Widening the GST Net – Reducing Administrative Complexities

It is often said that simplicity is one of the critical elements of sound tax administration and widening the GST net. The challenge to translate this fundamental requirement in a behemoth like India is astonishing. India prides itself on unity in diversity. This, however, has its own set of challenges in founding a tax administration based on simplicity.

Vision of One Nation One Tax

The foundation of GST is the ‘One Nation One Tax’ theory. Implicit in this tagline is the voluntary compliance by the taxpayer. The success of the GST model hugely depends on how the assessee faithfully adheres to timelines. Particularly in filing different returns, and more importantly, feeds inaccurate information. After all, the credit mechanism is the bedrock of the GST framework.

The design of our law is such that if there is a flaw in the first step, there is a chance to correct it in the second or, for that matter, the third step. A secure handover of this baton becomes essential to complete this relay race, widening the GST net in India.

Understanding the Myriad Forms

The introduction of the Goods and Services Tax in India was underpinned by the ambitious theory of ‘One Nation One Tax’. This comes with implicit trust in voluntary taxpayer compliance. The success of this model intricately links to the timely and accurate submission of returns, particularly concerning Input Tax Credits. Basically, it relies on the fact that the taxpayers shall take the onus of widening the GST net.

Currently, GST prescribes a web of forms. Leaving aside those taxpayers who opt for payment of composition tax, the regular assessee has to file nearly 24 forms. This includes maintaining mandatory returns and the records.

To begin with, every taxpayer (supplier) files GSTR-1 containing details of the outward supply by the 11th day of the succeeding month. This triggers the generation of an auto-populated statement called GST-2A. This includes details of inward supplies/purchases. On basis of this Input Tax Credit (ITC) is available to the recipient.

It is a dynamic statement and needs updates on new additions/amendments that the suppliers make on a real-time basis, which details then reflects in the GSTR-2A of the recipient. Then there is GSTR-2B, an auto-drafted static statement. This statement is for the typical taxpayer basis the information given by a supplier in GSTR-1, 5 and 6.

It indicates the availability and the non-availability of ITC against each document filed by the supplier made available on the 14th day of the succeeding month. This follows the filing GSTR- 3B by the 20th day of the following month containing details of inward and outward supplies, ITC availed, tax payable and tax paid.

Widening The GST Net as We Drive Towards Technology

The design of the GST law is driven by technology. Technology is expected to increase compliance and make it a smooth process. It enhances inter-departmental data feeding. This also enables a better interplay between agencies and assisted enquiries and investigations.

Here, software innovations like GSTrobo come into play, driving organizations’ and taxpayers’ smooth compliance processes. Making the GST processes faster, reliable and 100% automated, it streamlines the complex GST guidelines for taxpayers. The cloud-base technology of GSTrobo helps the teams coordinate better and makes compliances accessible from anywhere. Technologies like GSTrobo are truly widening the GST net in India.

