GST ITC-04- Due Date, Components and How to File ITC-04

The provisions for ITC for inputs and capital items submitted for Job Work are defined in Section 19 of the CGST Act, 2017. The principal or the registered person can claim ITC on inputs or capital items given to a job worker for Job Work.

Furthermore, if such inputs or capital items are transferred to the job worker for job work without first being transported to the principal’s place of business, the principal can claim ITC.

As a result, in Form GST ITC-04, a principal must record the specifics of the goods delivered or received from a job worker within a certain quarter. And in this blog, we will cover all the aspects related to GST ITC-04 Form.

What is GST ITC-04 Form?

In the event of job work, a registered manufacturer or a principal must make a declaration in Form GST ITC-04. GST ITC-04 should be filed by the manufacturer once per quarter in the following conditions:

- When the manufacturer sends inputs or capital goods for job work or gets it back.

- When a job worker sends inputs or capital goods to another job worker.

- When supplies are delivered straight to the customer from the job worker’s premises.

Due-Date to File GST ITC-04 Form

The due date to file Form GST ITC-04 is the 25th day of the month following the quarter for which such a Form is required by the manufacturer providing inputs or capital goods for job work. However, the Commissioner on the recommendation of the GST council can extend the GST ITC-04 due date by issuing a notification in this respect.

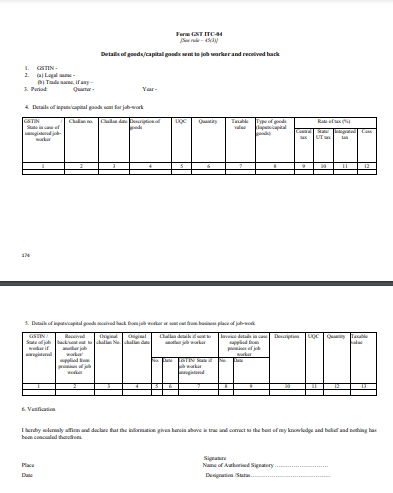

Components of GST ITC-04 Form

1. Manufacturer’s Basic Information

Section 1 – GSTIN

Section 2 – Legal Name and Trade name

Section 3 – Period

2. Inputs/capital goods sent for job work details

Section 4: Inputs/capital goods supplied for job work (includes inputs/capital goods sent straight to the job worker’s place of business/premises)

3. Information on the inputs/capital goods returned by the job worker

Section 5 – Inputs/capital products received back from job workers or sent out from the job worker’s business premises/location.

There are three parts to this section.

(A) Inputs/capital goods received back from job workers, as well as losses and waste

(B) Details of inputs/capital goods obtained back from another job workers, not from the job worker to whom such products were initially delivered for job work, as well as losses and wastes

(C) Details of inputs/capital goods sent to job workers and afterward supplied directly from job worker’s premises as well as losses and wastes

Format of GST ITC-04 Form

Step-By-Step Guide to GST Portal for Filing ITC-04

To file the GST ITC-04 Form you need to follow the steps below:

Step-1: Log in to the GST Portal with valid credentials

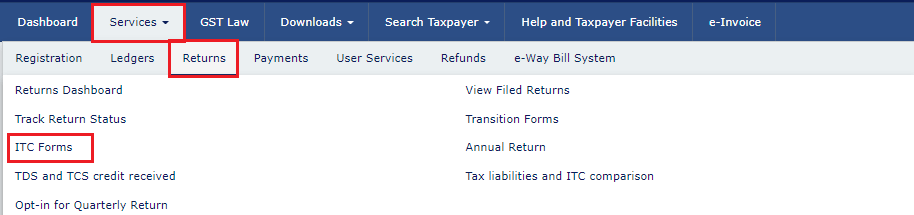

Step-2: Click the ‘Services’ tab after logging in to the site. Then, under “Services,” pick “Returns,” and then “ITC Forms” from the drop-down menu.

