How to Download GST Registration Certificate (GST REG-06)?

The GST registration certificate or Form GST REG-06 is provided to every successful GST registered person or business. The certification serves as confirmation that a person or business is registered under GST. It comprises GSTIN as well as other business information.

Only the digital version of GST REG-06 is accessible, and it may be obtained from the official GST portal. The department does not send a physical copy of the GST Registration Certificate to any registered person.

We have comprehensibly compiled all the information of the GST Registration Certificate in Form GST REG-06 and the steps to download GST REG-06 from the GST Portal for you:

Provision Related to GST Registration Certificate in GST REG-06 Form

Rule 10 of the CGST Rules, 2017 contains the provision relating to the GST registration certificate issuance in GST REG-06 Form. As per this rule:

- The person will be provided a registration certificate after a successful GST registration.

- The principal place of business and an additional business place will be listed on the certificate (if any).

- The GST registration certificate will be digitally signed (through electronic verification code) by the proper officer.

How to Download GST Registration Certificate (GST REG-06)?

Step-1: Go to gst.gov.in to access the GST portal.

Step-2: To log into your account enter the valid credentials.

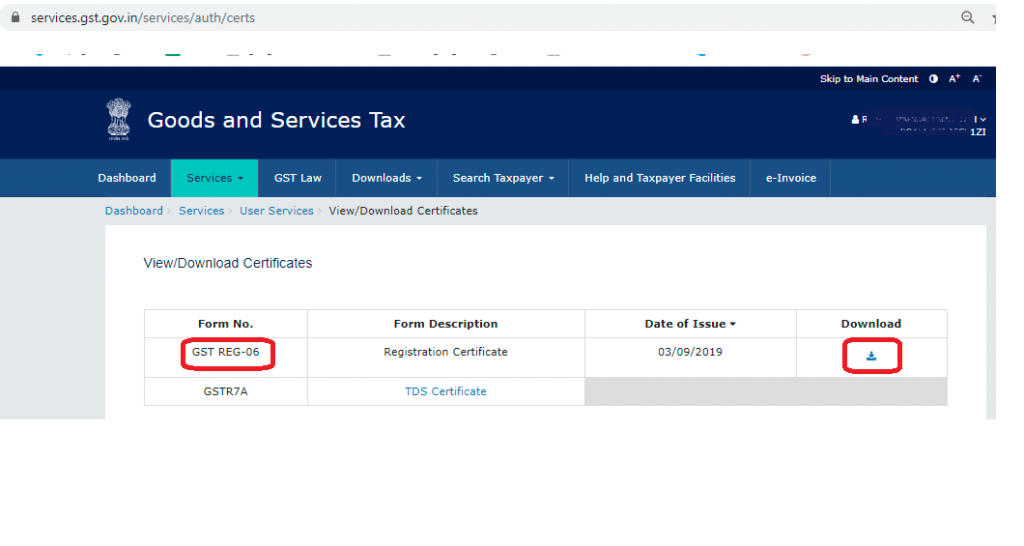

Step-3: When you log in, your dashboard will appear. Open User Services by clicking on Services. Click on ‘View/Download Certificates’ when the user services list appears.

Step-4: Select the Download option.

Step-5: Take a Print out of the downloaded PDF document.

Different Parts of GST Registration Certificate (GST REG-06 Form)