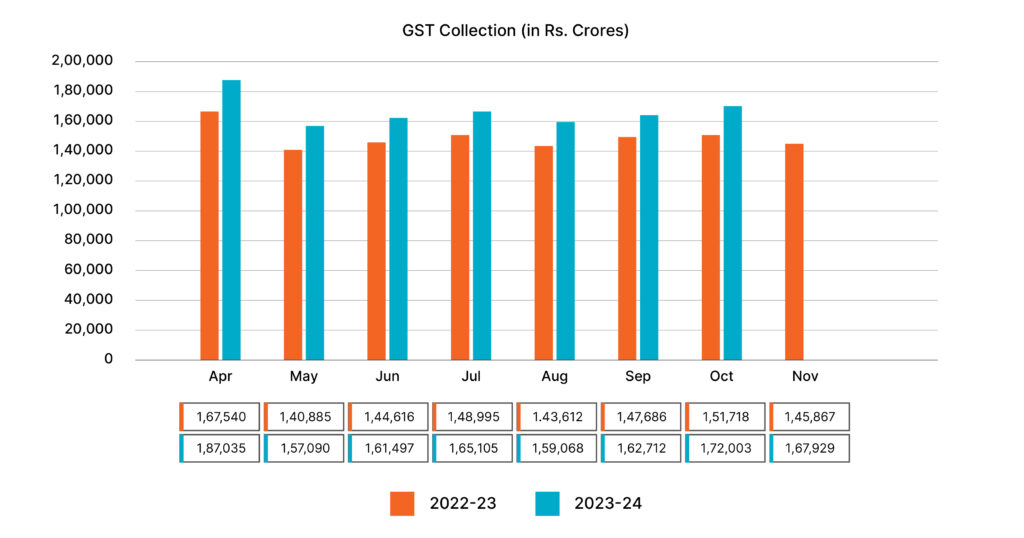

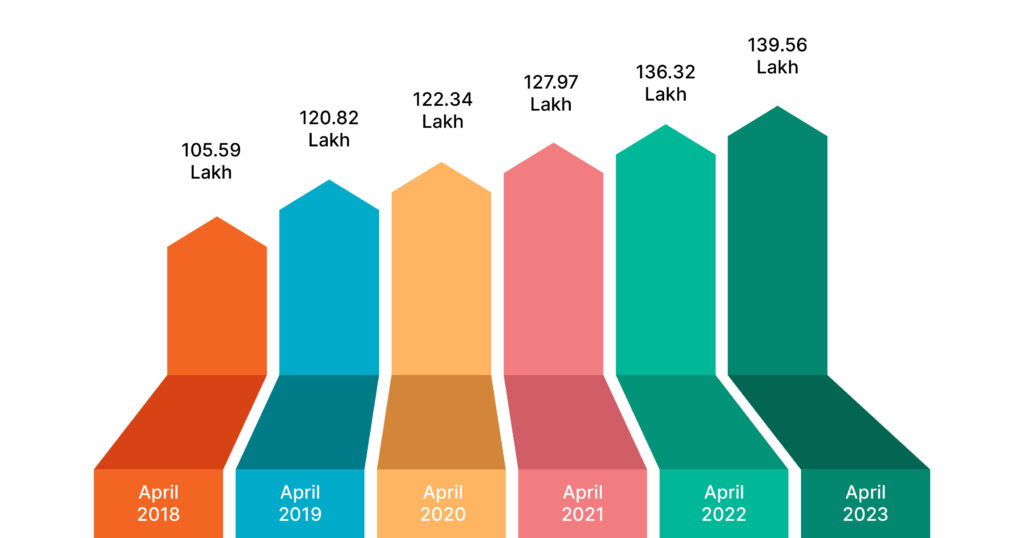

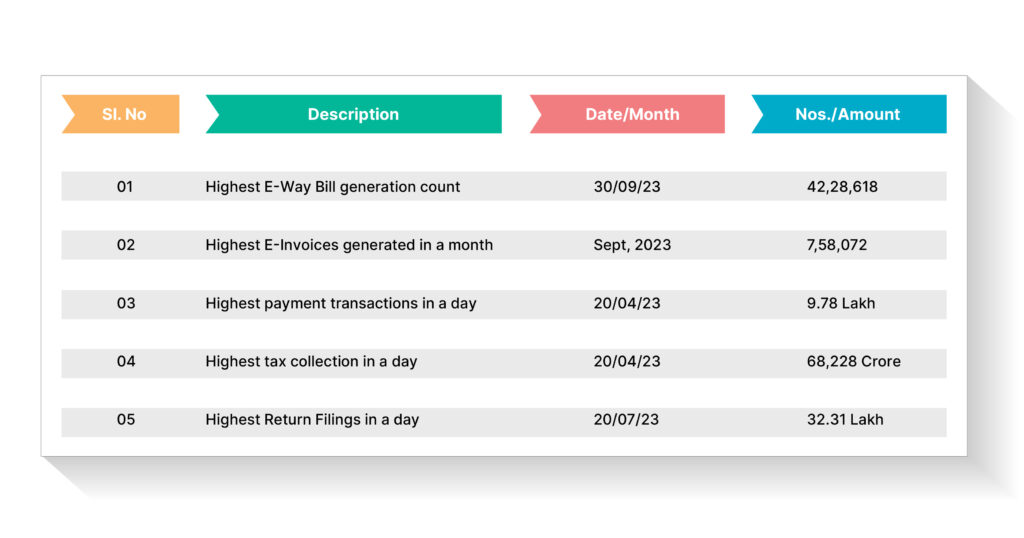

The use of technology is positive as it constantly boosts the detection of cases by quickly identifying tax evaders and fraudulent transactions, paving the way for higher collections. As they say, the proof of the pudding is in the eating. Monthly collections have crossed record levels and continue to do so.

As taxpayers do compliances electronically, it is evident that this needs a robust digital network. GSTN has had its share of teething glitches like all new systems. But this article is not about rating GSTN. It’s about the design of the GST as a tax model, in which compliance by one assessee inextricably links to compliance by the other.

Challenges in Data Accuracy

There is a scope of putting emphasis on the significance of compliance. Inherent in compliance are two benefits. The first is that the set-off based on the available credit, when validly taken, will bring down the cost of the transaction by taxing only the value addition. Secondly, this will ultimately reduce the incidence of tax on the ultimate consumer.