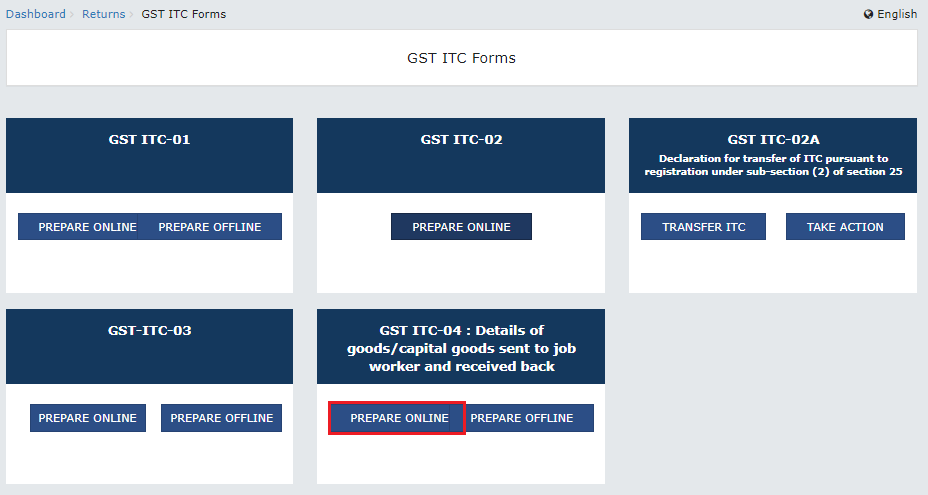

Step-3: When you click on ‘ITC Forms,’ a list of ITC Forms appears. Select the ‘Prepare Online’ option under the ‘GST ITC-04′ tile.

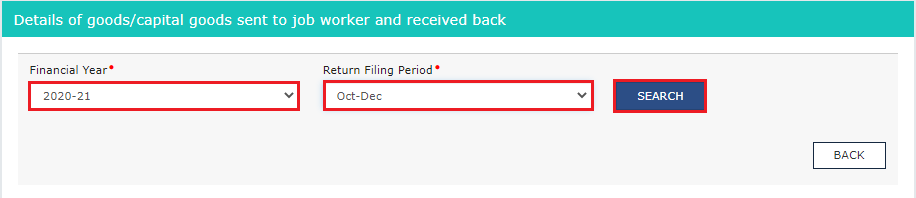

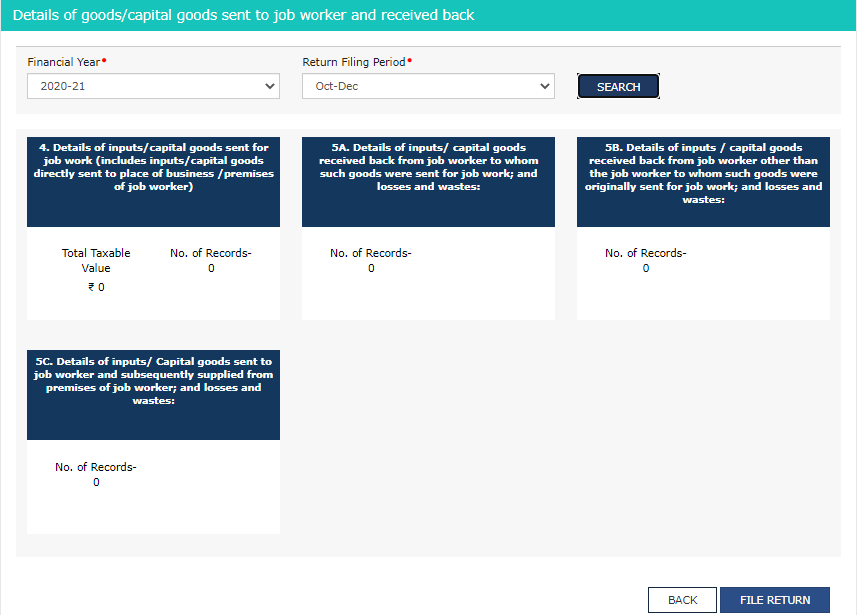

Step-4: Choose the Financial Year and Return Filing Period for which ITC-04 is required. After that, press the ‘Search’ button.

