Intra-State and Inter-State Supply under GST

The tax assessment framework might be very perplexing for some to comprehend because of the various legal customs that go with it. After the implementation of GST, different factors impact the supply of goods or/and services under GST. One of them includes intra-state and inter-state supply under GST. Regardless of whether the supply of goods and services is made within the city or across the borders, the taxpayer is liable to pay GST.

Meaning of Intra-State and Inter-State Supply under GST

GST as the name suggests Goods and Services Tax is applicable on the supply of goods or/and services. These supplies can be classified into two categories

- Inter-State Supplies

- Intra-State Supplies

Meaning of Inter-State Supply

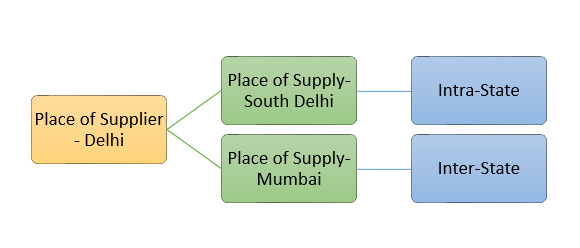

As per GST Act, inter-state supply is when the location of the supplier and the place of supply are in different states. In simple words, inter-state supply means supplying goods or/and services from one state border to another. In the case of inter-state supplies, the taxpayer is liable to pay Integrated Goods and Services Tax (IGST) that is collected by the Central Government. Example of Inter-state supply: supply of raw material from Punjab to Delhi.

Interstate Supply Applicability

- Inter-state is applicable on the domestic supply means when the place of supplier and the place of supply are:

- Two different states;

- Two different regions under one Union Territory; or

- State and a UT

- Inter-state supply includes the goods or/and services imported into India;

- Inter-state supply also includes the goods or/and service supplied from or special economic zone (SEZ) or export-oriented unit (EOU);

Meaning of Intra-State Supply

As per GST Act, intra-state supply is when the location of the supplier and the place of supply is in the same states. In simple words, intra-state supply means supplying goods or/and services within a state border. In the case of intra-state supplies, the taxpayer is liable to pay Central Goods and Services Tax (CGST) or States Goods and Services Tax (SGST). Here CGST is collected by the Central Government and SGST is collected by the State government. Example of Intra-state supply: supply of finished from Nehru Place to Lajpat Nagar (within Delhi border).

Intra-State Supply Applicability

- Intra-State supply is applicable when the goods or/and services are supplied with in the same:

- State

- Union Territory

Example of Intra-State Supply and Inter-State Supply

Why the Supplies are Differentiated?

As we already know that different taxes are paid depending on the type of supply. Hence, differentiating the supplies between intra-state and inter-state supply is important to determine which tax applicable on such supply either IGST or CGST and SGST/UTGST.

Difference between Intra-State Supply and Inter-State Supply

Here is the difference between Intra-State Supply and Inter-State Supply

| S.No | Parameters | Inter-State Supply | Intra-State Supply |

| 1 | Applicability | When the location of the supplier and place of supply is in two different states. | When the location of the supplier and place of supply is in the same state or union territory. |

| 2 | Tax Levied | Integrated Goods and Services Tax (IGST) | Central Goods and Services Tax (CGST); and State Goods and Services Tax (SGST) or Union Territory Goods and Services Tax (UTGST) |

Conclusion

To know the applicability of IGST or CGST and SGST/UTGST, we need to understand the meaning and basic difference between intrastate and interstate supply. Moreover, a business owner needs to know the factors impacting the supply of goods or/and services under GST.