Most recent list of all GSPs approved by the GSTN

Who Are GSPs

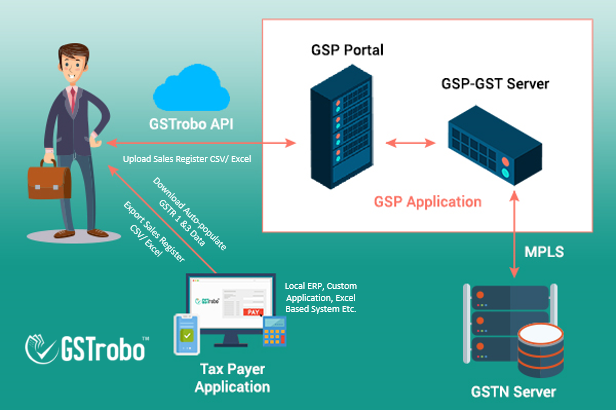

GSP or GST Suvidha Provider are special entities authorized by GSTN to provide a web-based platform compiling with all the regulatory requirements of the GST law to enable the taxpayer to do the GST compliances.

Eligibility Criteria of GSPs by GSTN

As a prerequisite, all GST Suvidha Providers (GSPs) are to be approved by GSTN which then are provided with API. GSPs use the APIs made accessible to them by GSTN and enhance the system in a way making the return filing processes much simpler and error free to taxpayers with 100% data privacy. GSTN has given licenses to below GSPs in 2 batches.

GSP License: Batch 1 Eligibility Criteria

The first set of GST Suvidha Providers were required to meet the following standards for obtaining GSP license:

Financial Strength

- Paid up / Raised capital of at least Rs. 5 crores and

- Average turnover of at least 10 Crores during the last 3 financial years

Demonstration of Capabilities

- Invoice upload by taxpayers

- GST Return #1 and #2 preparation and filing

- Reconciliation of downloaded GSTR2 with Purchase Register

- Multiple GSTIN Ids mapped to a single user account

- Multiple roles mapped to single GSTIN

- E-sign / DSC integration for the signing of returns

- UI / UX

- Mobile interface

- Alert generation to taxpayers

- Security design

Technical Capabilities

- Backend infrastructure, such as servers, databases etc., required specifically for the purpose of GSP work shall be based in the territory of India, and

- IT Infrastructure owned or outsourced to carry out a minimum of 1 Lakh GST transaction per month, and

- Data Privacy policy to protect beneficiary privacy, and

- Data security measures as per the IT Act.

GSP License: Batch 2 Eligibility Criteria

An IT / ITES / BFSI company having IT capability should have following parameters to qualify:

Financial Strength

- Paid up / Raised capital of at least Rs. 2 crores and

- Average turnover of at least 5 Crores during the last 3 financial years (2014-15, 2015-16, 2016-17)

- For FY 2016-17, unaudited results, duly authenticated by the Company Secretary only, may be quoted, to be followed up by the audited and signed balance sheets. For earlier years copy of the relevant page of audited balance sheet needs to be shared.

Demonstration of Capabilities

- Invoice upload by taxpayers and GSTR1 Preparation

- Reconciliation of downloaded GSTR2 with Purchase Register and

- preparation and filing of GSTR2

- Multiple GSTIN Ids mapped to a single user account

- Multiple roles mapped to single GSTIN

- E-sign / DSC integration for signing of returns

- UI / UX

- Mobile interface

- Alert generation to taxpayers

- Security design of GSP Application

- Technical Capability of GSP (Handling Large Load, Experience in handling large application, Managing Sizable Application Infrastructure, Experience in developing complex application etc.)

Technical Capabilities

- Backend infrastructure, such as servers, databases etc., required specifically for the purpose of GSP work shall be based in the territory of India, and

- IT Infrastructure owned or outsourced to carry out a minimum of 1 Lakh GST transaction per month, and

- Data Privacy policy to protect beneficiary privacy, and

- Data security measures as per the IT Act.

