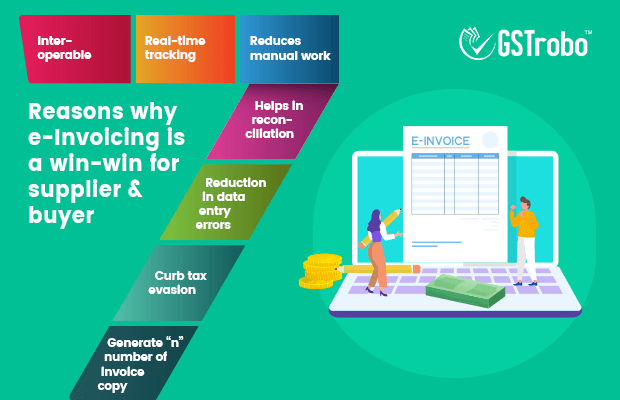

7 Reasons why E-Invoicing is a win-win for Supplier and Buyer

From April 1, 2022, every taxpayer whose turnover exceeds INR 20 Crores needs to generate e-invoices for their B2B supplies and exports. However, the main concern is whether e-invoicing is a win-win solution for the suppliers, buyers, and government? Let us unravel the truth.

WHAT IS E-INVOICING?

Currently, most of the businesses create and manage their invoices using ERP solution or accounting/billing software. However, under e-invoicing, the generation process remains the same. But the generated invoices need to be in a standard format, also called schema. Once generated, these invoices are sent to the Invoice Registration Portal (IRP) wherein every invoice gets a unique Invoice Reference Number (IRN) and QR code. This process is called ‘e-invoicing’.

Note: An invoice issued without obtaining IRN will be considered null and void.

FEATURES OF E-INVOICING

1. INTER-OPERABLE

As we already know, under e-invoicing there is a standard format (Schema) for generating an invoice. This will ensure that the invoice generated from one system can be easily read by other software; hence, promoting the interoperability of invoices.

2. REAL-TIME TRACKING

Under the e-invoicing system, a supplier can easily track the invoices on a real-time basis. This in turn will help the taxpayer to claim Input Tax Credit (ITC) faster.

3. REDUCES MANUAL WORK

Under the e-invoicing system, some of the invoice level data fetched from IRP auto-populates in the GSTR-1 and e-way bill. Thus, reducing the manual work of the taxpayer or e-way bill generator.

4. HELPS IN RECONCILIATION

Once the e-Invoice is uploaded on the IRP for authentication, it is auto-shared with the buyer on his/her mentioned e-mail ID. This helps the buyer to reconcile the e-invoice and purchase order. Not only this, the buyer can accept or reject the e-invoice generated by the supplier on a real-time basis.

5. REDUCTION IN DATA ENTRY ERRORS

As we already know that invoice level data will be fetched by the GST portal and e-way bill portal on a real-time basis. This will help in reducing the need for manual data entry, thus, eliminating the errors.

6. CURB TAX EVASION

Real-time access to invoice-level data by both supplier and recipient will curb tax evasion by a visible margin. As the government authorities will have ITC and output tax details, the government official will be able to track fake input credit.

7. GENERATE “N” NUMBER OF INVOICE COPY

There are times when we misplace documents or invoices, in such a case, a QR code will prove to be a great help as by scanning this the taxpayer would be able to generate “n” number of invoice copies.

CONCLUSION

E-invoicing seems to be another layer of compliance for taxpayers. Yet, a closer look shows it is a step towards simplifying compliance for organizations, as invoicing is an integral part of the business compliance process. So, through this, we can conclude that an e-Invoice is surely a win-win solution for the suppliers, buyers, and government.