GST PMT-09: Applicability and Format

GST PMT-09 is a form that was introduced by the CBIC and was first available on 21st April 2020 for the taxpayers. This blog talks about all the important aspects related to form GST PMT-09 its applicability and format.

What is GST PMT-09?

GST PMT-09 is a challan form that helps the taxpayer to transfer the wrongly paid tax from one head to another. In simple words, if a taxable registered person pays tax under the wrong head such as SGST and CGST instead of IGST then he/she can settle the same by transferring the amount from SGST and CGST to IGST by filing GST PMT-09 Form. GST PMT-09 form enables the taxpayer to undertake intra-head or inter-head transfer of amount in electronic cash ledger. Let us understand the GST PMT-09 form applicability with an example:

Mr. X wrongly paid INR 1000 CGST and INR 500 penalty instead of paying INR 500 CGST and INR 1000 penalty. In this case, Mr. X can use GST PMT-09 to transfer the amount from CGST (major head) to Penalty (minor head). Moreover, the amount can also be reallocated from minor head to major head.

GST PMT-09 Applicability

Every person who is registered under GST can take the advantage of GST PMT-09 facility introduced by CBIC. However, the taxpayer can only transfer the amount from the e-cash ledger, and the amount once used from the e-cash ledger cannot be transferred again.

Different Heads under GST PMT-09 Form

There are two different heads under GST PMT-09 Form and they are:

- Major Head

- Integrated Tax

- Central Tax

- State/UT Tax

- CESS

- Minor Head

- Interest

- Tax

- Fee

- Penalty

- Others

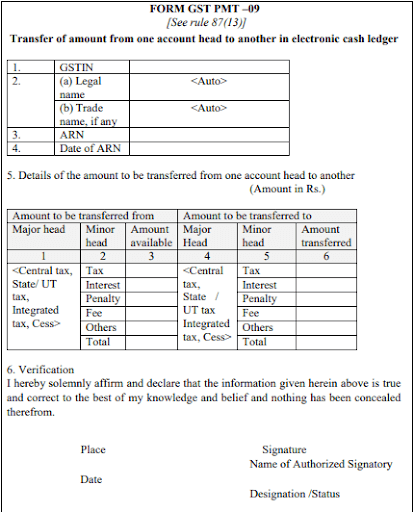

GST PMT-09 Content

- GSTIN: In this column, the taxpayer needs to mention his/her GST identification number.

- Legal and Trade Name: This will get auto-populated on the basis of GSTIN entered.

- ARN: The taxpayer needs to mention the application reference number (ARN) received on the registered mail ID and phone number.

- ARN Date: The date on which ARN was received by the taxpayer needs to be mentioned in this column.

Amount to be reallocated from One Account Head to Another: In this column, the taxpayer needs to mention the amount that has to be reallocated from one head to another. However, the taxpayer must have an e-cash ledger balance under that particular head at the time of allocating the amount.

GST PMT-09 Format

Here is a sample format of GST PMT-09 form:

GST PMT-09 Form: Important Points to Remember

- In a case, if the taxpayer utilizes the wrongly paid challans in GSTR-3B, he/she cannot reallocate the amount using the GST PMT-09 form.

- The taxpayer can only utilize the amount available in the e-cash ledger to shift the amount from one head to another under the GST PMT-09 form.

- Once the e-cash ledger amount is used, the taxpayer cannot reallocate the same.

- The taxpayer can use the GST PMT-09 form when he/she has made the wrong payment but not utilized the same.

- Mostly taxpayer uses GST PMT-09 form to reallocate their wrongly paid penalties.

How Can GSTrobo® Help you?

GSTrobo® – a division of Binary Semantics Ltd is one of the leading ASP- GSP who provides industry-leading GST compliance software and APIs for GST, e-way bill, and e-invoicing. These solutions not only seamlessly integrate with all the ERPs but also automates most of your GST compliance.