How to Pay Tax under QRMP Scheme?

On 1st January 2021, CBIC introduced QRMP Scheme for those taxpayers whose aggregate turnover was less than INR 5 Crores. As per the Quarterly Return Monthly Payment (QRMP) scheme, the eligible taxpayer can make tax payments on a monthly basis but can file GST returns monthly. Moreover, taxpayers who have opted for the QRMP scheme can also opt for IFF (Invoice Furnishing Facility) under GST. To know more about IFF under GST you can read this blog.

How to Pay Tax under QRMP Scheme?

Anyone who needs to make tax payments under the QRMP scheme can do it by furnishing challan GST PMT-06. To make payments under the QRMP scheme you need to follow the below-mentioned steps:

Step 1: Open and sign in to the GST portal.

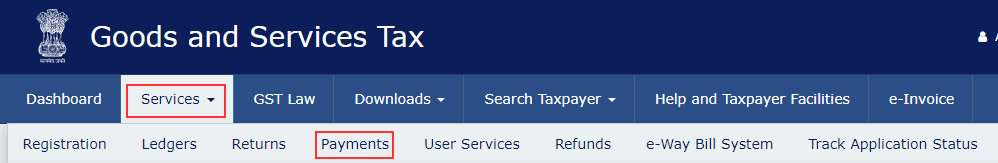

Step 2: Select the Payments option available under the Services menu.

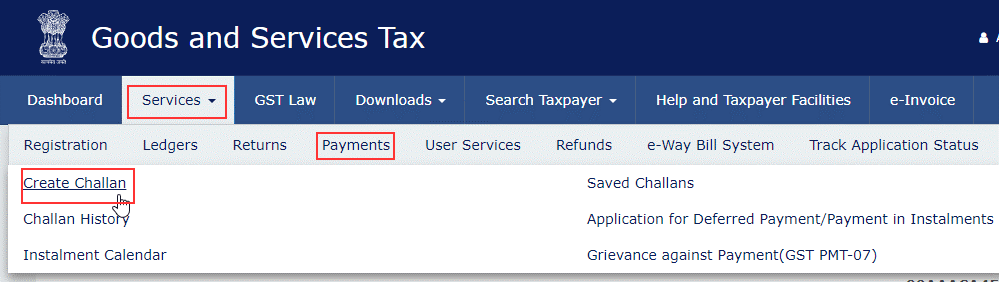

Step 3: Then click on the Payments option and select the Create Challan option available thereunder.

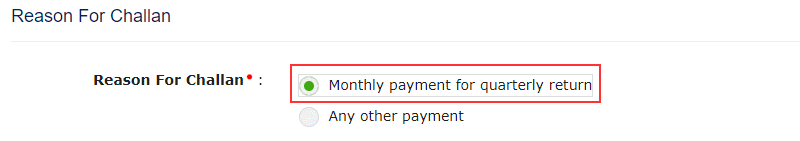

Step 4: Afterwards you need to choose the Monthly payment for the quarterly return reason.

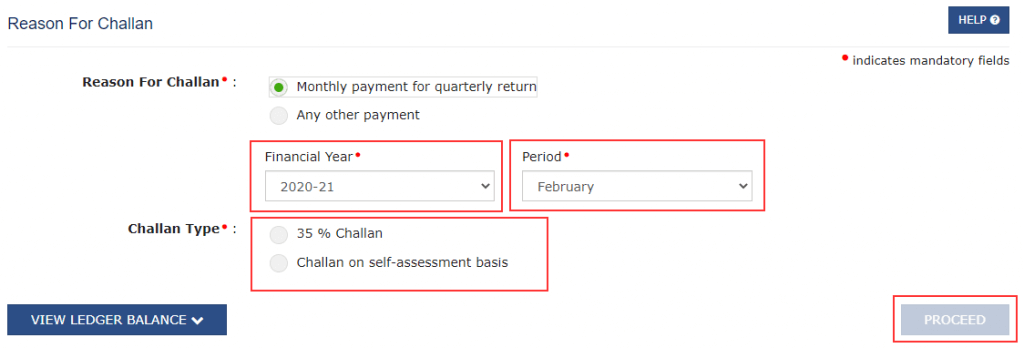

Step 5: Then you need to select the financial year, period, and challan type as discussed

- By choosing a 35% tax payment option, a taxpayer can generate a pre-populated Challan with 35% of the tax liability. This 35% liability will then be discharged from the e-cash ledger if he/she was already in QRMP Scheme during the previous tax period. If he/she was a monthly filer of GSTR-3B during the previous tax period 100% of the tax liability will be discharged from the e-cash ledger.

- By choosing the self-assessment option a taxpayer can self-assess his current month’s liability and generate a Challan for the same.

Step 6: Once you select the challan type, your challan will get auto-generated and the tax amount will get automatically calculated based on the previous months GSTR-3B.

Step 7: Then you just need to make the tax payment under the QRMP scheme. However, it shall be noted that in case if there is a sufficient balance in your e-cash or e-credit ledger, it will get deducted against the tax payment.