How to Opt-In for Composition Scheme for FY 2021-22?

You can easily get rid of tedious tasks and compliance under GST by registering for the GST composition scheme for FY 2021-22. However, by opting for a composition scheme you would not be able to claim ITC.

GST Rate Applicable for Composition Dealer

Here is the list of GST rate applicable on different composition scheme holder:

| Business Type | CGST | SGST |

| Manufacturers and Traders | 0.50% | 0.50% |

| Restaurants Excluding those service alcohol | 2.50% | 2.50% |

| Any other service provider | 3.00% | 3.00% |

How to Opt-In for Composition Scheme for FY 2021-22?

To opt-in for the composition scheme for FY 2021-22, the taxpayer needs to furnish the CMP-02 form on or before 31st March 2021. For filing the CMP-02 form you need to follow the below-mentioned steps:

Step 1: Open and Log in to the GST Portal.

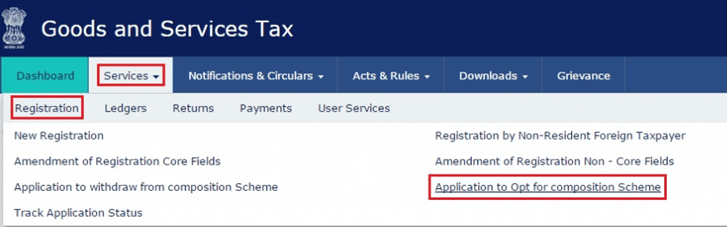

Step 2: Select the Registration option available under the Services section.

Step 3: Then select the application to Opt for composition levy as shown in the below snippet.

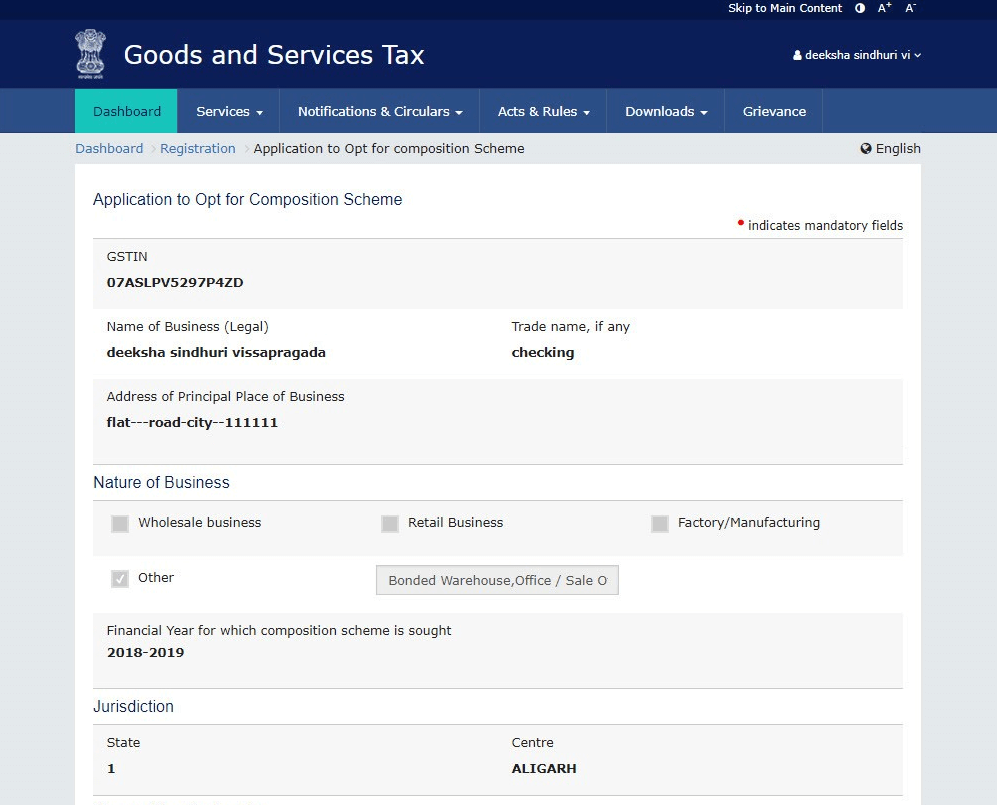

Step 4: You will be redirected to a new page wherein most of the basic details will be auto-populated such as GSTIN, Nature of Business, and Jurisdiction.

Step 5: Then you need to check the declaration box available under the Composition Declaration section, that you will follow all the conditions and restrictions applicable to the composition scheme holder in the GST Act.

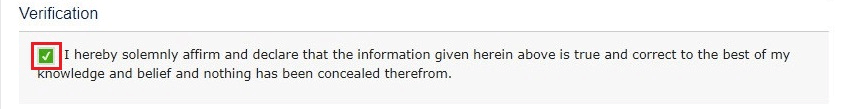

Step 6: To verify the above-mentioned information you need to click on the verification checkbox available under the Verification section.