The most recent list of additional GSPs approved by the GSTN in 2018 is:

- AARMS Value Chain Pvt. Ltd.

- Abhipra Capital Limited

- Adaequare Info Pvt. Ltd.

- Agile Labs Pvt. Ltd.

- APRA and Associates

- Balaji Mariline Pvt. Ltd.

- BCITS Pvt. Ltd.

- BDO India LLP

- GSTrobo– a product of Binary Semantics Ltd.

- CDSL Ventures Ltd.

- Chartered Information Systems Pvt. Ltd.

- Compare Infobase Ltd.

- CSC e-Governance Services India Ltd.

- Diya Systems (Mangalore) Pvt. Ltd.

- E-Connect Solutions Pvt. Ltd.

- Focus Softnet Pvt. Ltd.

- Gamut Infosystems Ltd.

- Image InfoSystems Pvt. Ltd.

- 3i Infotech Ltd.

- KPMG India Pvt. Ltd.

- Manuh Global Technologies Pvt. Ltd.

- Medhassu e-Solutions (India) Pvt. Ltd.

- (n)Code Solutions – A Division of GNFC Ltd.

- Net Access India Ltd.

- NETXCELL Ltd.

- Payswiff Solutions Pvt. Ltd.

- Perennial Systems

- PricewaterhouseCoopers Pvt. Ltd.

- Professional Softec Pvt. Ltd.

- RajCOMP Info Services Ltd.

- Ray & Ray, Chartered Accountants

- Span Across IT Solutions Private Limited (TaxSpanner)

- Sreeven Infocom Ltd.

- Tally (India) Pvt. Ltd.

- VG Learning Destination (India) Pvt. Ltd.

- Webtel Electrosoft Pvt. Ltd.

- Winman Software Pvt. Ltd.

- Zephyr Limited

- Zoho Corporation

The list of Government Agencies selected as GSPs in 2018 includes:

- BSNL

- Commissioner of Commercial Taxes (CCT, Karnataka)

- Gujarat Livelihood Promotion company (GLPC)

Apart from above, the following list of 34 GSPs was approved by the GSTN in 2017:

- Alankit limited

- Bodhtree Consulting Limited

- Botree Software International Pvt. Ltd.

- Central Depository Services (India) Limited

- Computer Age Management Services Private Limited

- Cygnet Infotech Private Ltd

- Deloitte Touché Tohmatsu India LLP

- Ernst & Young LLP

- Excellon Software Pvt. Ltd.

- Gofrugal Technologies Private Limited

- Hazel Mercantile Limited

- Iris Business Services Limited

- Karvy Data Management Services Limited

- Mastek Limited

- Masters India Private Limited

- MothersonSumi Infotech & Designs Ltd.

- NSDL e-Governance Infrastructure Limited

- RAMCO Systems Limited

- Reliance Corporate IT Park Limited

- Seshaasai Business Forms Private Limited

- Shalibhadra Finance Limited

- SISL Infotech Pvt. Ltd.

- Skill Lotto Solutions Pvt. Ltd.

- Spice Digital Limited

- Sugal & Damani Utility Services Private Limited

- Tally Solutions Private Limited

- TATA consultancy services Limited

- Taxmann Publication Pvt. Ltd.

- Tera Software Limited

- Trust Systems & Software (I) Pvt. Ltd.

- Vayana Private Ltd.

- Velocis Systems Pvt. Ltd.

- Vertex Customer Management India Private Limited

- WeP Solutions Limited

6 Replies to “Most recent list of all GSPs approved by the GSTN”

I am so happy to read this. This is the kind of manual that needs to be given and not the random misinformation that’s at the other blogs. Appreciate your sharing this best article.

Hi, this is shiva from karnataka need help in this regards, my contact no is 9986025225

Great post, you have pointed out some superb details, I also think this s a very wonderful website.

Total no of gsp companies and list

List of gsp approved by gstn

Hello,i want to open my gst suvidha center,please help me ,what i do