate the fresh one.

How GSTrobo Can Help You in E-invoicing?

GSTrobo is one of the leading GSP authorized by the GSTN providing e-invoicing software that seamlessly integrates with all the Major ERPs like SAP, Oracle, Microsoft Navision, etc. Using our e-invoicing software you can easily generate, print, and track an e-invoice in a few clicks with 100% security and an end to end assistance.

Author

Devesh Gupta

Content Specialist, GSTrobo