Everything About E-Invoice Schema

As per the recent mandate, every taxpayer whose aggregate turnover exceeds INR 20 Crores and who deals in B2B and export supplies in any preceding financial year from 2017-18 onwards needs to implement e-invoicing from April 1, 2022. In other words, the taxpayer who is covered in this mandate needs to generate an e-invoice as per the prescribed format i.e. Schema. So, in this blog, we will cover everything about e-invoice schema.

What is E-invoice Schema?

In general, schema means structured format or template. So, e-invoice schema means a structured format for e-invoice. CBIC notified the e-invoice schema as GST INV-01. The taxpayer needs to upload the schema in JSON format on the IRP.

Why E-Invoice Schema Was Implemented?

As we already know that e-invoice schema acts as a uniform standard for reporting the generated e-invoice to IRP. E-invoice schema was implemented by the CBIC

- To address the machine readability issue

- To ensure inter-operability

- To eliminate the transcription errors

E-Invoice Schema Content

Broadly, there are 12 sections and 6 annexures in the e-invoice schema that can be differentiated in:

Mandatory Sections and Annexures

The taxpayer needs to compulsorily fill the data in these fields. As per the latest update in the e-invoice schema, only 5 sections and 2 annexures are mandatory.

List of mandatory sections

- Basic detail of the taxpayer

- Information about the supplier

- Information about the recipient

- Item details

- Total documents

List of mandatory annexures

- Detail of items

- Total detail of documents

Optional Sections and Annexures

The taxpayer may or may not enter the data in these fields. The remaining 7 sections and 4 annexures are optional.

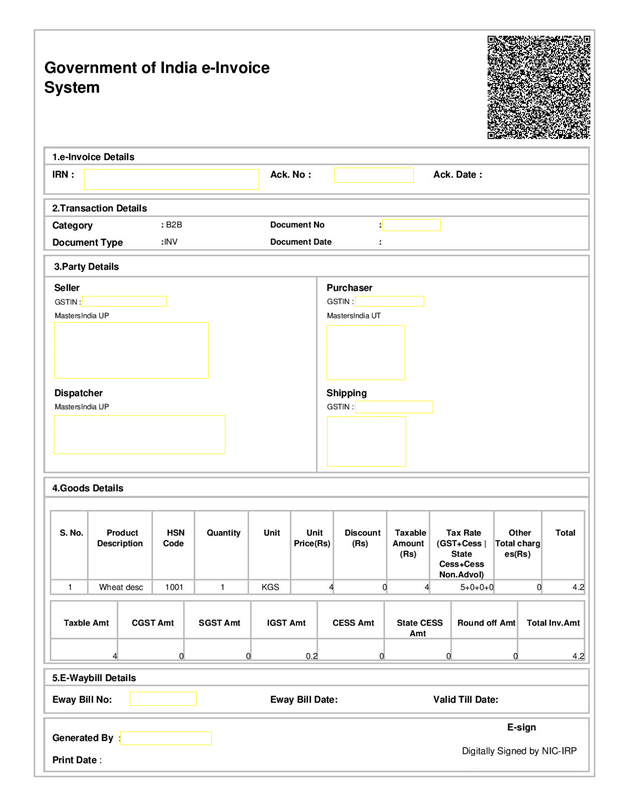

E-Invoice Format

Here is the basic format of an e-invoice:

- Header: Details about Invoice Number, Invoice Date, Supplier, Recipient, Invoice Reference Number (IRN)

- Transaction: This section contains information about the type of transaction (B2B or export).

- Document: This section contains details about the documents such as Type of Document, Number, Date, etc.

- Seller: This section contains information about the seller such as GSTIN, Tradename, Address, etc.

- Buyer: This section contains information about the buyer such as GSTIN, Tradename, Address, etc.

- Dispatch-to: This section contains dispatch details.

- Ship-to: This section contains ship-to details.

- Line Item: This section contains information about the invoice line items.

- Document summary: This section contains information about the total values of the documents uploaded.

- Payment Information: This section contain payment details and other terms & conditions about the payment.

- Reference Details: This section contains various details about references related to the invoice.

E-Invoice Template

Here is a sample template of an e-invoice: