GST REG-12 Form for Suo-Moto GST Registration

The provisions of section 25(8) of the Central Goods and Services Tax Act, 2017 allow the competent officer to register a person who is required to acquire GST registration but does not do so. The competent officer issues a Form GST REG-12 order allowing such Suo-moto registration.

Rule 16 of the Central Goods and Services Tax Act, 2017 specifies the procedure for suo-moto registration and issuing of orders in Form GST REG-12. The regulations governing the Suo-moto registration are covered in detail in this blog.

GST REG-12 Form Applicability

Suo-moto registration and order in Form GST REG-12 are applicable only when both of the following requirements are met, as per rule 16(1):

Condition 1: The competent officer has undertaken any survey, inspection, search, inquiry, or other processes in accordance with the Central Goods and Services Tax Act, 2017; and

Condition 2: During any of the above actions, the competent authority determines that the person is required to register for GST. However, the individual was unable to get GST registration.

If both of the aforementioned requirements are met, the competent authority can register the individual on a temporary basis Suo-moto. As a result, the competent officer will issue a GST REG-12 order.

It is crucial to remember that the temporary registration will begin on the day the order in Form GST REG-12 is issued.

Action on Receipt of An order in Form GST REG-12

The person to whom a temporary registration order in Form GST REG-12 is granted can do one of the following things:

Action 1 – Within 90 days of the temporary registration being granted, the individual can file an application for GST registration; or

Action 2 – The individual can submit an appeal against the interim registration order.

However, if the individual files an appeal, the appellate body will uphold the registration requirement. The person must next file an application for registration within thirty days of the date of the appellate authority order’s issue.

Points to Remember

- When an applicant submits a new registration application, the applicant’s information will be verified according to standard procedures.

- The applicant will be issued a GST registration certificate after the verification procedure is completed.

- The new Goods and Services Tax Identification Number will take effect on the day that the order in Form GST REG-12 is issued.

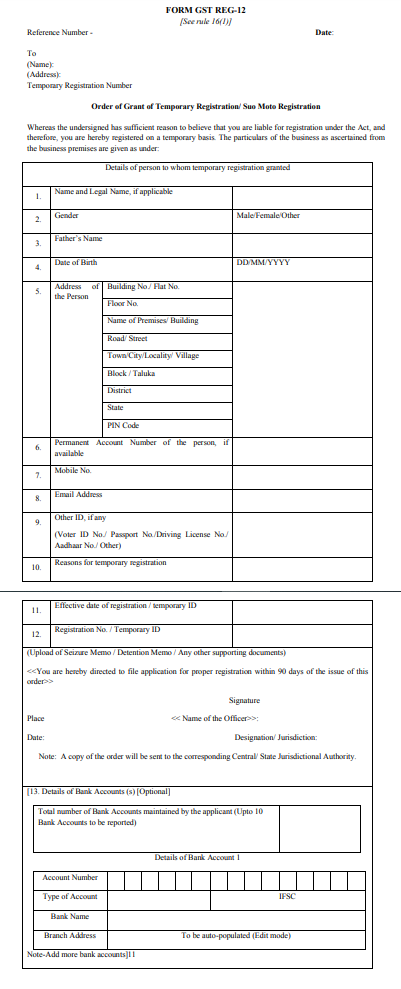

Sample Format of GST REG-12 Form