The GST Composition Scheme

All Hows and Whats!

The composition scheme under the CGST Act is intended specifically for small taxpayers in order to facilitate compliance and simplify tax levies. It is a supplementary scheme. A person who qualifies for this scheme must pay quarterly tax at the prescribed rate on his or her earnings. There is no input tax credit available if the composition scheme is chosen. The GST Return must be filed on an annual basis. As a result, compliance costs are reduced.

A registered person under this scheme must issue a ‘Bill of Supply,’ as he cannot issue taxable invoices or collect GST from customers. He must expressly state on the invoice, “Composition Taxable Person, ineligible to collect tax on Supply,” and he must prominently display “Composition Taxable Person” on business premises.

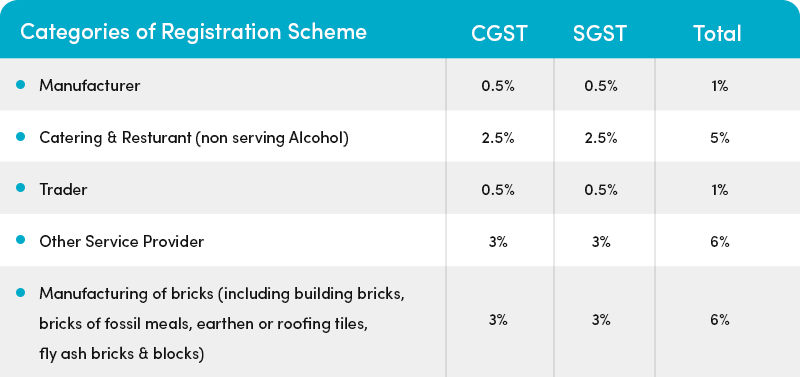

Under Section 10 of the CGST Act, the scheme was initially designed for small traders, manufacturers, and only one service, restaurant service providers. However, the benefits of the composition scheme were later extended to service providers other than restaurants, including mixed suppliers for marginal supply of services for the specified value in addition to the supply of goods to such eligible manufacturers and traders under Sec10 (2A).

Eligibility Criteria for Composition Scheme

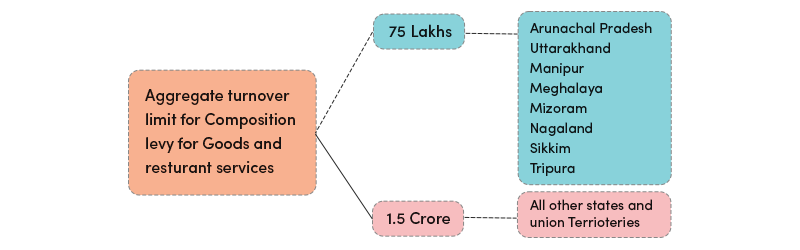

A registered person, manufacturer, trader, or restaurant/catering service provider(not serving Alcohol)can avail of this scheme if his aggregate turnover in the preceding financial year is up to Rs. 1.5 Cr. However, the turnover limit for composition levy for goods is up to Rs. 75 Lakh in respect of 8 Special Category States,

- Arunachal Pradesh

- Mizoram

- Uttarakhand

- Nagaland

- Manipur

- Meghalaya

- Sikkim

- Tripura

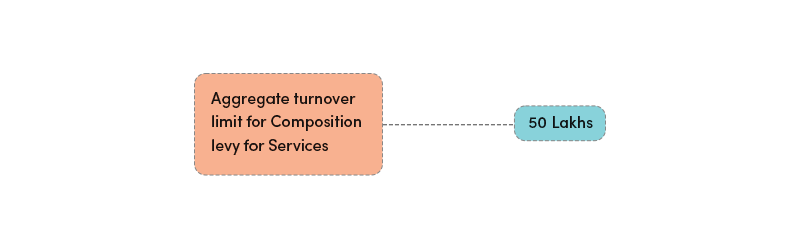

Similarly, a registered person providing services (other than the restaurant and catering services) can benefit from the composition scheme if the aggregate turnover in the previous financial year is up to Rs. 50 lakh.