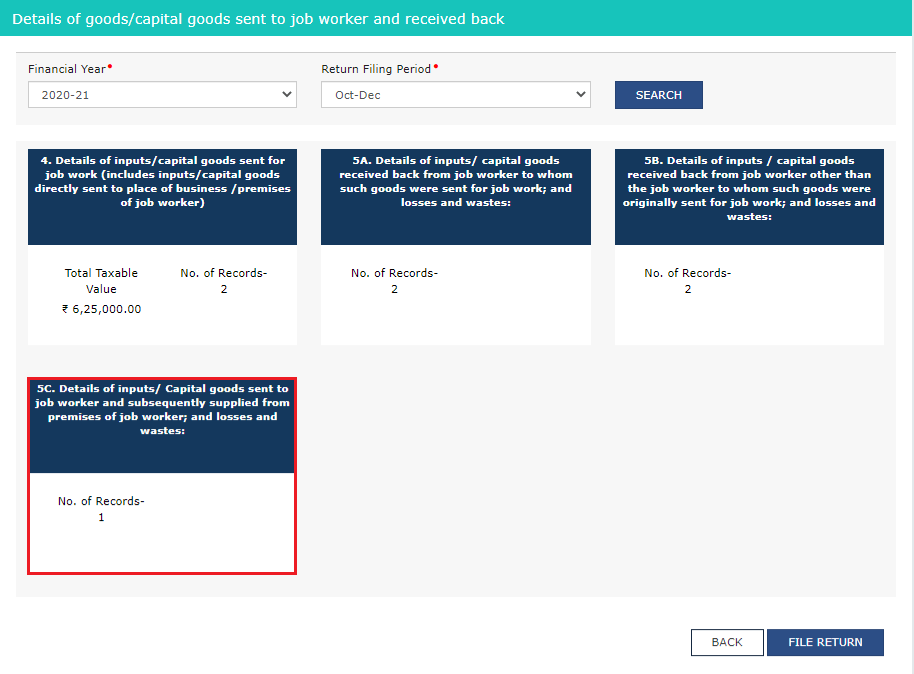

Step-5: When you click the ‘Search Button,’ many tables from Form GST ITC-04 appear. Fill details in each table.

Step-6: Once you finish filling out the data in each table, click the ‘Save’ button at the bottom of each one to save it.

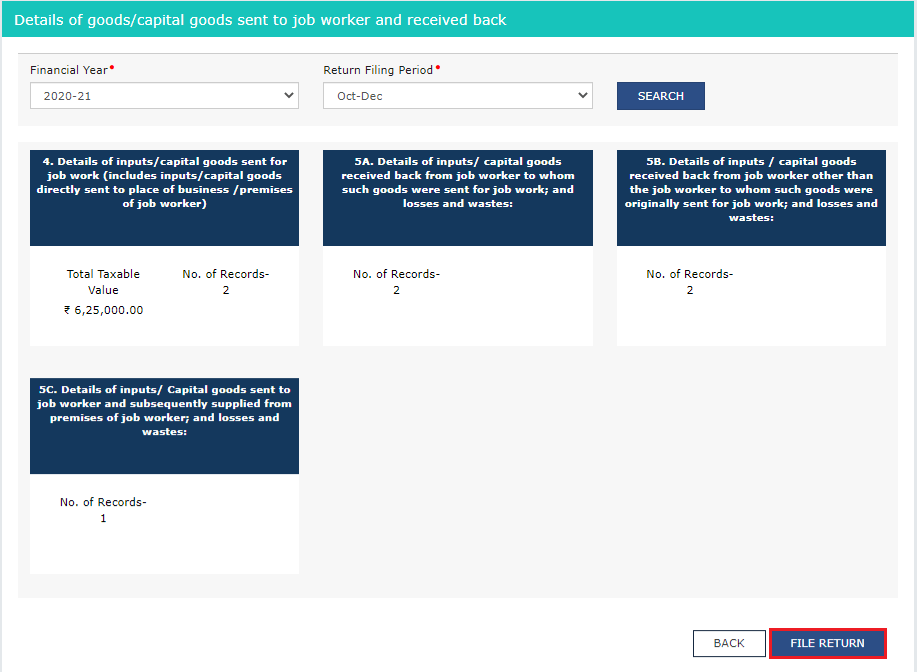

Step-7: After saving the details in each table, return to the ITC-04 tile page and click the ‘File Return’ button present on the bottom of the ITC-04 tile.

