GST and Revolutionizing Technology

The average person is unfamiliar with the concepts of taxation and technology. The handling of goods and services tax is so detailed and logical that it appears to be a difficult task to comply with it through technology. But, as in any other field, technology has also advanced and made its way into GST. Binary Semantics, a leading name in the field of seamlessly connecting the Goods and Services Tax (GST) system with cutting-edge technology to make GST compliance simple and quick, explains the deep connection between GST and Revolutionizing Technology.

The GST Act was enacted to simplify and unify the system of indirect taxation. Compliance has become inconvenient with this goal in mind. It has, on the other hand, attempted to digitalize, connect, and logicalize it. In this context, it is critical to emphasise the word “digital.” As a tax system, the GST system has been the most digital in India. It has made efforts to be fully digital, from initial registration to monthly compliance.

The Government & GST-Technology

The government has attempted to select the best system that allows for quick compliance, but there have been setbacks along the way. The policy transition from a manual to a technology-driven, coherent, and solitary GST framework has been positive. Various advantages have emerged as a result of the adoption of technology by both businesses and governments. The tax authorities now have access to a wealth of relevant data that can be used to detect potential tax evasion. Because of technological advancements, businesses can now gain deep insights into input tax credit leakages, automate compliances, conduct data analytics, and eliminate working capital challenges. As a result, informed gaps decisions were made, and corrective measures to mitigate financial loss were put in place.

The Business & GST-Technology

The industry had ridiculed and argued that GST had been “over-digitalized,” but digitalization has made many businesses’ lives much easier over the years. There is no need to go to the tax office and deal with the officials, and there are no lines and lengthy paperwork requirements; everything and every step has been integrated with technology.

It has undoubtedly increased the frequency and burdensomeness of compliance, but complying with a few clicks every month is far superior to physically going every year. Nonetheless, notable businesses struggle to navigate the GST compliance system correctly. After all, the incorporation of technology has not been so sweet.

Small businesses have demonstrated a lack of comprehension. This has resulted in a high reliance on GST Professionals, raising business costs. So returning to manual processing is not a wise decision. Still, a simple and all-in-one software can be designed to assist these businesses in complying with GST-Technology with their understandable technology.

The Professionals & GST-Technology

Through the GST compliance channel, Chartered Accountants, Tax Lawyers, Cost Accountants, and Tax Preparers have discovered a new source of income. All existing and newly added clients have a high demand for GST assistance because the technology displayed by the government has been challenging to adopt and incorporate into daily operations.

On the other hand, professionals face numerous challenges when providing GST services to their clients because it is primarily a monthly compliance issue, and a lack of a better system will cause havoc on the last day of the due date. To eliminate these issues, professionals will need revolutionary technology that will allow them to manage all of their clients’ GST compliances and carry them out quickly, accurately, and timely manner.

The GST Act & GST-Technology

This is the normal channel that takes place the most in the industry, but this channel can be integrated with technology at its important nodes like:

- Invoicing

- ITC Reconciliation

- E-way Bill

- Compliance

Invoicing

GST has its own set of rules and regulations regarding invoice structure and issuance. It is essential because it will only allow the purchaser to claim ITC if an authentic invoice is issued. E-invoicing is a well-known rule that has been imposed on businesses. The threshold limit for this E-invoicing has recently been reduced to Rs. 10 Crore and will almost certainly be reduced further.

It is critical to use automated, technologically sound software to assist you in complying with this new applicable E-invoicing rule. E-invoicing and the use of technology to comply with it will be unavoidable as the government plans to bring every business under the E-invoicing rule, with severe consequences if this rule is not followed.

