Reasons for GST Registration Cancellation or Suspension

GST laws provide a strong compliance framework. If a taxpayer does not comply with the GST law or rules gave thereunder, the GST registration of such taxpayer can be canceled or suspended. In this blog, we will take a gander what can be the circumstances when the GST registration of a taxpayer can be suspended or canceled.

GST Registration Cancellation – Consequences

Once the GST registration of a taxpayer is canceled they will not be able to pay tax or file a GST return.

It shall be noted If you fall under the mandatory category of the taxpayer and your GST registration has been canceled or suspended, you need to apply for the fresh GST registration. In a case, you do not apply for fresh GST registration GST authority will impose penalties for non-compliance with GST laws.

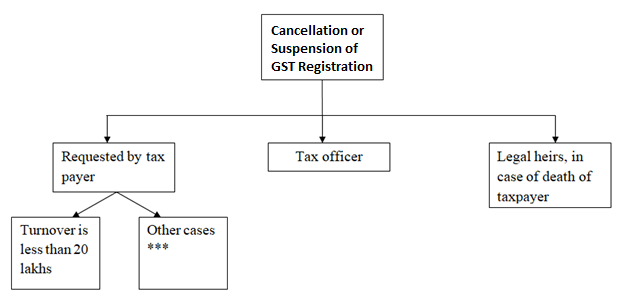

Who Can Cancel or Suspend GST Registration?

Reasons behind Cancellation or Suspension of GST Registration

| S.No. | Sections/ Rules of GST Act | Reason for GST Registration Cancellation |

| 1 | Section 29(1)(a) | Business is discontinued, merged/demerged, transferred, or dissolved due to any reason including the death of the owner or proprietor. |

| 2 | Section 29(1)(b) | Change in the business constitution. |

| 3 | Section 29(1)(c) | Taxpayer voluntarily opting out of GST registration. |

| 4 | Section 29(2)(a) | Taxpayers intentionally not abiding by the provision of the CGST Act or Rules. |

| 5 | Section 29(2)(b) | The composition scheme holder has not filed GST returns for 3 consecutive quarters. |

| 6 | Section 29(2)(c) | Any other taxpayer who has not filed returns for 6 consecutive months. |

| 7 | Section 29(2)(d) | A voluntarily registered taxpayer who has not yet started a business within 6 months from the date of GST registration. |

| 8 | Section 29(2)(e) | A person obtains registration under GST by fraudulent means. |

| 9 | Rule 21(a) | Not conducting business from the place of business mentioned in the GST registration certificate. |

| 10 | Rule 21(b) | Issues an invoice without actually supplying goods or services. |

| 11 | Rule 21(c) | Violates anti-profiteering measure of the CGST Act, 2017. |

| 12 | Rule 21(d) | Violates Rule 10A of the CGST Rules (furnishing bank account details). |

| 13 | Rule 21(e) | Claim ITC in violation of Section 16 provisions (Eligibility to claim ITC) |

| 14 | Rule 21(f) | If the amount of sales furnished in Form GSTR-1 is more than the number of sales declared in GSTR-3B for one or more tax periods. |

| 15 | Rule 21(g) | Violates payment Rule 86B of the CGST Rules 2017 (Restrictions on utilizing the amount available in the e-credit ledger) |