On the other hand, there is the need for over-compliance, which makes the life of an assessee cumbersome. This, in turn, directly impacts an increase in the transaction cost.

One way to deal with this argument is to reduce the number of forms and documents that needs filing. But the other and more serious one is a change of mindset by tax inspectors. Clamping down with an iron fist, more so for pure venial breaches like errors in e-Way bills, is counterproductive.

Like all technologies, GSTN operates on the “garbage in garbage out principle”. Hence, emphasis on data accuracy becomes necessary. Data mismatches are a major irritant to the seamless operation of Input Tax Credit (ITC). Discrepancies in the description, value or other material particulars are barriers to the ease of availing credit. A large amount of credit is lost in the system, and some solution to rectify the mistake as soon as possible needs implementation.

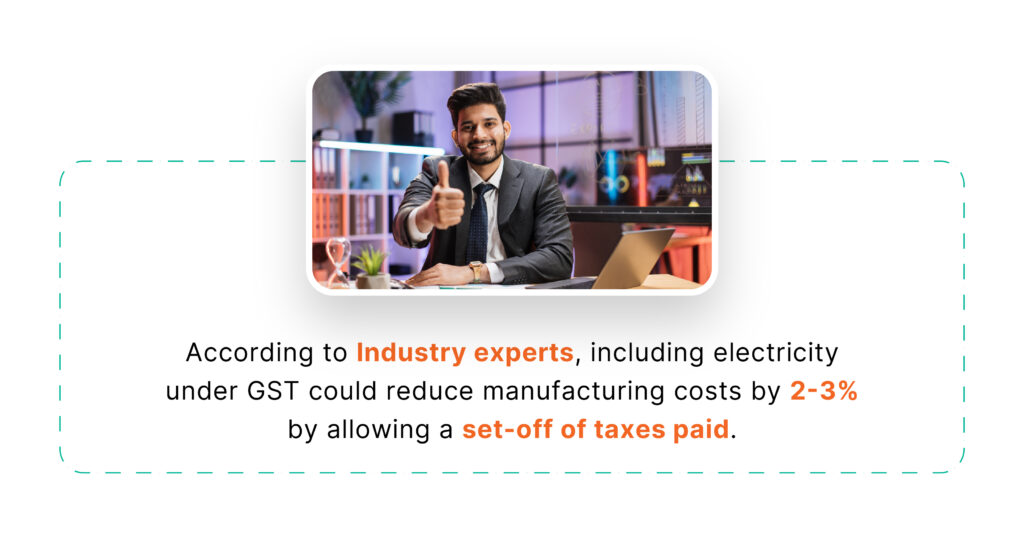

Since the transaction cost intertwines with compliances, one way to address the cost issue while streamlining compliance requirements is to widen the net of GST. The present GST regime is fractured since the energy sector has been kept out. The cost of electricity in the manufacturing sector in India is high when in comparison to other competitive economies like China.

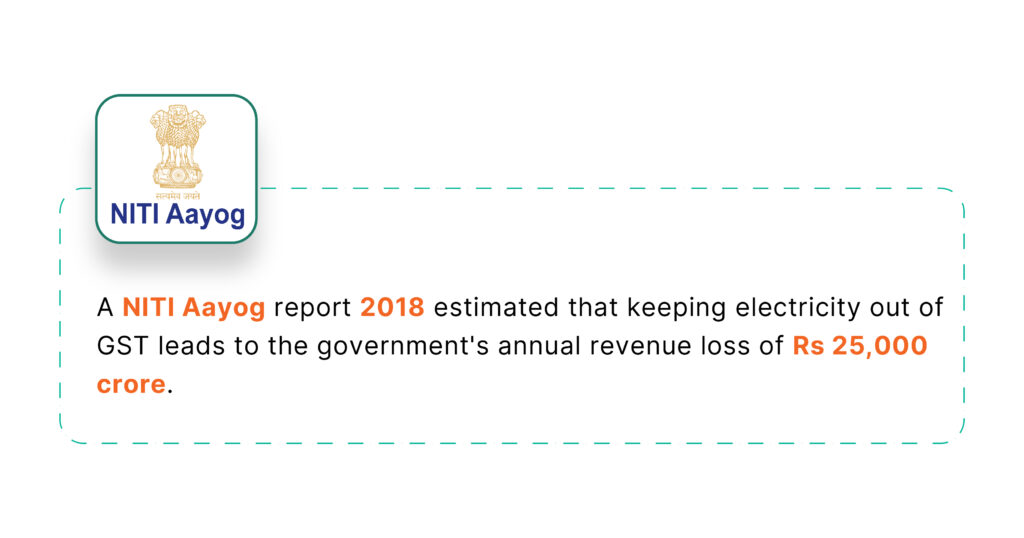

Electricity duty goes entirely to the State, and no set-off is there since electricity, though considered “goods”, is not part by the GST laws.

