GST Compliance Calendar 2023

Don’t worry about missing any deadlines in 2023 – we have created a GST Compliance Calendar with all the due dates of the year! To get you off to a good start, here is the monthly GST calendar so that you can keep track of all your compliance obligations.

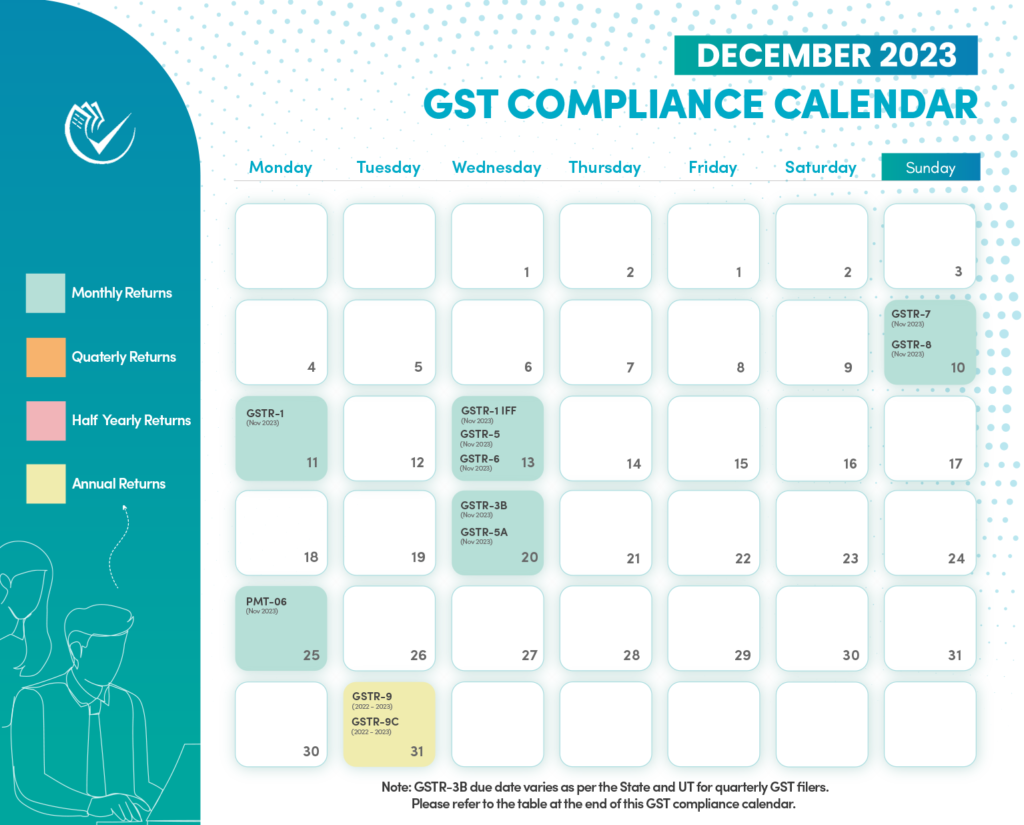

- GST Compliance Calendar for December 2023

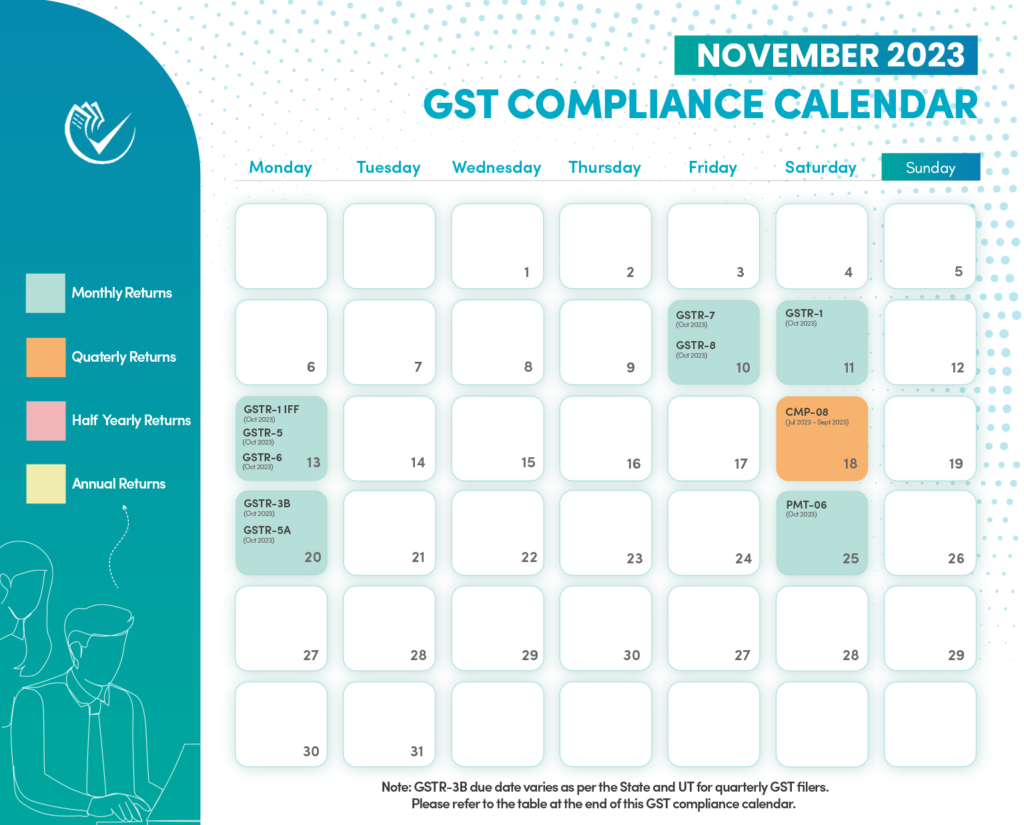