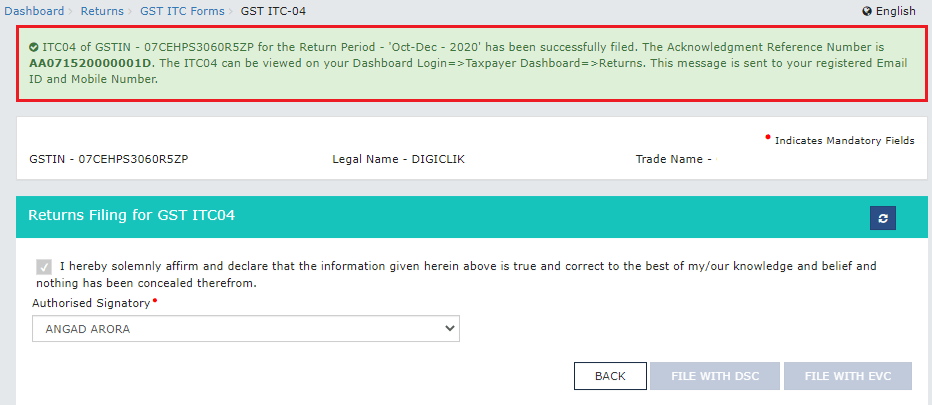

Step-8: When you click on the ‘File Return’ button, an OTP is provided to your registered number and email address.

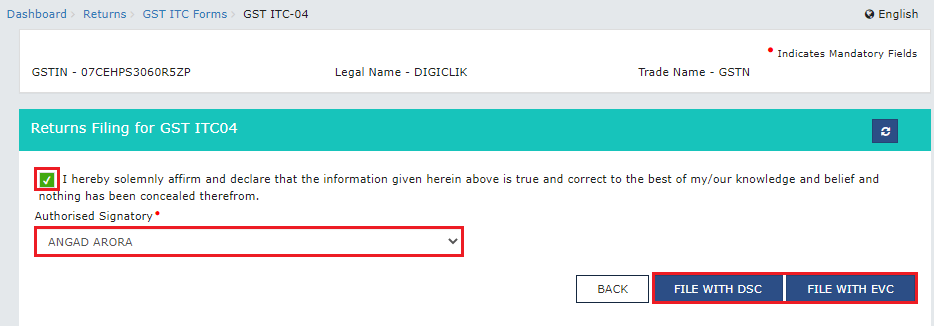

Step-9: Fill in the OTP and double-check the information. Fill out Form ITC-04 and upload your DSC or EVC.

Step 10: The ARN will be generated and the status will be changed to Filed after the Verification is finished. An e-mail and SMS will be sent to the taxpayer’s registered mobile number and e-mail address.

FAQs GST ITC-04

Q1. Is there a deadline for the principal (manufacturer) to receive them back?

Ans. Yes. The goods must be returned to the principal (manufacturer) within the following timeframe:

- In the case of capital goods, 3 years from the effective date.

- In case of input goods1 year from the effective date.

Q2. What happens if the items do not arrive within the specified time frame?

Ans. If items are not received within the above-mentioned time frame, they shall be considered supplies from the effective date. On such a deemed supply, the principal (manufacturer) will be required to pay tax. The challan issued will be considered an invoice for the supply.

Q3. Is it possible for the principal to supply the finished product straight from the job worker’s location?

Ans. The principal manufacturer can only supply items from a job worker’s place of business if he (the principal) declares that location as an additional place of business. However, the following are exempt from this rule:

- Where the job worker is registered under GST. Or

- Where the principal supplies those goods that the Commissioner has explicitly approved for sale directly from the job worker’s location.

One Reply to “GST ITC-04- Due Date, Components and How to File ITC-04”

if the goods are returned to the principal within a month. then also is it mandatory to file ITC 04?