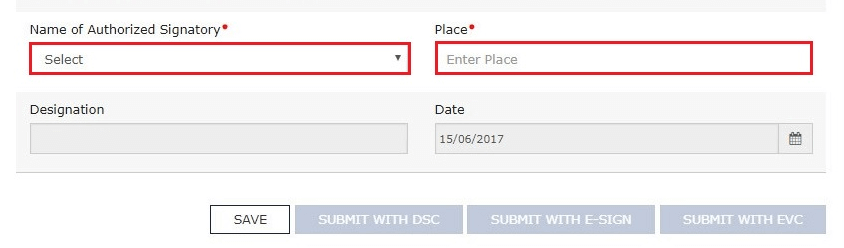

Step 7: Once you are done checking the verification checkbox you need to sign the CMP-02 form by entering the name of the authorized signatory along with the Place and designation.

Note: You will have three different options to sign the CMP-02 form:

- Submit with DSC,

- Submit with E-sign, or

- Submit with EVC

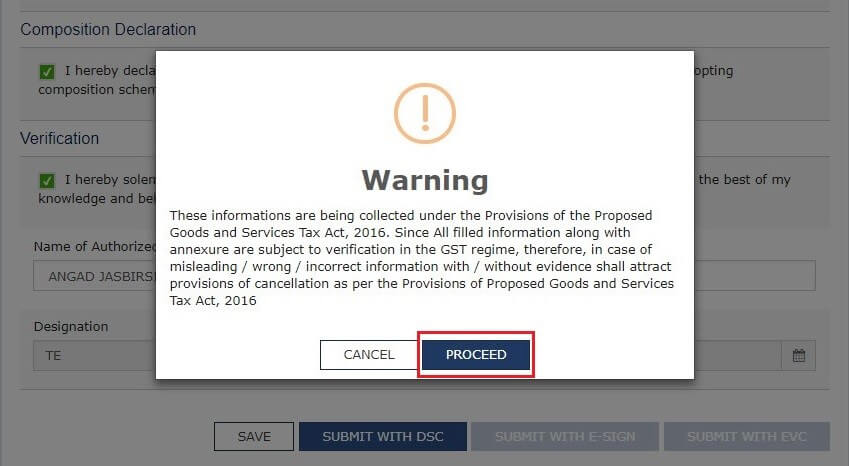

Step 8: Select any option to sign the CMP-02 form and you will get a Warning message, click on Proceed to move forward.

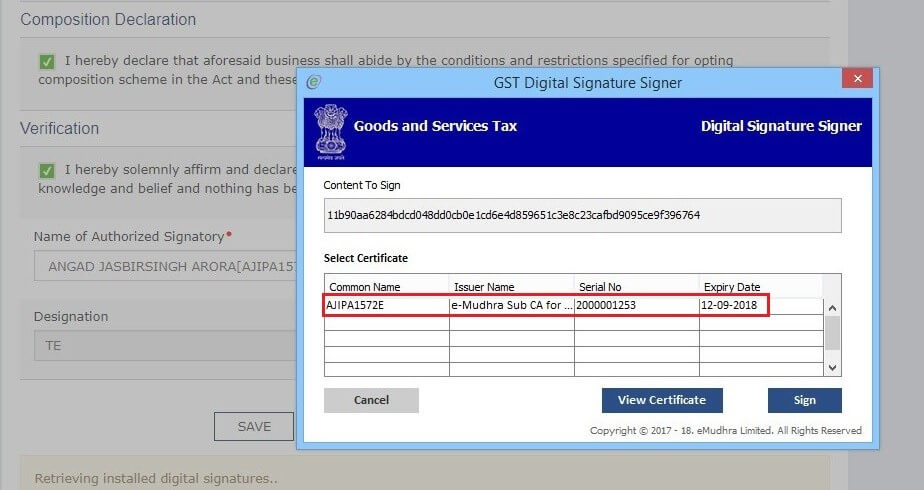

Step 9: The emSigner will then retrieve the DSCs in the system and you need to select the desired DSC.

Step 10: After you successfully sign and submit your composition registration form, your form will be validated based on the information disclosed.

Step 11: Once the data is verified an Acknowledgment Reference Number will get generated which will be issued to your registered e-mail address and mobile number.

2 Replies to “How to Opt-In for Composition Scheme for FY 2021-22?”

The facility to Opt-In for Composition Levy (Form GST CMP-02) for Financial Year 2021-22 is disabled for now.

The facility to Opt-In for Composition Levy (Form GST CMP-02) for Financial Year 2021-22 is disabled for now.