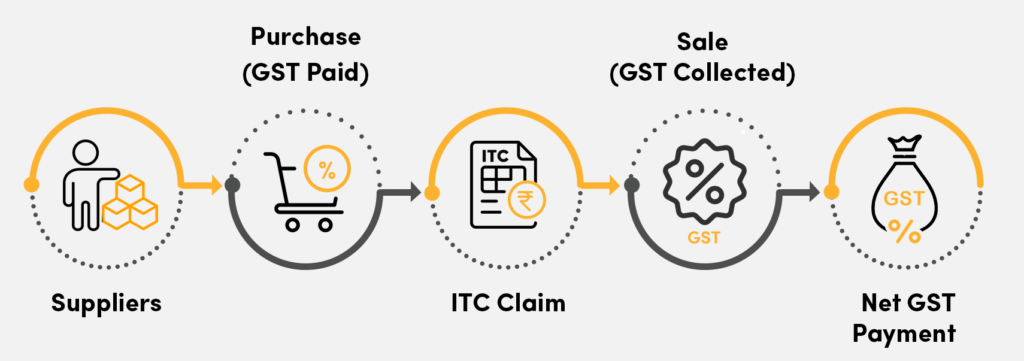

ITC Reconciliation

The best and worst aspects of GST are the Input Tax Credit (ITC) and the near-monthly reconciliation. Matching GSTR-2A and GSTR-2B records to claim a precise amount of ITC in GSTR-3B is time-consuming. The automation factor that technology brings to the table will reduce the time-consuming task of reconciliation to a few minutes, leaving the user to focus on the critical study of decision-making.

It’s also exhausting to keep track of whether the company’s suppliers have uploaded their GSTR-1 correctly so that it can be auto-populated in the company’s GSTR-2A. The advantage of technology is that timely reminders and information about the entities can be sent to all such suppliers.

E-Way Bill

Rule 138 of the CGST Rules, 2017 governs the concept of an E-way bill, which describes the detailed process of issuing an e-way bill as well as its significance. Along with e-way bills, the transporter must have a radio-frequency identification (RFID) tag attached to his or her vehicle. As a result, every time a vehicle passes by an RFID tag reader on the highway, the data fed into the device is uploaded to the government portal. Pen and paper will not suffice to manage this system. To make the compliance process go more smoothly, live tracking technology and technology that understands E-way bills will be used.

Compliance

The entire GST compliance channel can be managed via a single login software, making compliance extremely simple and quick. Tasks such as record maintenance, data integration, tax payment, and return uploading are all possible. GST technology can assist businesses by reminding them of the due date, allowing data integration, and facilitating tax payments.

Advantages

● Technology-driven software designed to assist businesses in complying with GST will be a cloud-based system, which means that access from anywhere is possible. Almost all web-based applications operate in the cloud. This means you can access your system and data from any device with an internet connection, including smartphones and tablets.

● Restaurants, IT, education, and service-based businesses are subject to VAT and service taxes. These service-based industries are responsible for the time-consuming task of calculating taxes based on transactions and various items with different rates. GST software simplifies invoicing by automatically calculating all taxes.

● There is no room for error when billing and invoicing are automated. By incorporating GST Technology, you can easily avoid mistakes and miscalculations that can harm your business.

● GST technology-led software will assist you in saving a significant amount of money because a regular staff member can easily understand and carry out the compliance, saving you a hefty fee for your GST professional.

● You can disregard inventory and supply logistics, money, and profit. GST billing software that is simple to use and will help small and large businesses increase efficiency by leaps and bounds is now available. It is not simply a matter of creating invoices. It is all about having complete control over your business. This will allow you to concentrate on your business while managing your cash flow.

● The use of technology in the GST compliance system will allow the system to be both accurate and fast. Unusual transactions and fraud-like situations can easily be reported to the government.

● GST software automates tax and other rate computations based on business processes. GST can be customised to meet the needs of the user’s business. There could be manufacturing flaws or defects, as well as additional taxes on goods and services. GST software is designed in such a way that it precisely addresses all tax penalties.

● You can instantly generate and share account statements with clients, view customer-specific accounts receivables, and overdue invoices, and send payment reminders with payment links. Create supplier account statements that include the details of the purchases, payments made, and payable.

Disadvantages

● Despite the fact that cloud-based technology’s security measures have advanced, with many claiming the cloud is safer than the alternative, there are still some security concerns. GST data is private and should be kept secure.

● Connectivity issues are a significant concern when carrying out compliance via specialized software. It might not allow offline access, and the non-availability of online connectivity can delay your GST compliance process.

Conclusion on GST-Technology

The goods and services tax system are highly integrated and compliant online. It is also one of the most widely used tax systems, with approximately 2-4 returns filed monthly. With this compliance burden, the process must be carried out using technology and automation.

GST has been inextricably linked with technology since its inception, and technology, whether it be government websites or private GST software, has advanced and improved significantly over the years. Approximately 75-80% of compliance tasks can be automated or completed with a few mouse clicks.