Bulk Uploading E-invoices using Offline Tool

What is Bulk Uploading E-invoicing?

Bulk generation is a facility that is available on the IRP where invoices in bulk can be uploaded at once. It is an offline tool using which a taxpayer can bulk upload the JSON format of e-invoices.

The Objective of Bulk Uploading E-invoices using Offline Tool

The objective of this offline tool is to simplify the bulk uploading process for taxpayers, tax consultants, and software companies.

Benefits of Bulk Uploading E-invoices using Offline Tool

- Reduces time to generates multiple Invoice Reference Number (IRN) in one go.

- Avoids duplicity when duplicate invoices are uploaded.

Types of Format Available

| Parameters | Format A | Format B | Format C | Format D |

| Nature | Summarized | Summarized | Detailed | Detailed |

| No. of Worksheets | 1 | 2 | 5 | 1 |

| Details Included in the Worksheet | E-invoice details in a single sheet | E-invoice details in two sheets | 1. E-invoice details 2. Item details 3. Payment Details 4. Invoice reference details 5. E-invoice additional sheet | All the details in Format C clubbed into a single sheet |

| Type of Transactions | B2B, SEZ, Exports and Deemed Exports | B2B, SEZ, Exports and Deemed Exports | B2B, SEZ, Exports and Deemed Exports | B2B, SEZ, Exports and Deemed Exports |

Steps of Bulk Uploading E-invoices using Offline Tool

Step 1: Open the e-invoicing Portal i.e., https://einvoice1.gst.gov.in/.

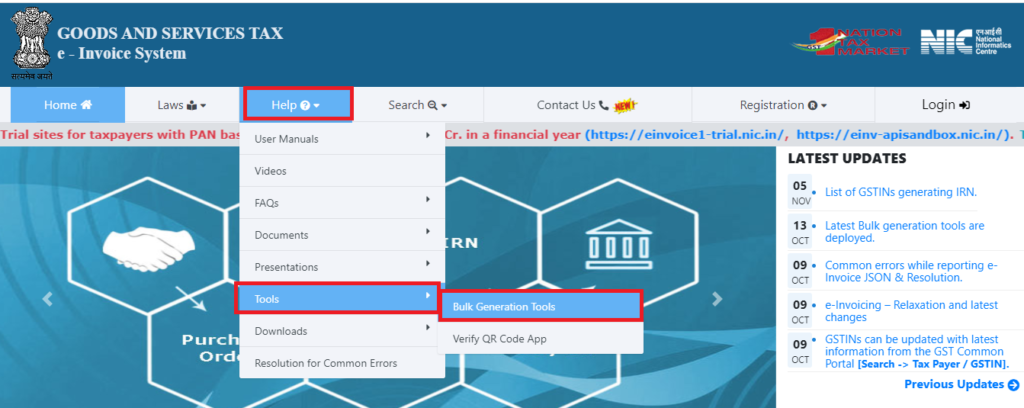

Step 2: To download the bulk e-invoice generation tool you need to click on the Help button available on the menu bar and select the tools option.

Step 3: Once you click on the bulk generation tool option, you will be redirected to a new page. On the redirected page you will be able to see four formats to bulk upload e-invoices, namely:

i. Format A

ii. Format B

iii. Format C

iv. Format D

Choose and select the format as per your requirement.

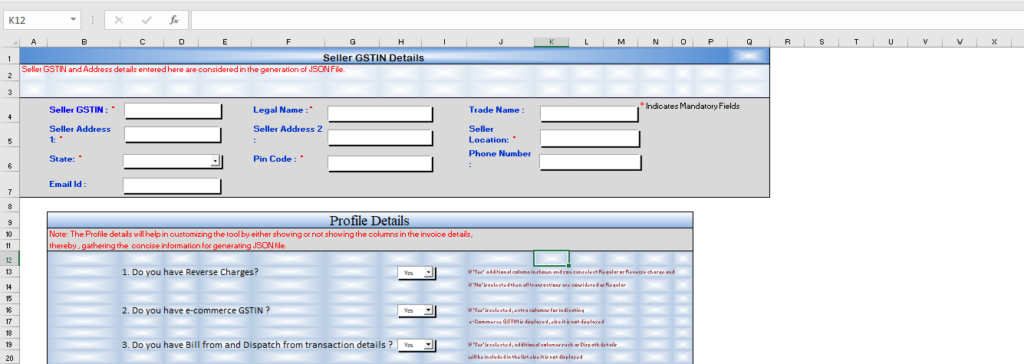

Step 4: Post downloading the applicable offline utility, enter all the basic details mentioned in the profile sheet.