The option availed by a Registered person for Composition Scheme shall lapse the day on which his ‘Aggregate Turnover’ during a Financial Year exceeds the limit of Rs. 1.50 Cr. or Rs.75 Lakh or Rs. 50 Lakh, as the case may be. Financial Year is considered from the 1st of April to the 31st of March.

It is important to note that aggregate turnover is computed on an all-India basis of the person having the same Permanent Account Number, i.e., the same PAN.

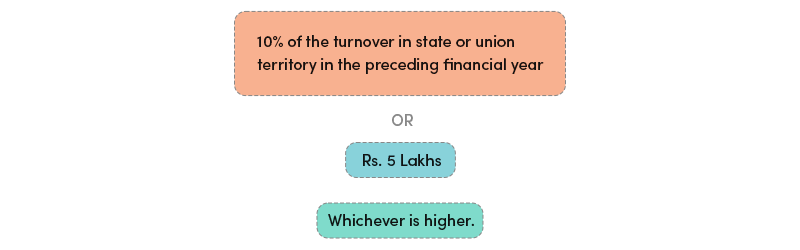

Further, a manufacturer or trader engaged in a marginal supply of services other than that of restaurant services can avail composition scheme for goods for a specified service value along with a supply of goods. This specified value is a value not exceeding

Suppose the value of the service exceeds the limit mentioned above. In that case, the registered person becomes ineligible for the composition scheme for goods and has to opt out of the scheme in the financial year.

Individuals ineligible to participate in the Composition Scheme

I. A person who is engaged in the supply of goods or services which are not taxable under the GST

II. A person making interstate outward supply of goods or services (interstate supply means place of supplier and place of supply are in two different states or union territories)

III. A person who is engaged in the supply of goods or services through an E-commerce platform

IV. A non-resident taxable person who is a supplier

V. A supplier who is a casual taxable person

VI. Manufacturer of notified goods such as ice cream and other edible ice, pan masala, aerated water, tobacco & tobacco substitutes

VII. A supplier who has exceeded the aggregate turnover limit specified under the composition scheme in the current financial year.

Note: there is a restriction on the registered person under the composition scheme regarding interstate outward supply of goods or services, but there is no restriction on receiving such interstate, inward supply of goods or services or both.

Aggregate Turnover Calculation

Aggregate turnover is defined as the total value of

- all taxable supplies,

- all exempt supplies,

- all inter-state supplies, and

- all exports of goods or services or both.

It does not include the following:

The value of inward supplies is subject to reverse charge taxation, including any cess paid under GST law, such as central tax, state tax, union territory tax, integrated tax, and any other cess.

The value of the aggregate turnover of a person is computed on an all-India basis of a person having the same PAN.

To calculate the aggregate turnover of a person, it will include the value of supplies made by such person from the 1st of April of a financial year up to the date when he becomes liable for registration under this Act. Still, it shall exclude the value of an exempt supply of services provided by extending deposits, loans, or advances so far as the consideration is represented by interest or discount.

It is also noted that the value of exports and inter-state supply are considered only for determining the value of aggregate turnover of the preceding financial year. These values are not relevant for computing the value of the current financial year under the composition scheme, and the supplier is not permitted to conduct interstate supply or exports in the said financial year when he opts for the composition scheme.

Conditions and restrictions for levy of Composition Scheme

A person who wants to apply for a composition scheme have to follow the following rules and conditions levied by law

I. The person shall not be manufacturing or trading the notified goods during the preceding financial year. Such notified goods include

a. ice cream and other edible ice, whether or not containing cocoa.

b. pan masala

c. tobacco and other products made from tobacco substitutes

d. aerated water

II. The person has to pay tax under reverse charge on inward supply of goods or services or both

III. The person cannot be a casual taxpayer

IV. The person cannot be a non-resident taxable person

V. In lieu of a tax invoice, the individual must issue a ‘Bill of Supply.’

VI. At the top of the bill of supply issued by the person to the customer, the words “Composition taxable person, not eligible to collect tax on supplies” must be mentioned.

VII. The “composition taxable person” must be mentioned on a signboard at his prominent place of business as well as at every other place of business.

