GST PMT-03 Form to Re-Credit ITC

In typical scenarios, any registered taxable person can claim a refund of excess tax or interest paid by furnishing GST RFD-01 under GST. However, in case if the authorities reject the claim, the ITC of such taxpayers is re-credited to their electronic cash or credit ledger with the help of the GST PMT-03 form. So, in this blog, we will cover all the aspects related to the GST PMT-03 form to re-credit ITC.

What is GST PMT-03 Form?

GST PMT-03 is a type of order form through which Input Tax Credit (ITC) is re-credited to the e-cash or e-credit ledger in full or parts on the rejection of a refund claimed. However, the order of re-crediting the ITC in form GST PMT-03 is passed by the proper officer via GST RFD-01B.

GST PMT-03 Form Applicability

Here is the list of refund for which the GST PMT-03 form can be used to re-credit ITC to the e-cash or e-credit ledger:

| S.No. | Refund Type | Ledger |

| 1 | Refund in case of excess balance of cash | Cash ledger |

| 2 | Accumulated ITC due to export of goods or services without making tax payment | Credit Ledger |

| 3 | ITC accumulated because of inverted tax structure | Credit Ledger |

| 3 | Supplies made to SEZ units or SEZ developers without making tax payment | Credit Ledger |

| 4 | Refund in case of deemed export supplies to the recipient | Credit Ledger |

| 5 | Refund of tax paid due in case of wrongly paid tax (inter-State supply which is subsequently held to be intra-State supply and vice versa) | Credit Ledger |

| 6 | Refund due to assessment or provisional assessment or any other order | Credit Ledger |

| 7 | Refund in case of “any other” reason that is not listed above. | Credit/Cash Ledger |

Once the ARN is generated for any of the aforementioned refund types the status will automatically change to the Pending for Provisional Refund. Once, the proper officer verifies it, he/she will sanction the provisional refund via GST RFD-01B.

GST PMT-03 Non-Applicability

If a taxpayer leaves the refund application incomplete due to any reason and the proper officer finds it he/she can file a Deficiency Memo. In such cases, the whole amount of refund debited will be re-credited to the respective ledger. So, GST PMT-03 will not be applicable in such types of scenarios. It shall be noted that once the recipient receives the deficiency memo from the proper officer, he/she needs to furnish a fresh refund application.

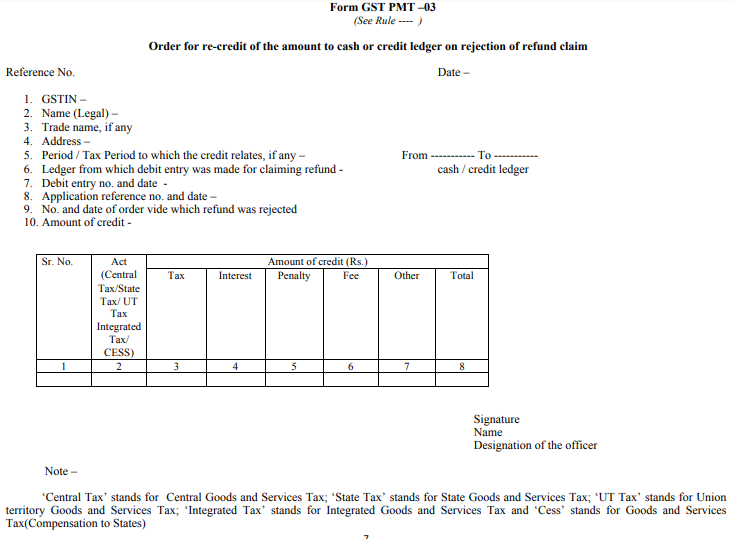

GST PMT-03 Format

The Form GST PMT-03 looks as follows:

Important Points to Remember about GST PMT-03

- The taxpayer always needs to make sure that his/her refund application is not incomplete.

- The taxpayer will receive a re-credited ITC amount in the same mode by which tax liability was discharged by him/her.

- ITC part of the refunded amount is re-credited to the e-credit ledger of the taxpayer by filing PMT-03.

- The cash part will be deposited back to the bank of the recipient by filing GST RFD-05.

- The taxpayer will not receive a refund for zero-rated supplies made by him or her.

- Only the proper officer can verify and order the refund in the GST RFD-01B Form.

2 Replies to “GST PMT-03 Form to Re-Credit ITC”

How can I file PMT 03 ( under taking) online in GST Portal, or Where is the tab to file PMT 03 in the GST Portal

i filed pmt 03 but not response by tax officer my RFD 01 Rejected