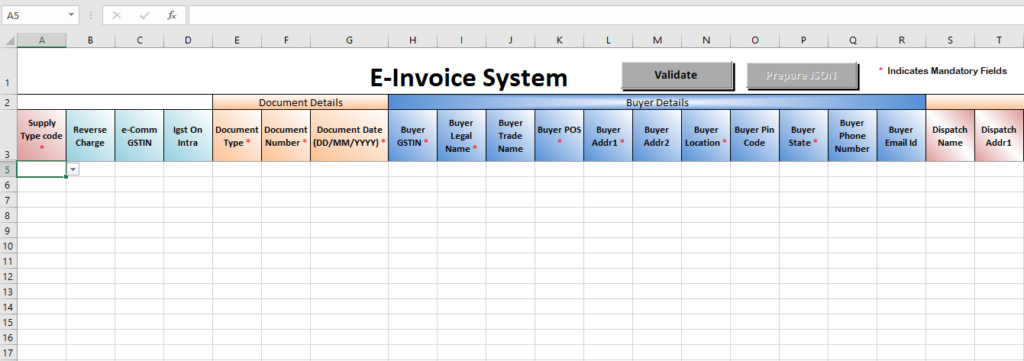

Step 5: Then enter all the invoice details in the e-invoice sheet

Note 1: You can validate the invoice details entered using the validate button to ensure that the e-invoice schema is followed.

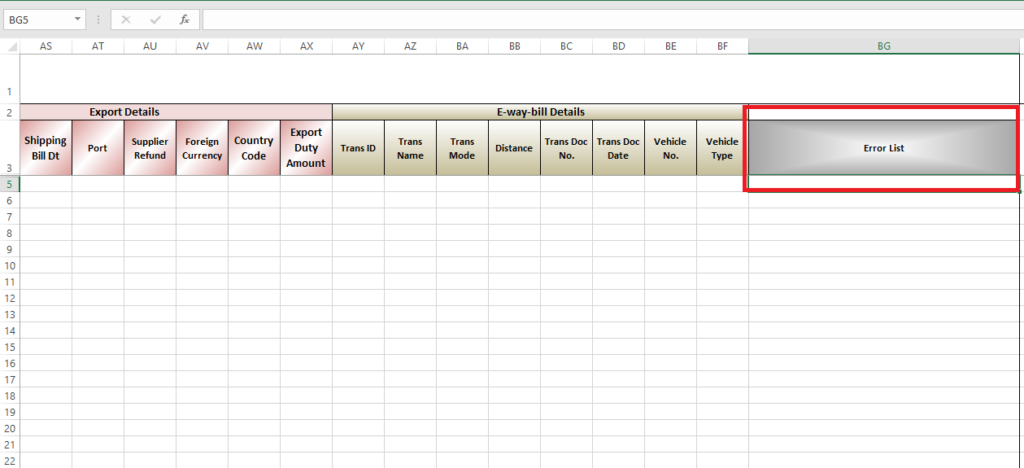

Note 2: In case if there is any error in the details, you will get an error in the error list as shown in the snippet. Then you need to rectify that error and re-validate the data.

Step 6: Once all the e-invoices details are validated, click on the prepare JSON button to create a single JSON file for multiple e-invoices details.

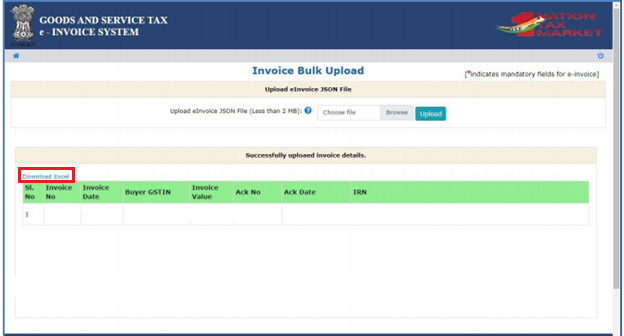

Step 7: Log in to the e-invoice portal using the valid credentials and then go to:

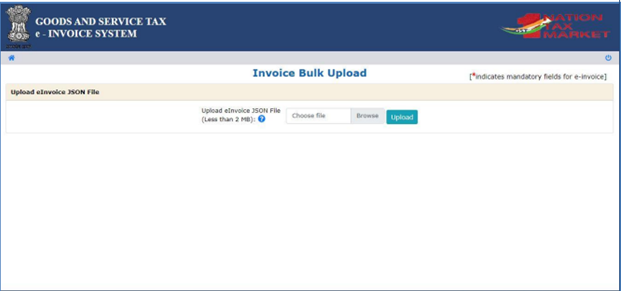

e-invoice > Bulk upload and click on the browse button.

Step 8: After choosing the JSON file, click on the upload button.

Note: Ensure that the size of the JSON file is not more than 2MB.