- GST Compliance Calendar for November 2023

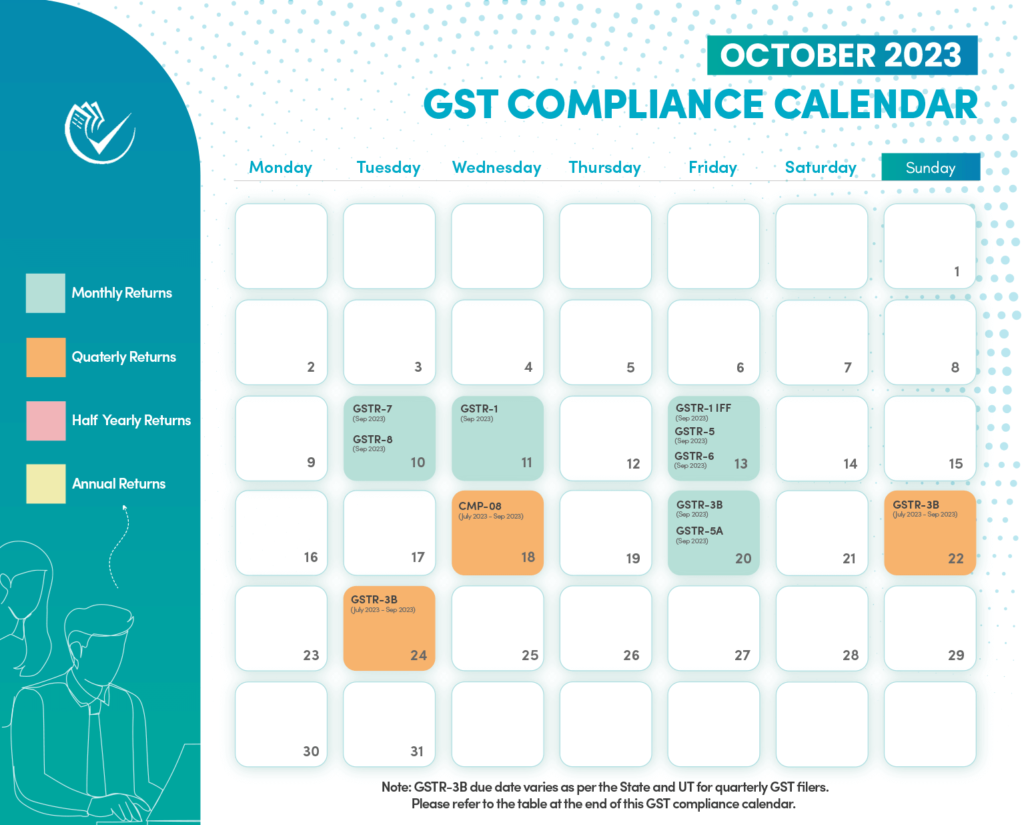

- GST Compliance Calendar for October 2023

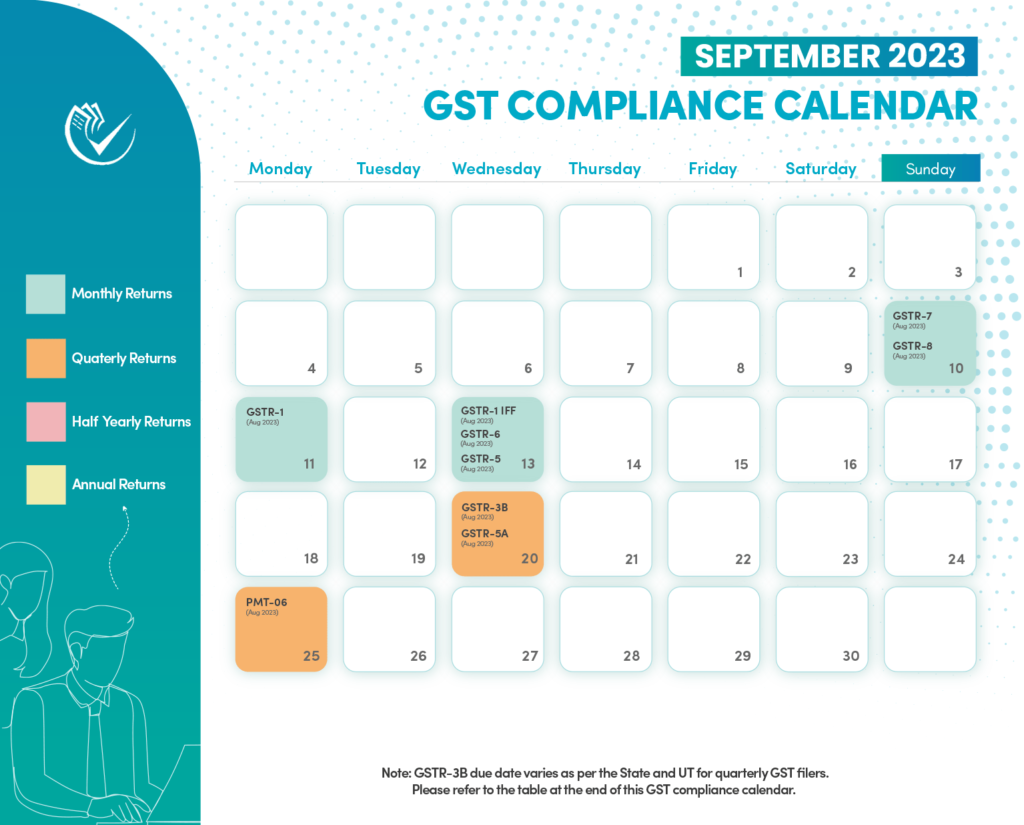

- GST Compliance Calendar for September 2023

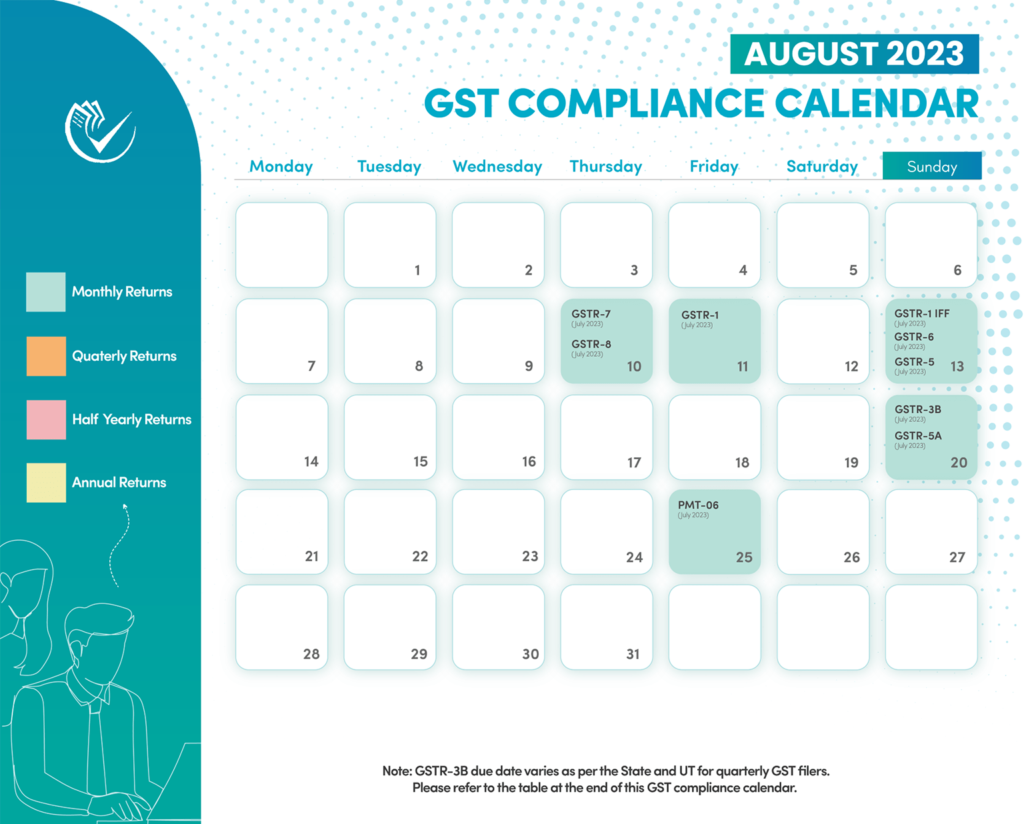

- GST Compliance Calendar for August 2023

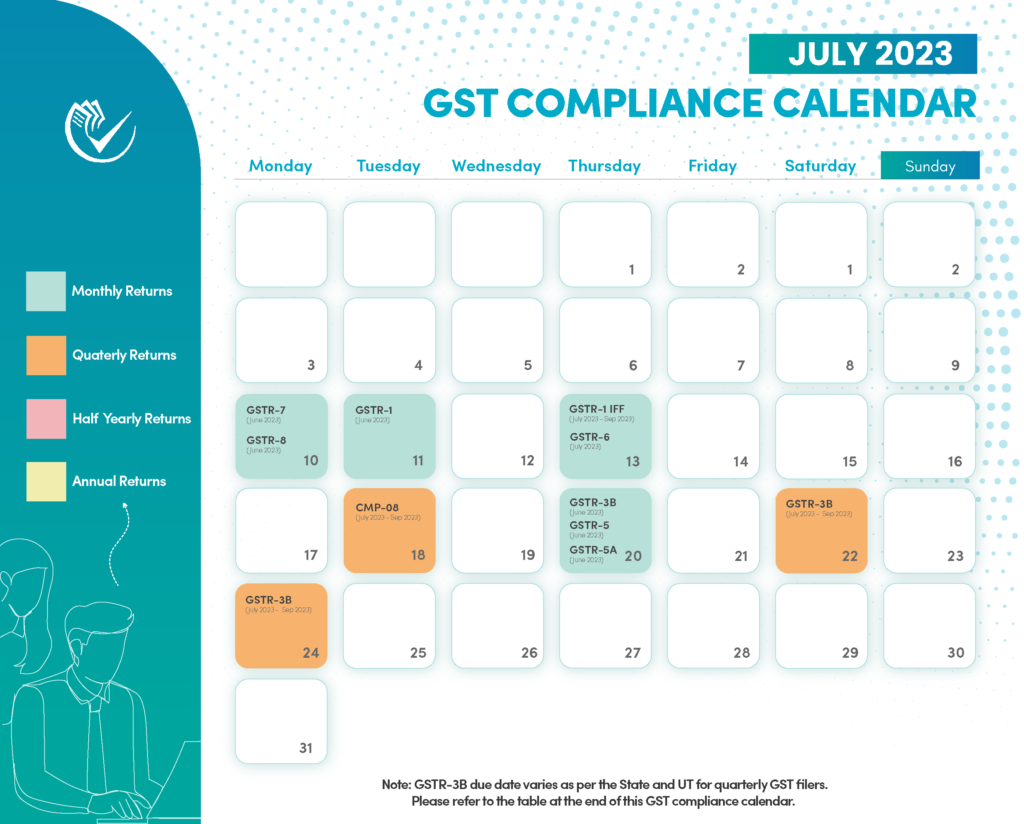

- GST Compliance Calendar for July 2023

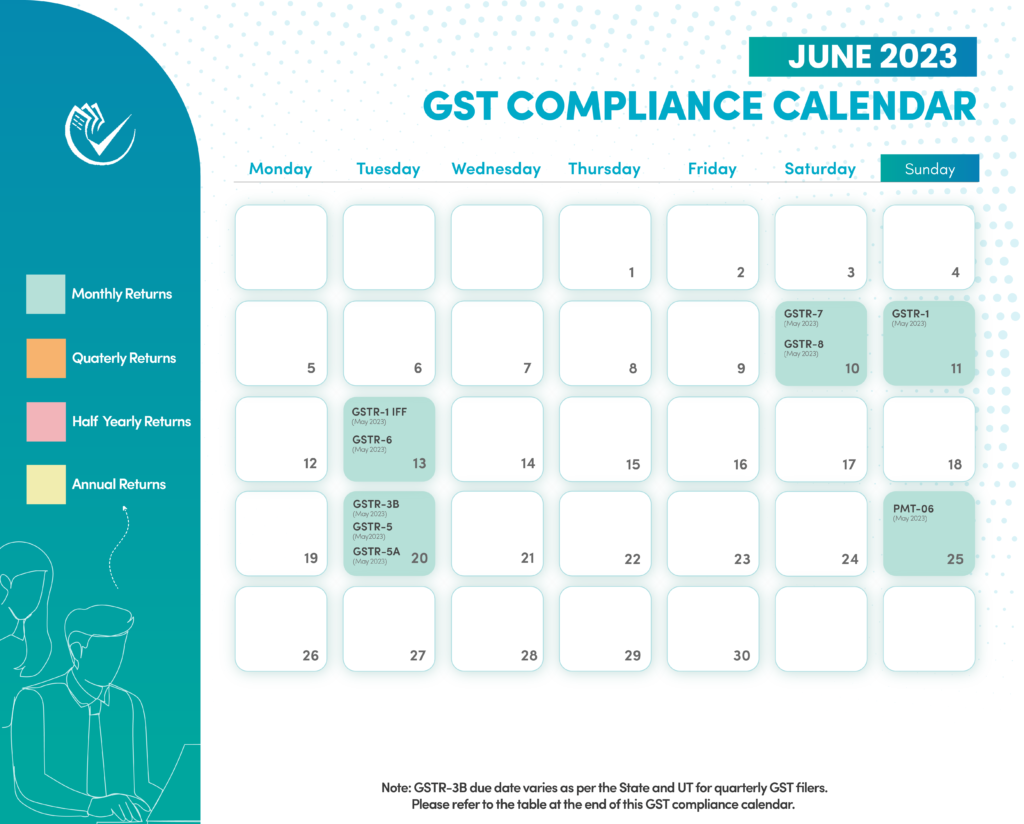