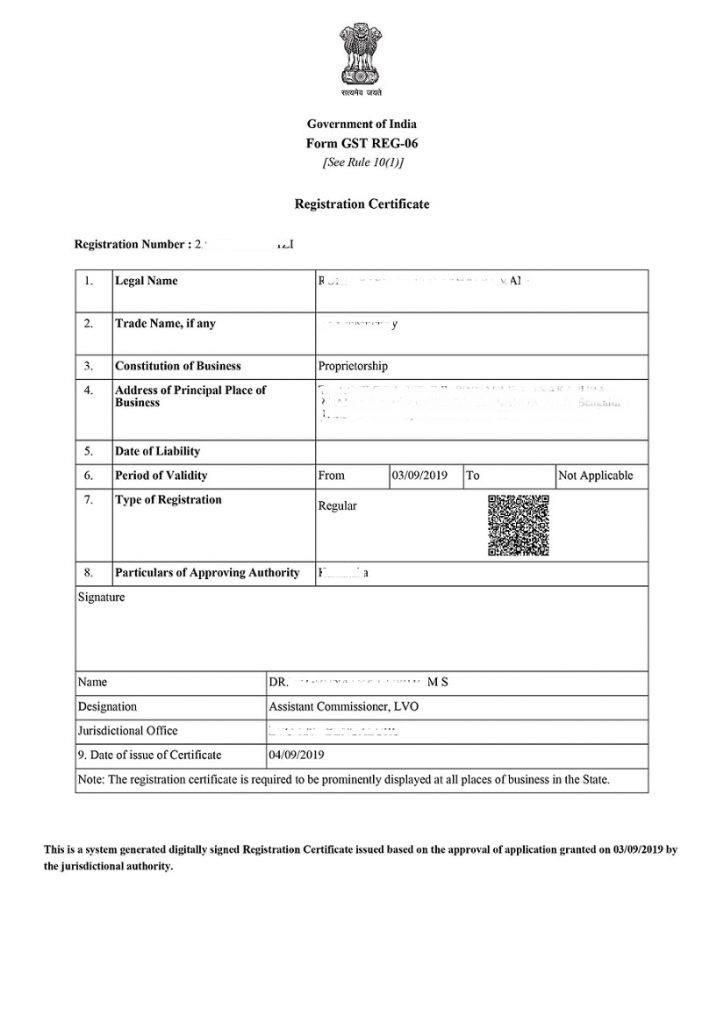

1. Registration Certificate

This part contains:

• Registration Number

• Legal Name

• Trade Name (if any)

• Constitution of the business

• Address of the Principal Place of Business

• Date of liability

• Period of Validity (Notably, the same is applicable only in case of registration of a casual taxable person or non-resident)

• Type of registration

• Particulars of the Approving Authority

• Date of issue of Certificate

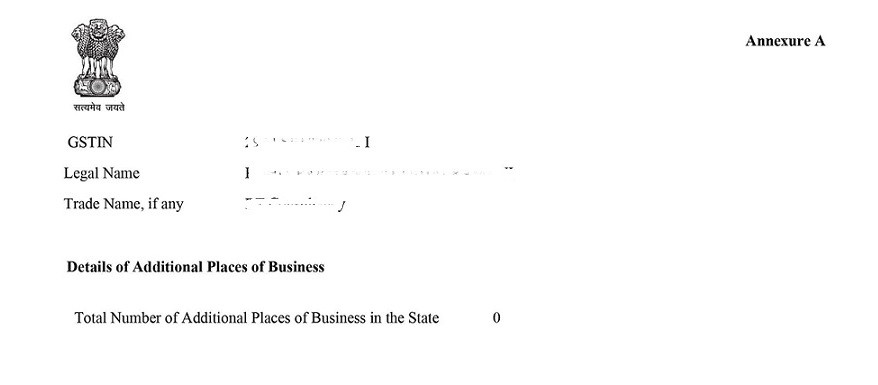

2. Annexure-A

This part consists of the following details:

• GSTIN

• Legal Name

• Trade Name (if any)

• Details of Additional Places of Business

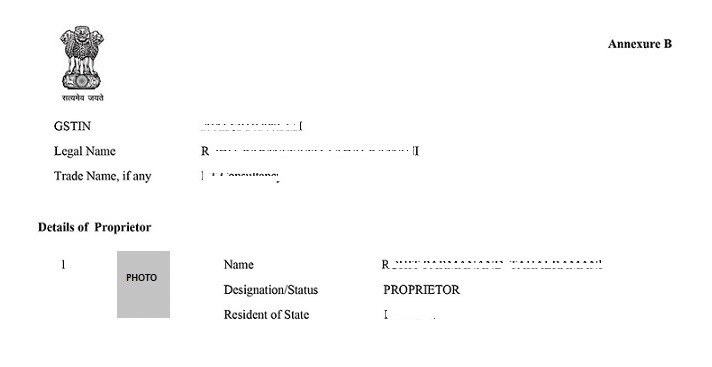

3. Annexure-B

This section contains the following information:

• GSTIN

• Legal Name

• Trade Name (if any)

Below-mentioned the details of partners, proprietor, Karta, managing director, the board of trustees, etc.

• Photo

• Name

• Designation/ Status

• A resident of State

Provision for Displaying GST Registration Certificates

The need of showing the GST registration certificate is stated in Rule 18(1) of the Central GST Rule, 2017. Every GST-registered business must show its registration certificate at its principal business place, according to the law. Moreover, it is mandatory to display the GST registration certificate at all other additional places of business listed on the GST REG-06 form.

One Reply to “How to Download GST Registration Certificate (GST REG-06)?”

GSTREG-06