Update and Maintain Masters in e-Way Bill Portal

Using the e-way bill portal masters facility, every taxpayer can easily update and maintain master. So, in this blog, we will learn how to update and maintain masters on the e-way bill portal.

Why Updating and Maintaining Masters on E-way Bill Portal is Important?

Updating and maintaining masters on the e-way bill portal is important as it will help the taxpayer to save time by not entering the same details of the customer, product along with HSN, GST Rate, etc., every time. In other words, the update and maintain the master’s facility in the e-way bill portal it will help the transporters to avoid repetitive tasks. Hence, masters on the e-way bill portal fasten the process of e-way bill generation by eliminating the scope of data entry errors

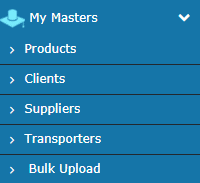

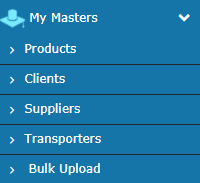

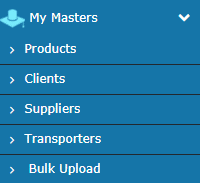

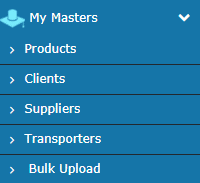

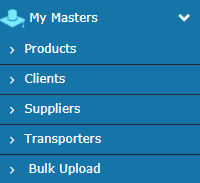

Different Heads Available in Maintain Masters on E-way Bill Portal

- Products

- Customers or Clients

- Suppliers

- Transporters

How Does Masters on E-way Bill Portal Works?

Once a taxpayer updates and maintains masters on the e-way bill portal, it auto-detects and populates the product, client, transporter, or supplier based on the history. He/she just needs to enter the first letter of product, client, transporter, or supplier.

How Does Masters on E-way Bill Portal Works?

Once a taxpayer updates and maintains masters on e-way bill portal, it auto-detects and populates the product, client, transporter or supplier based on the history. He/she just needs to enter the first letter of product, client, transporter or supplier.

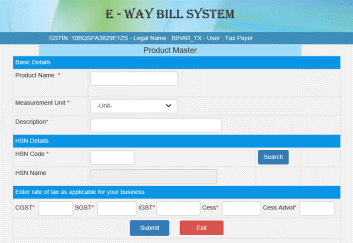

Updating and Managing Product Masters on E-way Bill Portal

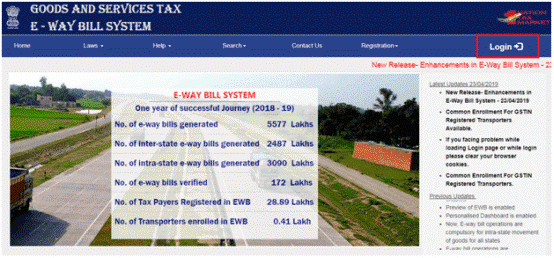

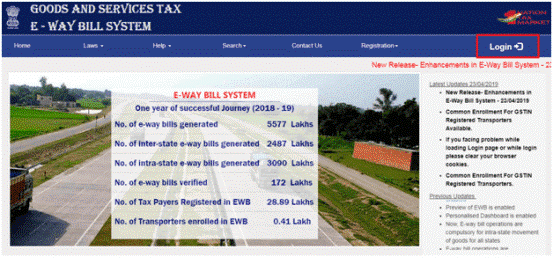

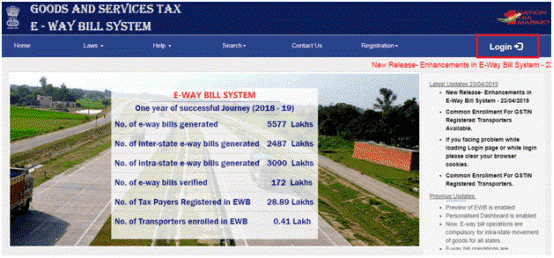

Step-1: Open and Log into the e-way bill portal

Step-2: From the Masters on the e-way bill portal, Choose the Products masters.

Step-3: Once you select that a new page will open where you will need to enter the following details:

- Product’s name

- Measurement Unit

- Description

- HSN Code

- GST Rate

Step-4: Hit on the Submit button once you have entered all the mandatory details.

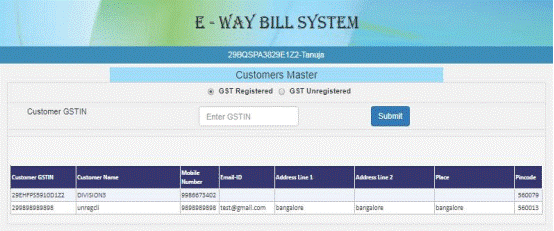

Updating and Managing Clients Masters on E-way Bill Portal

Step-1: Open and Log into the e-way bill portal

Step-2: From the Masters on the e-way bill portal, Choose the Clients masters.

Step-3: Once you select that option, a new page will open having two options:

- GST Registered

In this option, you need to enter the client’s GSTIN and the e-way bill portal will auto-fetch the details of that client from the database.

- GST Unregistered

In this option, you need to enter the details of the client manually.

Updating and Managing Suppliers Masters on E-way Bill Portal

Step-1: Open and Log into the e-way bill portal

Step-2: From the Masters on the e-way bill portal, Choose the suppliers masters.

Step-3: Once you select that option, a new page will open. On this page, you need to enter the supplier’s GSTIN and the e-way bill portal will auto-fetch the details from the GSTN database.

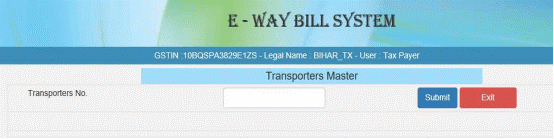

Updating and Managing Transporters Masters on E-way Bill Portal

Step-1: Open and Log into the e-way bill portal

Step-2: From the Masters on the e-way bill portal, Choose the transporters masters.

Step-3: Once you select that option, a new page will open. On this page, you need to enter the transporter’s number and the e-way bill portal will auto-fetch the details.

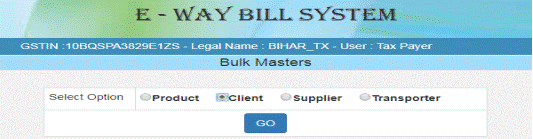

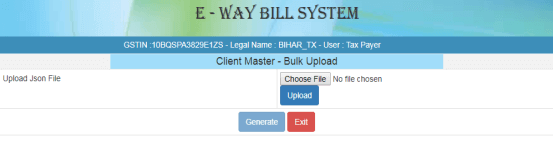

Updating and Managing Bulk Upload Masters on E-Way Bill Portal

Bulk upload masters on the e-way bill portal help taxpayers to upload the data of products, clients/customers, suppliers, and transporters in bulk. To use this bulk upload facility, you need to upload the JSON file.

Step-1: Open and Log into the e-way bill portal

Step-2: From the Masters on the e-way bill portal, Choose the transporters masters.

Step-3: Once you select that option, a new page will open having 4 different options to choose from.

Step-4: Choose the suitable options as per the requirement and upload the JSON file of the same.

Pic credit: https://fci.gov.in