- GST Compliance Calendar for June 2023

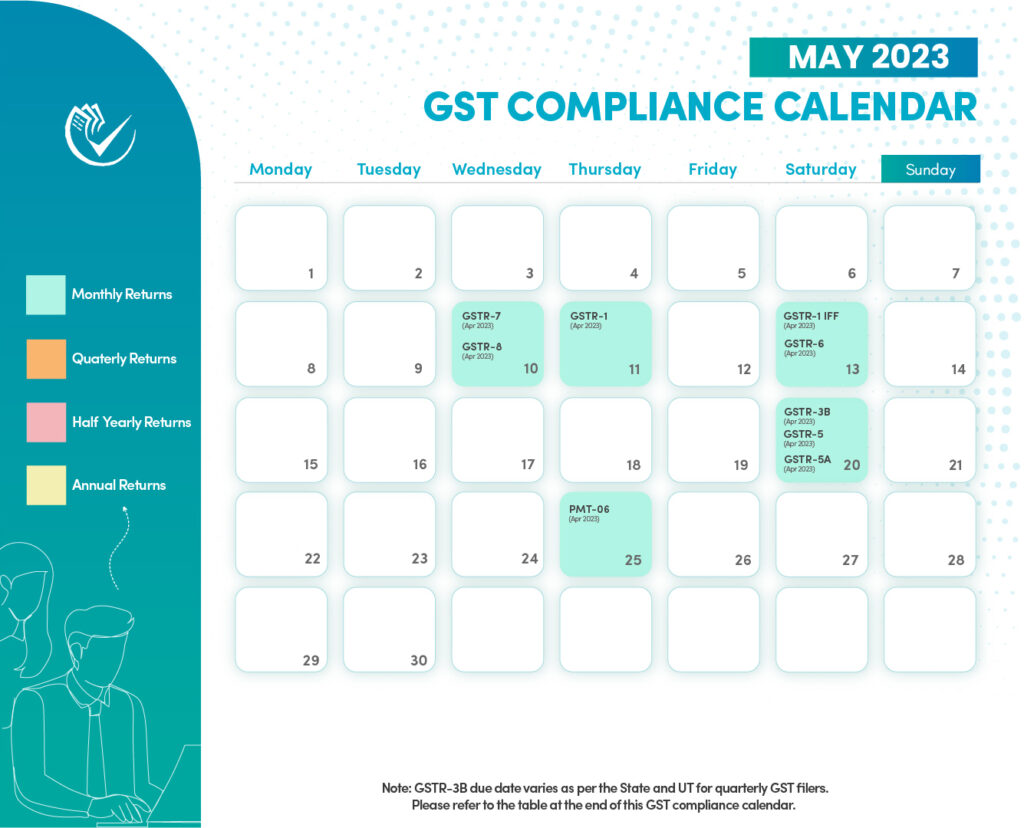

- GST Compliance Calendar for May 2023

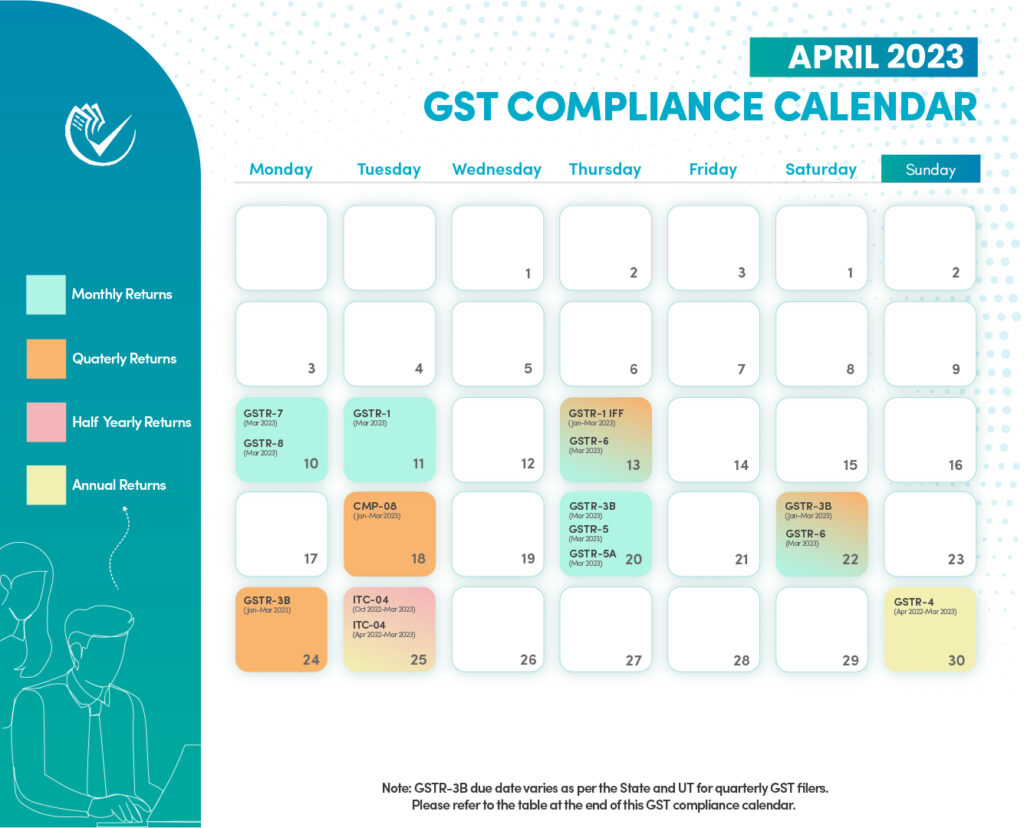

- GST Compliance Calendar for April 2023

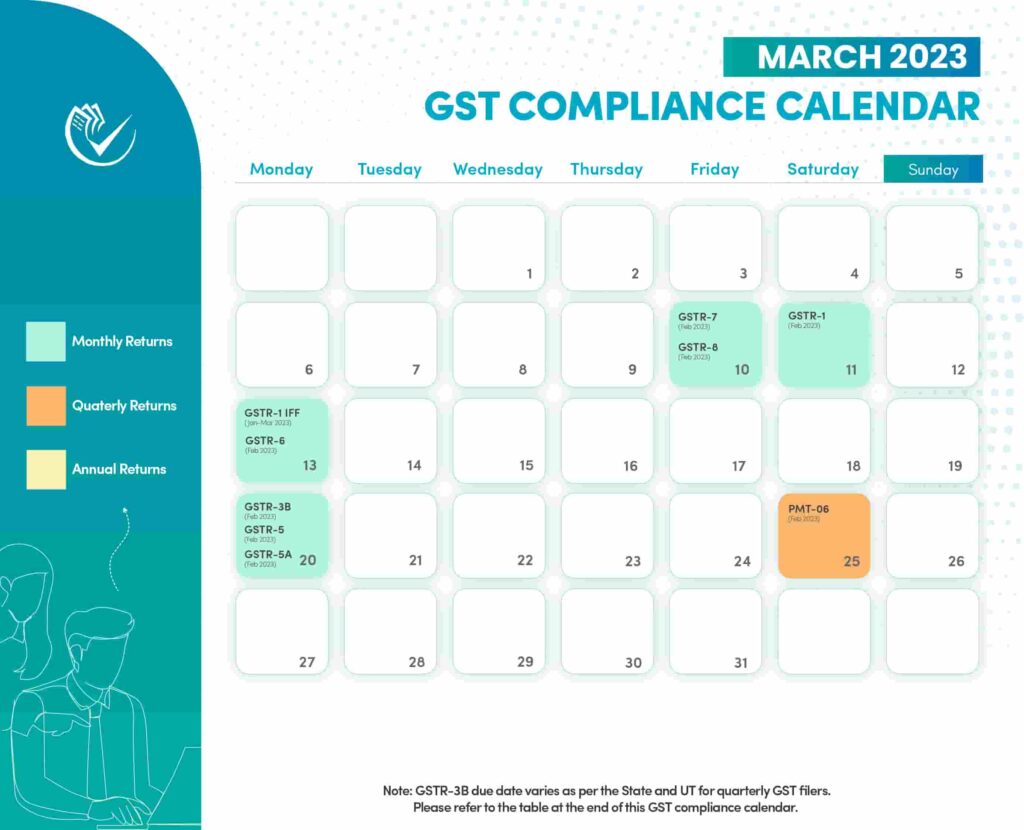

- GST Compliance Calendar for March 2023

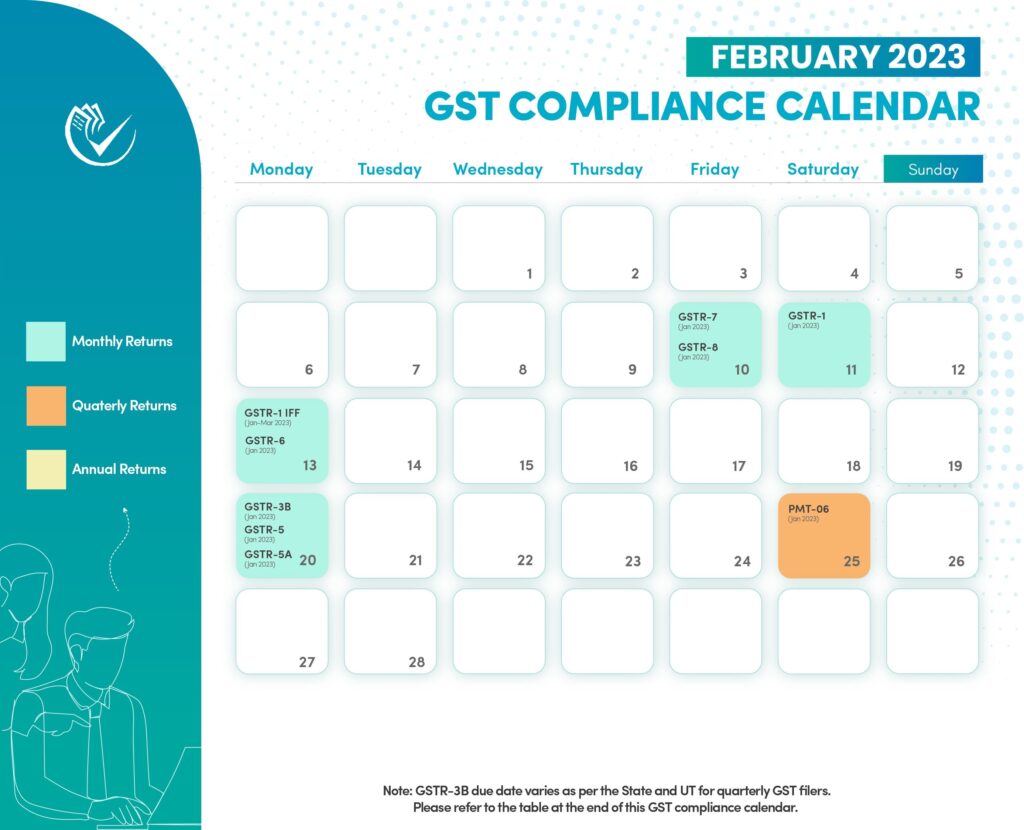

- GST Compliance Calendar for February 2023

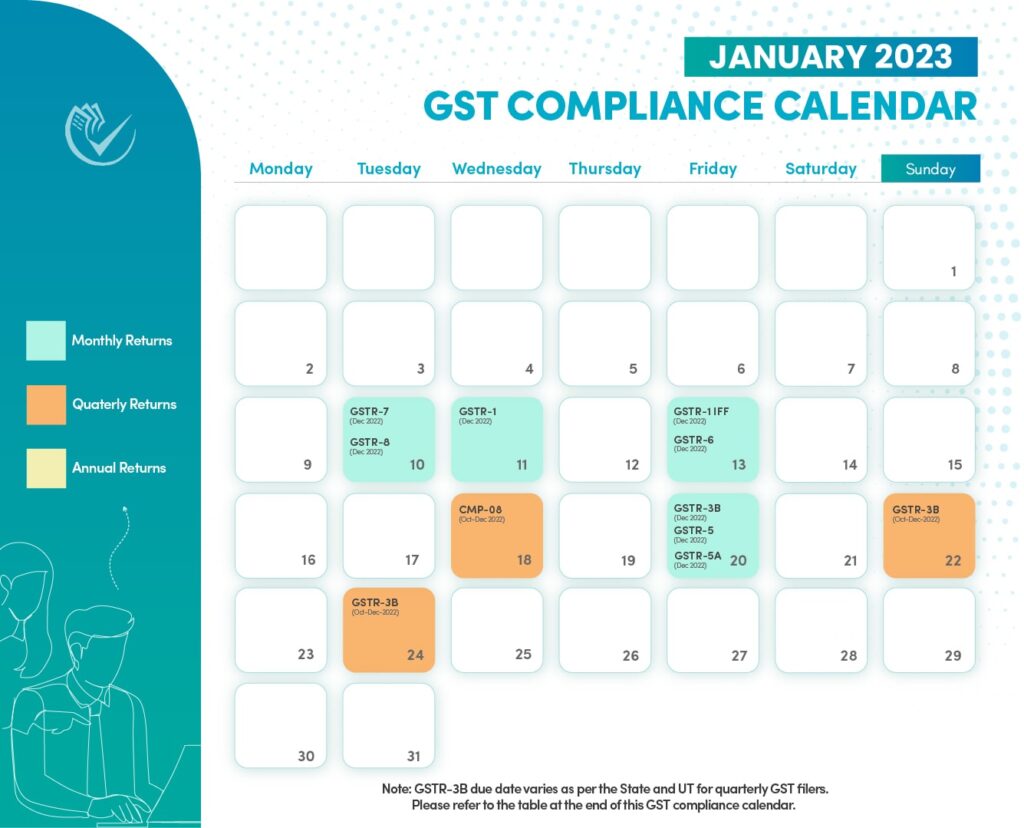

- GST Compliance Calendar for January 2023

- *Specified State and UT List for GSTR-3B Quarterly Filers

The GST compliance calendar keeps track of GST returns and GST-related due dates. In light of the increasing complexity and ever-growing areas becoming a regularized reality, it is always prudent to maintain a GST compliance calendar, online or offline. Furthermore, the risk of non-compliance is much greater than the cost of compliance. Here are some ways GST compliance calendar can assist you:

- Planning and Organizing Data

- Timely filing of GST Returns

- Clear Compliance History

- Aids in Audits

- Simple Reporting

- Satisfied Vendors, Clients, and Customers

Note: GSTR-3B due date varies as per the State and UT for quarterly GST filers. Please refer to the table at the end of this GST compliance calendar.

GST Compliance Calendar for December 2023

| DATE | RETURN | PERIOD | DESCRIPTION |

| 10th Dec | GSTR-7 | Nov 2023 | Summary of Tax Deducted at source (TDS) and deposited under GST laws. |

| 10th Dec | GSTR-8 | Nov 2023 | Summary of Tax collected at source (TCS) by e-commerce operators. |

| 11th Dec | GSTR-1 | Nov 2023 | GST Monthly return for registered persons having turnover of more than Rs.5 crores or who doesn’t opt for QRMP scheme. |

| 13th Dec | GSTR-5 | Nov 2023 | GST Return for Non-resident foreign taxpayers |

| 13th Dec | GSTR-1 IFF | Nov 2023 | GSTR-1 ‘Invoice Furnishing Facility’ under QRMP Scheme. |

| 13th Dec | GSTR-6 | Nov 2023 | GST Return for ITC received and distributed by an Input Service Distributor (ISD). |

| 20th Dec | GSTR-3B | Nov 2023 | GST monthly return to pay tax for the preceding month. |

| 20th Dec | GSTR-5A | Nov 2023 | GST Return OIDAR service provider. |

| 25th Dec | PMT-06 | Nov 2023 | GST Challan Payment if no sufficient ITC for March |

| 31st Dec | GSTR-9 and GSTR-9C | 2022-23 | GSTR – 9: An annual return is to be filed by all regular taxpayers having turnover above 2 crores in a particular financial year (i.e. taxpayers who file regular returns in FORM GSTR-3B, GSTR-1, etc.). GSTR – 9C: A self-certified reconciliation statement form for all the taxpayers having turnover above 5 crores in a particular financial year. |

GST Compliance Calendar for November 2023

| DATE | RETURN | PERIOD | DESCRIPTION |

| 10th Nov | GSTR-7 | Oct 2023 | Summary of Tax Deducted at source (TDS) and deposited under GST laws. |

| 10th Nov | GSTR-8 | Oct 2023 | Summary of Tax collected at source (TCS) by e-commerce operators. |

| 11th Nov | GSTR-1 | Oct 2023 | GST Monthly return for registered persons having turnover of more than Rs.5 crores or who doesn’t opt for QRMP scheme. |

| 13th Nov | GSTR-5 | Oct 2023 | GST Return for Non-resident foreign taxpayers |

| 13th Nov | GSTR-1 IFF | Oct 2023 | GSTR-1 ‘Invoice Furnishing Facility’ under QRMP Scheme. |

| 13th Nov | GSTR-6 | Oct 2023 | GST Return for ITC received and distributed by an Input Service Distributor (ISD). |

| 20th Nov | GSTR-3B | Oct 2023 | GST monthly return to pay tax for the preceding month. |

| 20th Nov | GSTR-5A | Oct 2023 | GST Return OIDAR service provider. |

| 25th Nov | PMT-06 | Oct 2023 | GST Challan Payment if no sufficient ITC for March |

GST Compliance Calendar for October 2023

| DATE | RETURN | PERIOD | DESCRIPTION |

| 10th Oct | GSTR-7 | Sept. 2023 | Summary of Tax Deducted at source (TDS) and deposited under GST laws. |

| 10th Oct | GSTR-8 | Sept. 2023 | Summary of Tax collected at source (TCS) by e-commerce operators. |

| 11th Oct | GSTR-1 | Sept. 2023 | GST Monthly return for registered persons having turnover of more than Rs.5 crores or who doesn’t opt for the QRMP scheme. |

| 13th Oct | GSTR-1 IFF | Sept. 2023 | GSTR-1 ‘Invoice Furnishing Facility’ under QRMP Scheme. |

| 13th Oct | GSTR-5 | Sept. 2023 | GST Return for Non-resident Foreign taxpayers. |

| 13th Oct | GSTR-6 | Sept. 2023 | GST Return for ITC received and distributed by an Input Service Distributor (ISD). |

| 18th Oct | CMP-08 | July 23 – Sept. 23 | Quarterly Statement for payment of self-assessed tax by composition taxpayers |

| 20th Oct | GSTR-3B | Sept. 2023 | GST monthly return to pay tax for the preceding month. |

| 20th Oct | GSTR-5A | Sept. 2023 | GST Return OIDAR service provider. |

| 22nd Oct | GSTR-3B | July 23 – Sept. 23 | Summary of outward supplies, ITC claimed, and tax payable by taxpayers who have opted for the QRMP scheme and registered in specified states and UT. |

| 24th Oct | GSTR-3B | July 23 – Sept. 23 | Summary of outward supplies, ITC claimed, and tax payable by taxpayers who have opted for the QRMP scheme and registered in specified states and UT. |

GST Compliance Calendar for September 2023

| DATE | RETURN | PERIOD | DESCRIPTION |

| 10th Sept. | GSTR-7 | August 2023 | Summary of Tax Deducted at source (TDS) and deposited under GST laws. |

| 10th Sept. | GSTR-8 | August 2023 | Summary of Tax collected at source (TCS) by e-commerce operators. |

| 11th Sept. | GSTR-1 | August 2023 | GST Monthly return for registered persons having turnover of more than Rs.5 crores or who doesn’t opt for QRMP scheme. |

| 13th Sept. | GSTR-1 IFF | August 2023 | GSTR-1 ‘Invoice Furnishing Facility’ under QRMP Scheme. |

| 13th Sept. | GSTR-5 | August 2023 | GST Return for Non-resident foreign taxpayers |

| 13th Sept. | GSTR-6 | August 2023 | GST Return for ITC received and distributed by an Input Service Distributor (ISD). |

| 20th Sept. | GSTR-3B | August 2023 | GST monthly return to pay tax for the preceding month. |

| 20th Sept. | GSTR-5A | August 2023 | GST Return OIDAR service provider. |

| 25th Sept. | PMT-06 | August 2023 | GST Challan Payment if no sufficient ITC for March |

