Integration of E-Way Bill with VAHAN Portal

As we know that digital records allow you to quickly verify and cross-check any information such as AADHAAR. The e-way bill site will now be linked to the VAHAN system to increase compliance and tax administration. In this regard, a pilot program has already commenced in the state of Karnataka.

What exactly is the VAHAN system?

‘VAHAN’ is a National Register that serves as a central repository for vital vehicle-related information. It is a project of the Ministry of Road Transport and Highways. The following parameters can be used to search the system for information on registered vehicles:

- Vehicle Registration Number

- Unique Number of the Chassis and Engine

The VAHAN system can handle a variety of services, including vehicle registration, permit issuance and renewal, state (road) tax computation and payment, fitness certificate issuance and renewal, challan issuance, and settlement, etcetera.

Why Integration of E-Way Bill with VAHAN Portal is Important?

The integration of the e-way bill system with the VAHAN portal serves a specific purpose. When creating an e-way bill, the e-way bill system and the VAHAN portal are connected to cross-check or validate a vehicle’s registration number. This will prevent any future attempt to generate an e-way bill using a vehicle number that is not registered with the VAHAN system.

Possible Alerts While Integrating an E-Way Bill with VAHAN and

The vehicle number entered in the e-way bill will be checked against the VAHAN system right away to ascertain that it is correct. The following are the numerous alerts and their potential solutions:

- The vehicle number is unavailable.

When the vehicle number is not found in the VAHAN database, this error is displayed. Initially, such a vehicle number will be permitted on the e-way bill gateway, but it will not be permitted to be used again. This problem can be fixed by updating the vehicle information at the relevant Regional Transport Office (RTO).

- Vehicle Registered In More than 1 Regional Transport Office (RTO)

Vehicles that are registered in more than one RTO are referred to as “multi-registered vehicles. The gateway may accept such a vehicle number at first, but it will not be allowed to be used again. This may be rectified by going to the relevant RTO and amending the relevant information. Once the status in the VAHAN system is modified, the status in the e-Waybill system will also get updated.

- Registration is only valid for a limited time.

If a taxpayer transports products in a vehicle with a temporary license plate, the EWB portal will not check the vehicle’s information. In this scenario, the taxpayer creating the EWB should begin the e way bill with TR and insert the temporary vehicle number.

- Details are available in VAHAN, but not on the EWB portal.

If the taxpayer’s vehicle number is available on the VAHAN system but not on the EWB portal, he or she can contact the E-way bill helpdesk and file a complaint using the Vehicle number.

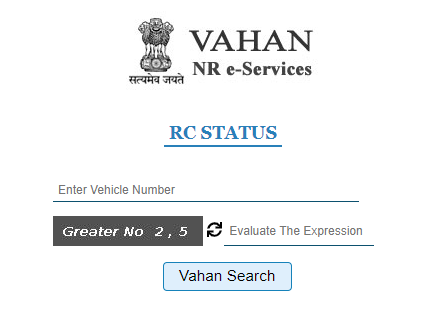

What Is The Best Way To Check The Status Of A Vehicle’s Registration?

The vehicle information can be confirmed on the VAHAN track before being added to the EWB.