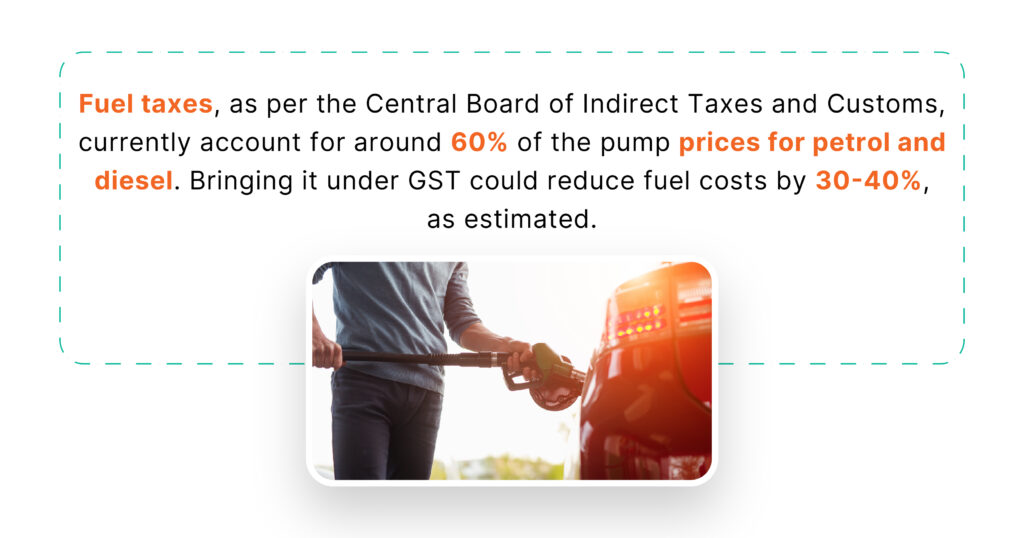

Similarly, the government put heavy taxes on the oil and gas sectors. The cost of transportation accounts for a substantial portion of the rupee towards the transaction’s cost. 80% of the expenditure of the transport sector is towards fuel, becoming a barrier in widening the GST net in India.

India mainly uses road transportation followed by railways, and the balance by other means of transportation such as coastal, shipping, air, etc.

Transactions towards transportation and energy consumption involves a significant cost. Taxes on these two sectors, namely, electricity and fuel, still need to be absorbed by the credit mechanism outside GST and imminently set off.

GST Exclusion and Impact on Cost

It has been six years since the introduction of GST, but there has yet to be a move to bring the energy sector within the net of GST. Perhaps there is also no political will to do so. At the time of the introduction of GST, there was a provision for a levy of compensation cess. This cess is here to safeguard the State revenues in case of a shortfall due to migration from VAT/sales tax to GST.

The 101st Constitutional Amendment envisaged the compensation cess to continue for five years, but despite the time lapse, one must see the end of the compensation cess. The compensation cess may enjoy an extended tenure if the energy sector is also brought within the GST fold.

Against this backdrop, including goods kept out, particularly the energy sector, will offset the cost of compliance, widening the GST net in India. Coupled with a reduction in the number of forms with improved GSTN, one can expect rationalisation of tax rates and slabs.

The government is taking substantial steps to make India’s energy sector a powerhouse.

The compensation cess period is over, but at the same time, there has been consistently higher collection with record-breaking sums in a few months. With an expected buoyant economy, an inextricable link between improved compliance and tax rationalisation compliance assumes greater significance.

Conclusion

As India continues its journey with the Goods and Services Tax, simplifying compliance remains a key priority. By widening the GST net in India to include sectors like energy and fuel, authorities can offset compliance costs, enable tax credits, and rationalize rates across industries. Addressing data accuracy issues, reducing excessive paperwork, and adopting a more supportive mindset towards minor errors can further streamline the process.

Leveraging technology effectively, while ensuring a robust digital infrastructure, is also crucial for driving voluntary compliance. Innovative solutions like GSTrobo, a pioneering GST compliance automation platform, can be a game-changer for businesses.

GSTrobo provides an all-in-one solution for return filing, reconciliation, e-way billing, e-invoicing, and more, automating tedious compliance tasks with advanced technologies like AI and Machine Learning.

By eliminating manual errors, providing real-time alerts, and offering a seamless digital experience, GSTrobo empowers businesses to achieve a hassle-free and efficient GST journey.