GST Compliance Calendar for August 2023

| DATE | RETURN | PERIOD | DESCRIPTION |

| 10th Aug | GSTR-7 | July 2023 | Summary of Tax Deducted at source (TDS) and deposited under GST laws. |

| 10th Aug | GSTR-8 | July 2023 | Summary of Tax collected at source (TCS) by e-commerce operators. |

| 11th Aug | GSTR-1 | July 2023 | GST Monthly return for registered persons having turnover of more than Rs.5 crores or who doesn’t opt for the QRMP scheme. |

| 13th Aug | GSTR-1 IFF | July 2023 | GSTR-1 ‘Invoice Furnishing Facility’ under QRMP Scheme. |

| 13th Aug | GSTR-6 | July 2023 | GST Return for ITC received and distributed by an Input Service Distributor (ISD). |

| 13th Aug | GSTR-5 | July 2023 | GST Return for Non-resident foreign taxpayers |

| 20th Aug | GSTR-3B | July 2023 | GST monthly return to pay tax for the preceding month. |

| 20th Aug | GSTR-5A | July 2023 | GST Return OIDAR service provider. |

| 25th Aug | PMT-06 | July 2023 | GST Challan Payment if no sufficient ITC for March |

GST Compliance Calendar for July 2023

| DATE | RETURN | PERIOD | DESCRIPTION |

| 10th July | GSTR-7 | Jun 2023 | Summary of Tax Deducted at source (TDS) and deposited under GST laws. |

| 10th July | GSTR-8 | Jun 2023 | Summary of Tax collected at source (TCS) by e-commerce operators. |

| 11th July | GSTR-1 | Jun 2023 | GST Monthly return for registered persons having turnover of more than Rs.5 crores or who doesn’t opt for the QRMP scheme. |

| 13th July | GSTR-1 IFF | July 2023 – Sept. 2023 | GSTR-1 ‘Invoice Furnishing Facility’ under QRMP Scheme. |

| 13th July | GSTR-6 | Jun 2023 | GST Return for ITC received and distributed by an Input Service Distributor (ISD). |

| 18th July | CMP-08 | July 2023 – Sept. 2023 | Quarterly Statement for payment of self-assessed tax by composition taxpayers |

| 20th July | GSTR-3B | Jun 2023 | GST monthly return to pay tax for the preceding month. |

| 20th July | GSTR-5 | Jun 2023 | GST Return for Non-resident foreign taxpayers |

| 20th July | GSTR-5A | Jun 2023 | GST Return OIDAR service provider. |

| 22nd July | GSTR-3B | July 2023 – Sept. 2023 | Summary of outward supplies, ITC claimed, and tax payable by taxpayers who have opted for the QRMP scheme and registered in specified states and UT. |

| 24th July | GSTR-3B | July 2023 – Sept. 2023 | Summary of outward supplies, ITC claimed, and tax payable by taxpayers who have opted for the QRMP scheme and registered in specified states and UT. |

GST Compliance Calendar for June 2023

Here is the comprehensive GST Compliance Calendar for June 2023. This guide contains all the GST due dates for June 2023 so you won’t miss a thing!

| DATE | RETURN | PERIOD | DESCRIPTION |

| 10th June | GSTR-7 | May 2023 | Summary of Tax Deducted at source (TDS) and deposited under GST laws. |

| 10th June | GSTR-8 | May 2023 | Summary of Tax collected at source (TCS) by e-commerce operators. |

| 11th June | GSTR-1 | May 2023 | GST Monthly return for registered persons having turnover of more than Rs.5 crores or who doesn’t opt for QRMP scheme. |

| 13th June | GSTR-1 IFF | May 2023 | GSTR-1 ‘Invoice Furnishing Facility’ under QRMP Scheme. |

| 13th June | GSTR-6 | May 2023 | GST Return for ITC received and distributed by an Input Service Distributor (ISD). |

| 20th June | GSTR-3B | May 2023 | GST monthly return to pay tax for the preceding month. |

| 20th June | GSTR-5 | May 2023 | GST Return for Non-resident foreign taxpayers. |

| 20th June | GSTR-5A | May 2023 | GST Return OIDAR service provider. |

| 25th June | PMT-06 | May 2023 | GST Challan Payment if no sufficient ITC for March. |

GST Compliance Calendar for May 2023

Here is the comprehensive GST Compliance Calendar for May 2023. This guide contains all the GST due dates for May 2023 so you won’t miss a thing!

| DATE | RETURN | PERIOD | DESCRIPTION |

| 10th May | GSTR-7 | Apr 2023 | Summary of Tax Deducted at source (TDS) and deposited under GST laws. |

| 10th May | GSTR-8 | Apr 2023 | Summary of Tax collected at source (TCS) by e-commerce operators. |

| 11th May | GSTR-1 | Apr 2023 | GST Monthly return for registered persons having turnover of more than Rs.5 crores or who doesn’t opt for QRMP scheme. |

| 13th May | GSTR-1 IFF | Apr 2023 | GSTR-1 ‘Invoice Furnishing Facility’ under QRMP Scheme. |

| 13th May | GSTR-6 | Apr 2023 | GST Return for ITC received and distributed by an Input Service Distributor (ISD). |

| 20th May | GSTR-3B | Apr 2023 | GST monthly return to pay tax for the preceding month. |

| 20th May | GSTR-5 | Apr 2023 | GST Return for Non-resident foreign taxpayers |

| 20th May | GSTR-5A | Apr 2023 | GST Return OIDAR service provider. |

| 25th May | PMT-06 | Apr 2023 | GST Challan Payment if no sufficient ITC for March |

GST Compliance Calendar for April 2023

Here is the comprehensive GST Compliance Calendar for April 2023. This guide contains all the GST due dates for April 2023 so you won’t miss a thing!

| DATE | RETURN | PERIOD | DESCRIPTION |

| 10th April | GSTR-7 | Mar 2023 | Summary of Tax Deducted at source (TDS) and deposited under GST laws. |

| 10th April | GSTR-8 | Mar 2023 | Summary of Tax collected at source (TCS) by e-commerce operators. |

| 11th April | GSTR-1 | Mar 2023 | GST Monthly return for registered persons having turnover of more than Rs.5 crores or who doesn’t opt for QRMP scheme. |

| 13th April | GSTR-1 IFF | Mar 2023 | GSTR-1 ‘Invoice Furnishing Facility’ under QRMP Scheme. |

| 13th April | GSTR-6 | Mar 2023 | GST Return for ITC received and distributed by an Input Service Distributor (ISD). |

| 18th April | CMP-08 | Jan 2023 – Mar 2023 | Quarterly Statement for payment of self-assessed tax by composition taxpayers |

| 20th April | GSTR-3B | Mar 2023 | GST monthly return to pay tax for the preceding month. |

| 20th April | GSTR-5 | Mar 2023 | GST Return for Non-resident foreign taxpayers |

