How to Generate GST EWB-04 Form?

In 2018, under the GST regime, the concept of the E-way Bill (EWB) was introduced to ensure the smooth movement of goods from one check post to another. As per the e-way bill provision, every taxpayer supplying goods valuing more than INR 50,000 must generate and carry an e-way bill. This is because patrolling officers have the authority to stop the vehicle to check the consignment or necessary documents. Any failure in complying with the e-way bill provision may lead to penalties. . However, the taxpayer can generate a detention report in the form of GST EWB-04, if the patrolling officer does not have a proper reason for the detention of the vehicle.

What is Form GST EWB-04?

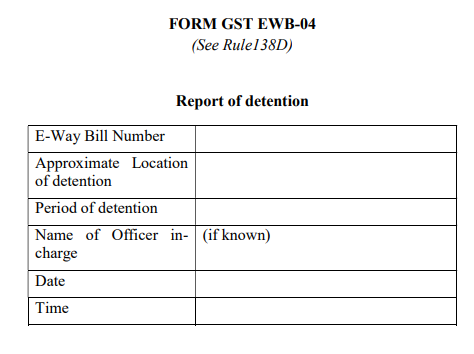

GST EWB-04 form is a detention report that can be generated by the taxpayer when the vehicle along with consignment is detained by the patrolling officer without any proper reason. In the GST EWB-4 form, the taxpayer needs to fill in the details regarding the detention of the vehicle. Then this GST EWB-04 form is shared with the State Nodal Officer so that he/she can take necessary action.

Format of GST EWB-04 Form

How to Generate GST EWB-04 Form?

Any taxpayer whose vehicle is detained for more than 30 minutes, without any proper reason can file GST EWB-04 form by following the below-mentioned steps:

Step 1: Open and log in to the E-way bill Portal.

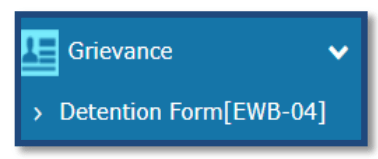

Step 2: From the side menu select Detention Report available under the tab Grievance.

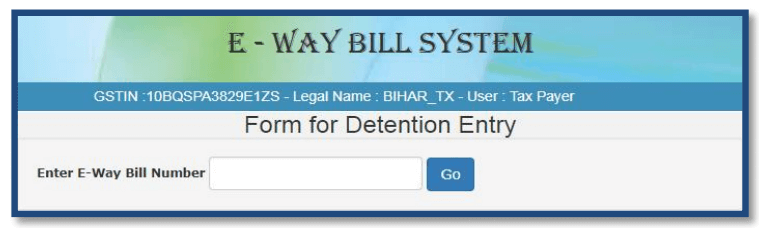

Step 3: After clicking on it detention entry form (GST EWB-04) will open in which a taxpayer needs to enter the following details:

- E-way Bill Number

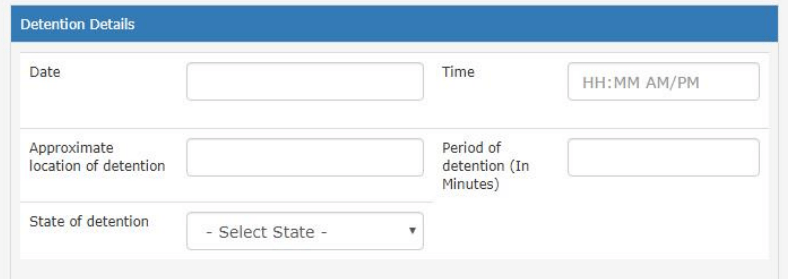

2. Detention Details: This includes

- Date of detention

- Time of Detention

- Approximate location of detention

- Period of detention (in minutes)

- State in which vehicle is detained

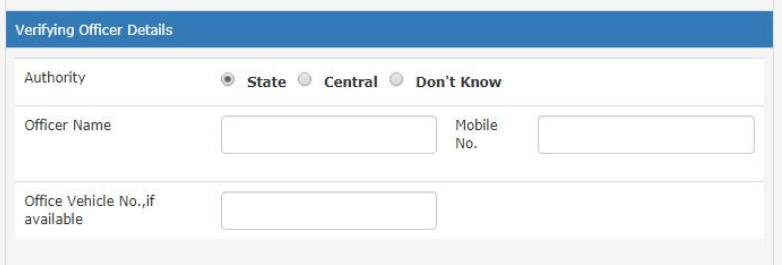

3. Verifying Office Details: This includes

- Authority

- Name of officer-in-charge (if known)

- Phone number and vehicle number of officer-in-charge (if known)

- Note: If a taxpayer does not know the authority of the officer, he/she can select the Do not know option available

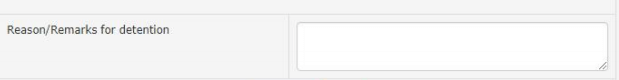

4. Reason or Remarks of detention

Step 4: After verifying the above details the taxpayer needs to click on the submit button. Once he/she clicks on its GST EWB-04 form will get generated.