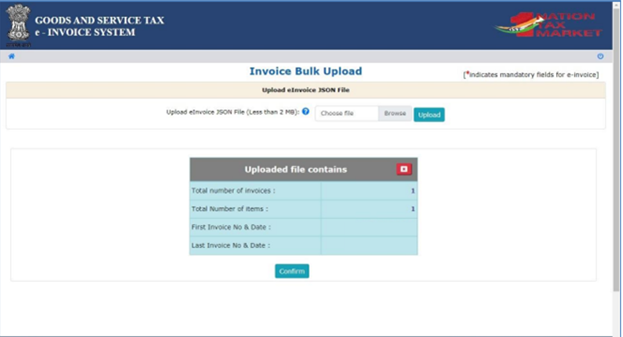

Step 9: Click on the confirm button to generate a 64-character length Invoice Reference Number (IRN) for each

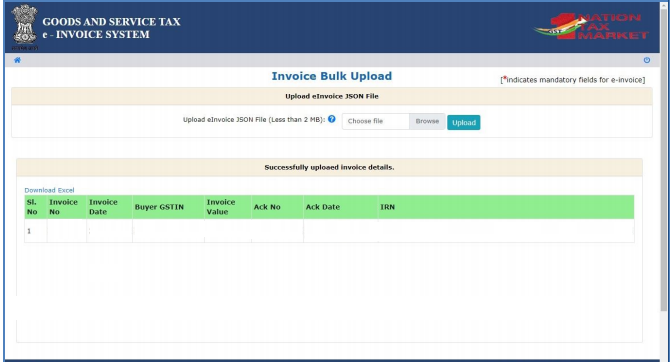

Step 10: In case if you want to download excel of the same you can download it by clicking on the download excel button.

Special Slides in the Format A, B, C & D

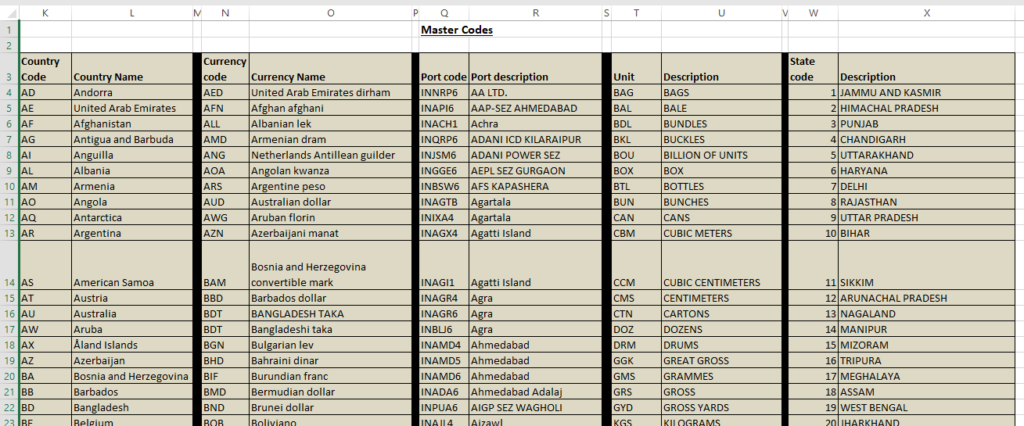

1. Master Codes Slide

This slide shows all the masters codes related to units, country, state, currency and port codes as shown in the snippet.

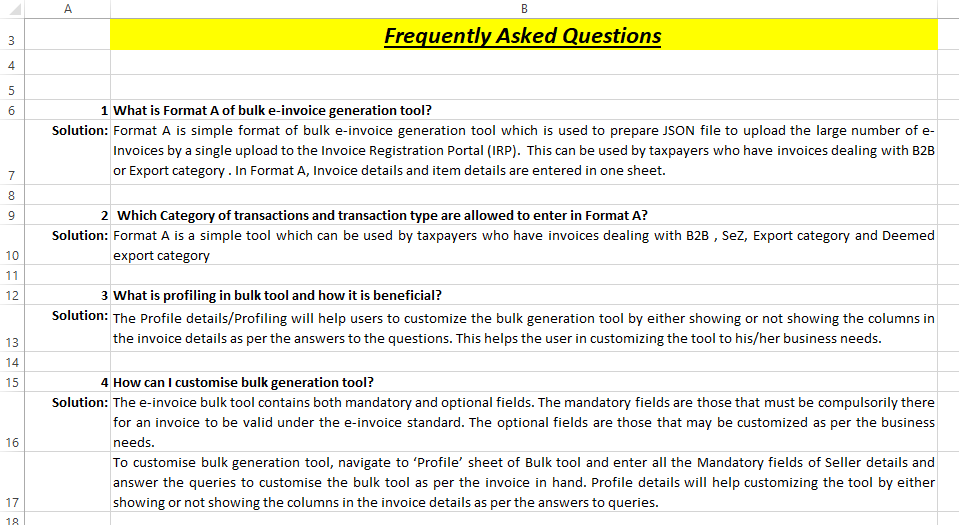

2. FAQs Slide

In this slide you will get majority of answers to your queries related to bulk generation tool.

3. Calculations Slide

This slide shows different calculations used in the format. This includes Item calculations and summation calculations.