VIII. The person must pay the Reverse Charge Mechanism tax on the goods he owns because the stock is taxed under reverse charge.

IX. No tax shall be imposed on the recipient of goods or services or both.

X. If the scheme is used, it will cover all registered persons with the same PAN across India.

XI. The penalty shall be imposed on the Registered person in case of irregular availment of the composition scheme

Benefits of opting Composition Scheme

➢ Reduction in compliance cost by maintaining fewer books of record and issuance of the taxable invoice

➢ Brings ease for small taxpayers in filling out returns

➢ Quarterly payment of taxes

➢ Tax computed to pay under this scheme is less compared to regular GST payment

➢ Simple calculation of tax based on the turnover computed

Disadvantages of opting Composition Scheme

➢ The area or territory of conducting business will be limited to the same state where the person conducting the business as a person registered under this scheme is not allowed for interstate supply or any export of goods or services or both.

➢ Input Tax Credit cannot be availed under this scheme

➢ No E-commerce trading of goods or services can be done if opted for this scheme

➢ Cannot supply non-taxable goods example, Alcohol.

Procedure for opting for Composition Scheme

I. Application for registration notification:

If a person is not registered under GST but wants to get registered and apply for an option to pay tax under the Composition Scheme has to file PART B of the registration form, i.e., GST REG-01. However, permission for the composition scheme shall be granted only after the person has successfully registered himself under GST.

The effective date of registration under the composition scheme will be the date of registration under GST.

II. Intimation by a registered person:

The registered person shall electronically file an intimation in the prescribed form under GST Common Portal, i.e., www.gst.gov.in. The intimation must be filled out before the commencement of the financial year for which one wants to opt for the scheme. A statement in prescribed form is also to be furnished within 60 Days of the commencement of the relevant financial year.

The effective registration date under the composition scheme will be from the commencement of the said financial year.

Return to be filled under the Composition scheme.

Once the scheme is availed, the composition dealer has to pay GST quarterly through a chalan-cum-statement, i.e., form CMP-08, by the end of the 18th of the month following the quarter.

Also, he is required to file a return annually, i.e., GSTR-4 & GSTR-9A, till the 30th of April of the following financial year.

Withdrawal from the Composition Scheme

Withdrawal from the scheme by the taxpayer as he ceases to satisfy any or all of the prescribed conditions

- The option to avail composition scheme lapses from the day aggregate turnover exceeds the prescribed limit of Rs. 1.5Cr/75 lakh/50 lakhs as is the case in the government’s budget year.

- Will have to pay tax under the regular scheme from the day he ceases to levy composition scheme

- Will have to issue a taxable invoice in place of the bill of supply

- Will have to inform the authority about such withdrawal from the composition scheme within 7 days of the occurrence of such an event.

The taxpayer will indicate the effective date of withdrawal from the scheme in his intimation to the authorities.

Withdrawal from the scheme by the taxpayer voluntarily

- The taxpayer who intends to withdraw from the scheme has to intimate the authorities in the prescribed form about such withdrawal before the date of voluntary withdrawal.

The taxpayer will indicate the effective date of withdrawal from the scheme in his application to the authorities.

Withdrawal due to denial to pay tax under this scheme by the tax authorities

- When the tax authorities have some reason to believe that the taxpayer is not eligible to pay GST under the composition scheme or has violated any rules/provisions of GST, the authorities may issue Show Cause Notice, i.e., SCN, to the taxpayer.

- The taxpayer then has to submit the reply to SCN.

- Upon receiving such a reply, the authorities can accept or deny the option to avail of the Composition Scheme.

The effective date of withdrawal from the scheme will be the date of infringement of the rules/provisions of GST or any retrospective date determined by the tax authorities.

On such withdrawal from the scheme, the taxpayer has to furnish details of stock of inputs and inputs of semi-finished goods as well as finished goods held by him on the date of such withdrawal in the prescribed format within 30 days from the date of withdrawal.

One Reply to “The GST Composition Scheme”

Singal Vehicle No Other Vehicle Tours & Travels Owner Can Pay GST & GST Mandatory OR Not