Pro Forma Invoice under GST

A business issues a tax invoice when they supply goods or/and services along with the transfer of title of ownership. But apart from tax invoices, there are other documents that a taxpayer draws one such document is pro forma invoice under GST. So, in this article, we will cover every aspect related to pro forma invoices under GST.

What is a Pro Forma Invoice under GST?

Pro Forma invoice under GST is a type of invoice that is given to a prospective customer when they enquire about any product or/and service. In simple words, it is a kind of quotation form that describes the products or/and services, their approximate price, expected time of delivery, terms, and condition of sale and payment.

However, it shall be noted that the recipient is not required to make a payment on the basis of a pro forma invoice. Moreover, a pro forma invoice is not a legal document and hence the price of products or services can change before issuing a tax invoice.

Difference Between Pro Forma Invoice and Tax Invoice

A broad difference between an Invoice and a Proforma Invoice is that the Proforma Invoice is a replica or a format of how an actual invoice would look like so that the buyer can see all the elements covered in the actual tax invoice which is yet to be produced. This would help them understand, not only the values mentioned in it but also, how they would punch the future tax invoice in their ERP.

Most of the buyers use it for making advance payment on the basis of Pro-forma Invoice. However, a Proforma Invoice is only a replica and not a document which promises a transfer of title, it cannot be called a Legal Sales Document.

When is a Pro Forma Invoice Used?

Normally, a Pro Forma invoice is given before the actual deal happens. Hence, a provider is needed to give a Pro Forma invoice in the event that the customer requests such an invoice to know the estimated cost and the detail of products or services that will be dispatched.

Yet, Proforma invoices are all the more regularly utilized for export exchanges. In exports, the potential customer sitting abroad sends an inquiry and the supplier readies a Pro Forma invoice giving estimated cost and different subtleties like product depiction, terms of the offer, and so forth

Besides, such an invoice is likewise utilized by a merchant for acquiring import licenses, opening a letter of credit, or arranging funds. Additionally, Pro Forma invoice is utilized for shipments that comprise products that are not for sale or purchase such as gifts. Also, the supplier needs to provide a Pro Forma invoice to get the products delivered to the port.

GST Pro Forma Invoice Purpose

The very reason behind providing a Pro Forma invoice is to provide the prospective customer a rough estimate about value, type of merchandise, different terms of the offer, and so forth. And based on this pro forma invoice, the prospective customer concludes if they want to buy products or services.

GST Pro Forma Invoice Content

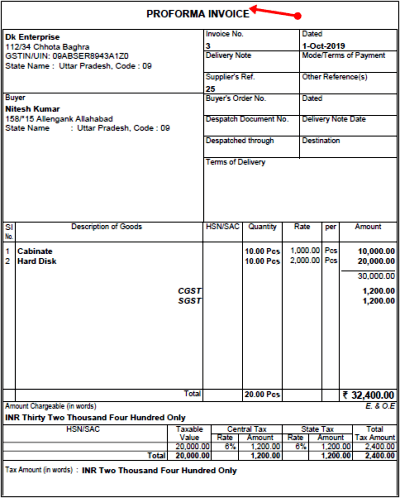

Contents of Pro Forma Invoice under GST are:

- Pro Forma invoice issuance date

- Supplier’s and Buyer’s GSTIN

- Supplier’s and Buyer’s Address

- Ship to Address

- Goods or/and services description such as GST rates quantity, unit price, HSN/SAC codes, etc.

- Validity period

- Terms and conditions of sale and purchase

- Supplier’s banking details such as account number and IFSC code

- Signature of the authorized person

Sample Format of Pro Forma Invoice

2 Replies to “Pro Forma Invoice under GST”

good showing & perfect invoice format

CAN WE MAKE PER FORMA INVOICE VAI E-INVOICE