Guide to file GST ITC-02 Form

As per statistics more than 50% companies are likely to lose money on a merger or acquisition due to a lack of preparation? Now, the question is how can a company minimize these losses? So, the answer is by filing GST ITC-02 form and in this blog, we will discuss the same.

Table of Contents

What is GST ITC-02 Form?

The ITC-02 form is used to transfer the balance of an Input Tax Credit (ITC) in a GSTIN’s e-credit ledger to another GSTIN due to

- Sale

- Merger

- Demerger

- Amalgamation

- Lease

- Transfer

The transferor must electronically file this form on the GST portal to transfer the unutilized ITC from his/her e-credit ledger to the transferee.

Pre-Requisites to File GST ITC-02 Form

- In the event of a demerger, the ITC will be allocated according to the ratio of the new firms’ assets as defined in the demerger scheme.

- A copy of a certificate given by a practising CA (certifying authorities) or CWA confirming that the sale, merger, demerger, amalgamation, lease, or transfer of business was done in conformity with the applicable rules and regulations is required from the transferor.

- As soon as the transferee accepts the details provided by the transferor on the GST portal, the unutilized ITC, as declared in Form GST ITC-02, will be credited to the transferee’s electronic credit ledger. The transferee must then record the ITC and capital goods transferred into their books of accounts.

- The transition will be treated as a transfer of a business under the GST act and rules if the registered taxpayer (transferor) is a sole proprietor and the legal heirs decide to continue the firm after his/her death. As per Rule 41(1) of the CGST (Central Goods and Services Tax) Rules, 2017, the credit can be transferred to the GSTIN of the legal heirs.

Content of GST ITC-02 Form

- GSTIN of transferor

- Legal name of transferor

- Trade name, if any

- GSTIN of transferee

- Legal name of transferee

- Trade name, if any

- Details of Input Tax Credit to be transferred

• Tax

• Amount of matched ITC available

• Amount of matched ITC to be transferred - Information Related to the Certifying CA or CWA

a) Name of the Firm issuing certificate

b) Name of the certifying CA/CWA

c) Membership number

d) Certificate issuance date to the transferor

e) Attachment (option for uploading certificate) - Verification

• Signature of authorized signatory

• Name and Designation

How to File GST ITC-02 Form?

Step 1: Go to the GST Portal and log in.

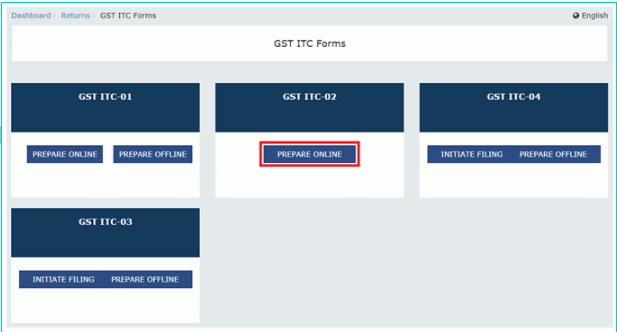

Step 2: Open ITC-02 by going to Services then selecting Returns>ITC Forms.

On the ITC-02 tile, click the ‘Prepare Online’ button as shown below:

Step 3: Fill in the transferee’s information. Enter the transferee’s GSTIN and the amount to be transferred under each major heading. The amount of unutilized ITC will be auto-populated in the form of the e-credit ledger when Form GST ITC-02 is opened. The transferor can either transfer the full ITC or a portion of it, depending on the situation.

Step 4: Update the information about the certificate issued by CA or CWA. Click ‘Save’ after attaching a copy of the certificate. When you click the save button, a notice will appear saying that the information has been successfully saved.

Step 5: Use EVC (Electronic Verification Code) or DSC (Digital Signature Certificate) to file your documents. Select the approved signatory from the drop-down list and tick the declaration checkbox. On the warning message, click ‘Proceed’ and enter the OTP received on the registered mail ID or phone number to verify. Once verified successfully, a confirmation message will appear on the screen.

Steps to Reject or Accept GST ITC-02 Form

Once GST ITC-02 form is filed by the transferor, the transferee can accept or reject the same by performing the below steps:

Step 1: Go to the GST Portal and log in.

The transferee can accept or reject the transfer when the transferor files Form GST ITC-02. He should take the following actions:

Step 2: Select Services > User Services > ITC-02 pending for action will be displayed.

Step 3: Select the ARN (Application Reference Number) and the information related to that will be displayed.

Step 4: The recipient has the option to accept or reject the transfer. A confirmation notification will appear if the transferee ‘Accepts’ the ITC-02 form.

Step 5: The transferee can pick up the authorized signature by checking the declaration option, and then file it with DSC or EVC.

Step 6: A confirmation message will appear after a successful transfer. To validate that the status has changed to “Accepted,” the transferee needs to go back to the GST ITC-02 pending for action screen.