| 20th April | GSTR-5A | Mar 2023 | GST Return OIDAR service provider. |

| 24th April | GSTR-3B | Jan 2023 – Mar 2023 | Summary of outward supplies, ITC claimed, and tax payable by taxpayers who have opted for the QRMP scheme and registered in specified states and UT. |

| 24th April | GSTR-3B | Jan 2023 – Mar2023 | Summary of outward supplies, ITC claimed, and tax payable by taxpayers who have opted for the QRMP scheme and registered in specified states and UT. |

| 25th April | ITC-04 | Oct 2022 – Mar 2023 | Details of Goods dispatched to a job worker or Received from a job worker or Sent from one job worker to another. Those with an annual aggregate turnover of more than Rs.5 crore |

| 25th April | ITC-04 | Apr 2022 – Mar 2023 | Details of Goods dispatched to a job worker or Received from a job worker or Sent from one job worker to another. Those with an annual aggregate turnover of upto Rs.5 crore |

| 30th April | GSTR-4 | Apr 2022 – Mar 2023 | Taxpayer opting for the Composition Scheme is required to file GSTR-4. |

GST Compliance Calendar for March 2023

Here is the comprehensive GST Compliance Calendar for March 2023. This guide contains all the GST due dates for March 2023 so you won’t miss a thing!

| DATE | RETURN | PERIOD | DESCRIPTION |

| 10th March | GSTR-7 | Feb 2023 | Summary of Tax Deducted at source (TDS) and deposited under GST laws. |

| 10th March | GSTR-8 | Feb 2023 | Summary of Tax collected at source (TCS) by e-commerce operators. |

| 11th March | GSTR-1 | Feb 2023 | GST Monthly return for registered persons having turnover of more than Rs.5 crores or who doesn’t opt for QRMP scheme. |

| 13th March | GSTR-1 IFF | Jan-Mar 2023 | GSTR-1 ‘Invoice Furnishing Facility’ under QRMP Scheme. |

| 13th March | GSTR-6 | Feb 2023 | GST Return for ITC received and distributed by an Input Service Distributor (ISD). |

| 20th March | GSTR-3B | Feb 2023 | GST monthly return to pay tax for the preceding month. |

| 20th March | GSTR-5 | Feb 2023 | GST Return for Non-resident foreign taxpayers. |

| 20th March | GSTR-5A | Feb 2023 | GST Return OIDAR service provider. |

| 25th March | PMT-06 | Feb 2023 | GST Challan Payment if no sufficient ITC for February |

GST Compliance Calendar for February 2023

Here is the comprehensive GST Compliance Calendar for February 2023. This guide contains all the GST due dates for February 2023 so you won’t miss a thing!

| DATE | RETURN | PERIOD | DESCRIPTION |

| 10th February | GSTR-7 | Jan 2023 | Summary of Tax Deducted at source (TDS) and deposited under GST laws. |

| 10th February | GSTR-8 | Jan 2023 | Summary of Tax collected at source (TCS) by e-commerce operators. |

| 11th February | GSTR-1 | Jan 2023 | GST Monthly return for registered persons having turnover of more than Rs.5 crores or who doesn’t opt for QRMP scheme. |

| 13th February | GSTR-1 IFF | Jan-Mar 2023 | GSTR-1 ‘Invoice Furnishing Facility’ under QRMP Scheme. |

| 13th February | GSTR-6 | Jan 2023 | GST Return for ITC received and distributed by an Input Service Distributor (ISD). |

| 20th February | GSTR-3B | Jan 2023 | GST monthly return to pay tax for the preceding month. |

| 20th February | GSTR-5 | Jan 2023 | GST Return for Non-resident foreign taxpayers |

| 20th February | GSTR-5A | Jan 2023 | GST Return OIDAR service provider. |

| 25th February | PMT-06 | Jan 2023 | GST Challan Payment if no sufficient ITC for January |

GST Compliance Calendar for January 2023

Now, let us look at the GST Compliance Calendar for January 2023; here is a comprehensive image of our GST Compliance Calendar. It has all the GST Due dates for January 2023 so that you never miss a due date!

| DATE | RETURN | PERIOD | DESCRIPTION |

| 10th January | GSTR-7 | DEC 2022 | Summary of Tax Deducted at source (TDS) and deposited under GST laws. |

| 10th January | GSTR-8 | DEC 2022 | Summary of Tax collected at source (TCS) by e-commerce operators. |

| 11th January | GSTR-1 | DEC 202 | GST Monthly return for registered persons having turnover of more than Rs.5 crores or who doesn’t opt for QRMP scheme. |

| 13th January | GSTR-1 IFF | OCT-DEC 2022 | GSTR-1 ‘Invoice Furnishing Facility’ under QRMP Scheme. |

| 13th January | GSTR-6 | DEC 2022 | GST Return for ITC received and distributed by an Input Service Distributor (ISD). |

| 18th January | CMP-08 | OCT-DEC 2022 | Quarterly Statement for payment of self-assessed tax by composition taxpayers. |

| 20th January | GSTR-3B | DEC 2022 | GST monthly return to pay tax for the preceding month. |

| 20th January | GSTR-5 | DEC 2022 | GST Return for Non-resident foreign taxpayers. |

| 20th January | GSTR-5A | DEC 2022 | GST Return OIDAR service provider. |

| 22nd January | GSTR-3B | OCT-DEC 2022 | Summary of outward supplies, ITC claimed, and tax payable by taxpayers who have opted for the QRMP scheme and registered in specified states and UT. |

| 24th January | GSTR-3B | OCT-DEC 2022 | Summary of outward supplies, ITC claimed, and tax payable by taxpayers who have opted for the QRMP scheme and registered in specified states and UT. |

*Specified State and UT List for GSTR-3B Quarterly Filers

Here is the list of States and UTs for quarterly GSTR-3B filers to determine the exact due date to file GSTR-3B.

| State and UT Who Needs to File GSTR-3B on 22nd | State and UT Who Needs to File GSTR-3B on 24th |

| Chhattisgarh | Himachal Pradesh |

| Madhya Pradesh | Punjab |

| Gujarat | Uttarakhand |

| Maharashtra | Haryana |

| Karnataka | Rajasthan |

| Goa | Uttar Pradesh |

| Kerala | Bihar |

| Tamil Nadu | Sikkim |

| Telangana | Arunachal Pradesh |

| Andhra Pradesh | Nagaland |

| Dadra and Nagar Haveli | Manipur |

| Puducherry | Mizoram |

| Andaman and Nicobar Islands | Tripura |

| Lakshadweep | Meghalaya |

| Daman and Diu | Assam |

| West Bengal | |

| Jharkhand | |

| Odisha | |

| Jammu and Kashmir | |

| Ladakh | |

| Chandigarh | |

| New Delhi |