How to Verify GSTIN of an Invoice?

The government of India introduced e-invoicing to prevent fake invoicing under GST as the details of an invoice get verified on different parameters such as duplicity of invoice data. However, a taxpayer can easily verify the GSTIN of an invoice with few simple steps.

Verify GSTIN of an Invoice

In case of a taxpayer wants to verify the GSTIN of an invoice, he/she needs to follow the below steps:

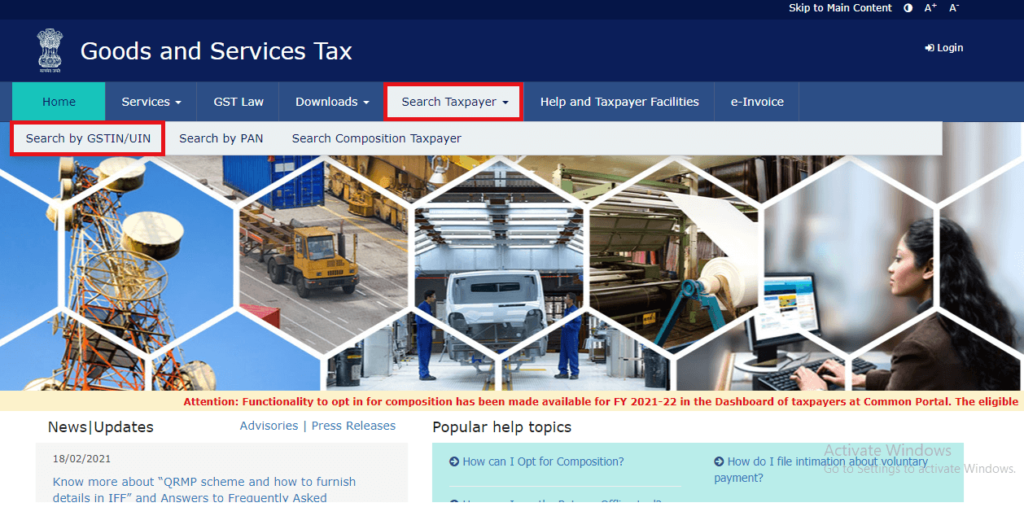

Step 1: Go to https://www.gst.gov.in

Step 2: Click on Search Taxpayer and then select Search by GSTIN/UIN.

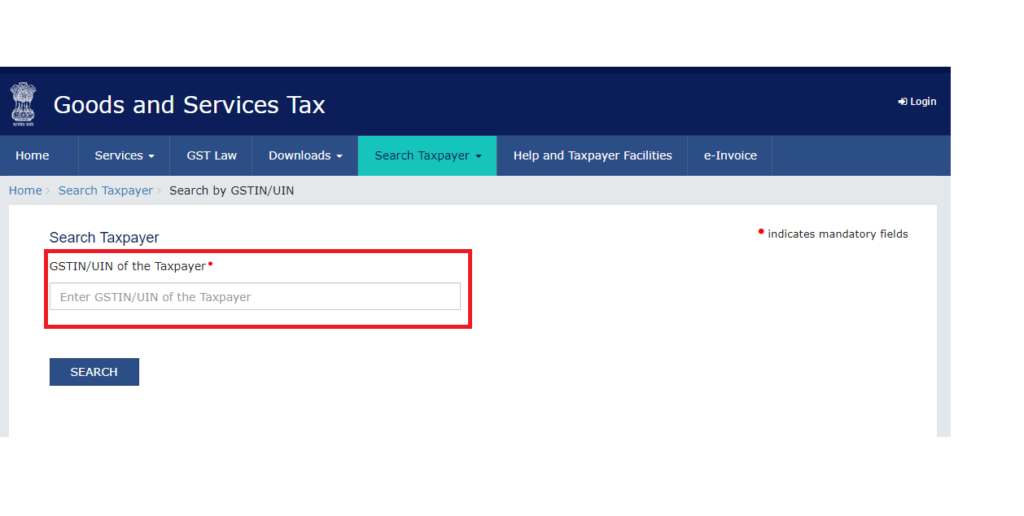

Step3: Once clicked on that button the taxpayer will get redirected to a new page wherein he/she needs to enter the GSTIN.

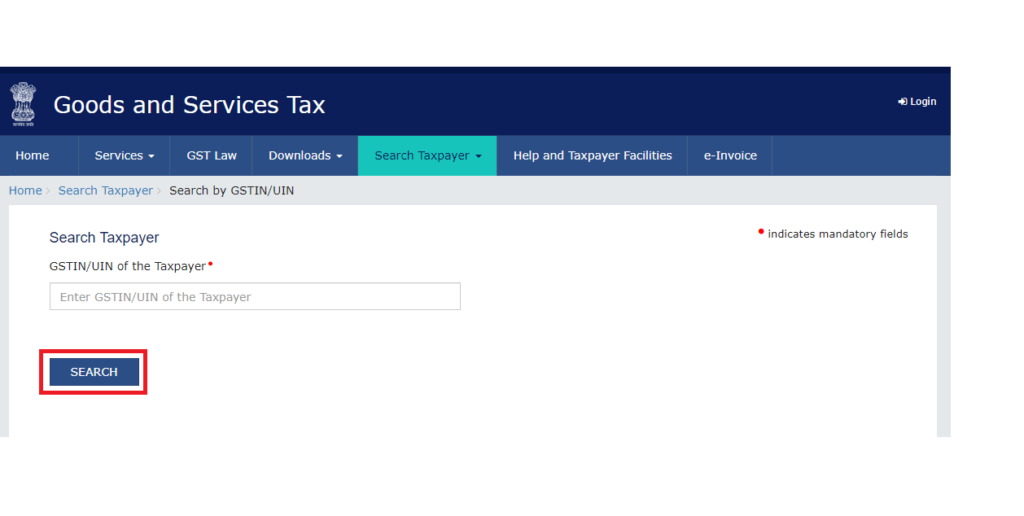

Step 4: Then the taxpayer needs to click on the Search button.

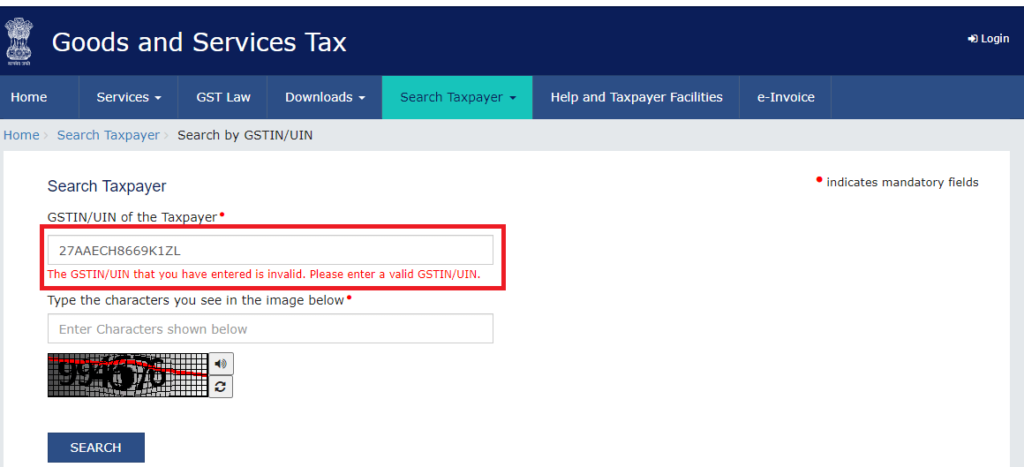

Incorrect GSTIN: In case if the GSTIN/UIN entered by the taxpayer is incorrect, a message will pop-up indicating the following error as shown in the below snippet.

Correct GSTIN: If the GSTIN/UIN is correct then in such case it will show the following details:

- Trade name and legal name of the business

- Date of GST registration

- Sate and Center Jurisdiction

- Business or taxpayer type

- GSTIN or UIN status

Check GST Rates

In case if the taxpayer wants to check the GST rate levied is correct or not, then he/she can do the same by the following steps:

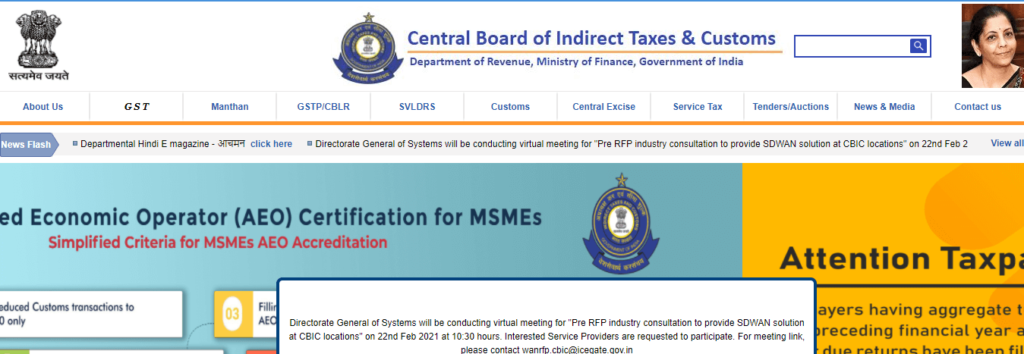

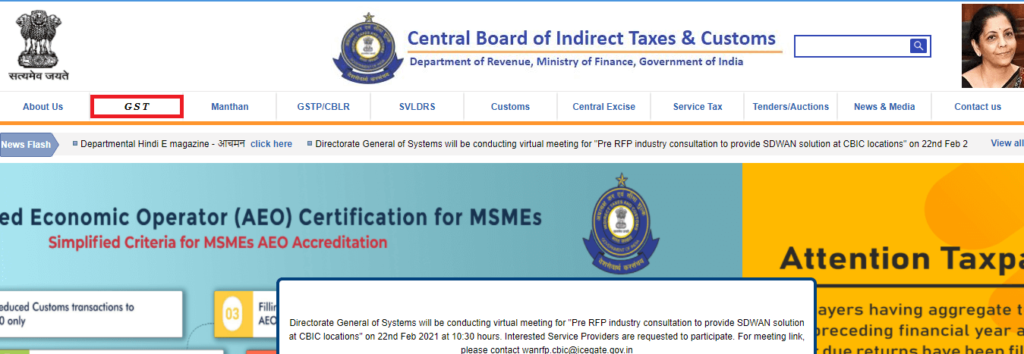

Step 1: Open the CBIC website

Step 2: Click on the GST button from the menu bar as shown in the snippet below.

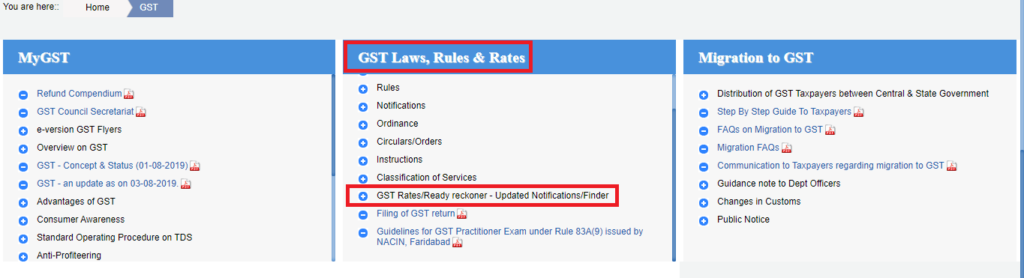

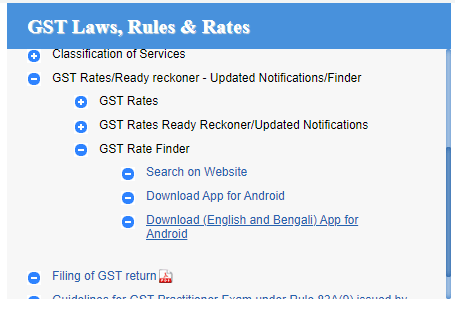

Step 3: Once the taxpayer clicks on it, he will be redirected to a new page, where he/she needs to choose GST Rates/Ready reckoner available under GST Law, Rules, and Rates.

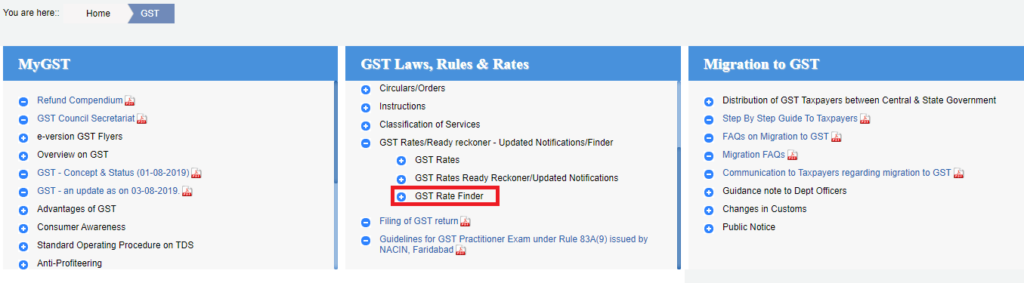

Step 4: From the given options taxpayer needs to choose the GST Rate Finder option as shown in the below image.

Step 5: The taxpayer will then get different options as shown in the snippet.

- Using the Search on Website option, the taxpayer can easily find the GST rate on the website.

- The taxpayer can also download an Application for Android to check GST rates.

- Using an HSN code search you can easily find the GST rate.