How to Generate E-way Bill for Unregistered Buyer?

An E-way bill is an online document that is generated via an e-way bill portal for the movement of goods from one place to another. The Government of India implemented an e-way bill to minimize the illegal movement of goods and control tax evasion incidents. Usually, the supplier or transporter is responsible for generating an e-way bill but in certain circumstances, an unregistered buyer can also generate an e-way bill. So, the question is how to generate an e-way bill for an unregistered buyer?

Circumstances for E-Way Bill Generation by Unregistered Buyer

Here is the list of circumstances where an e-way bill can be generated by an Unregistered Buyer

- When neither the consignor nor the transporter has generated an e-way bill

- When the supplier is an unregistered dealer under GST.

- When an unregistered buyer is moving goods under ex-works contracts.

- When the conveyance belongs to an unregistered buyer.

How to Generate E-way Bill for Unregistered Buyer?

Here is a step-by-step guide using which an unregistered buyer can easily generate an e-way bill:

Step 1: Open the e-way bill portal.

Step 2: From the top-most menu bar click on the Registration tab and select E-way Bill for Citizens option.

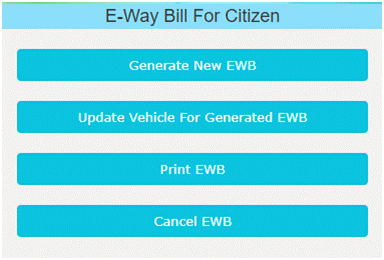

Step 3: Once you click on that e-way bill for citizens, select Generate New EWB option.

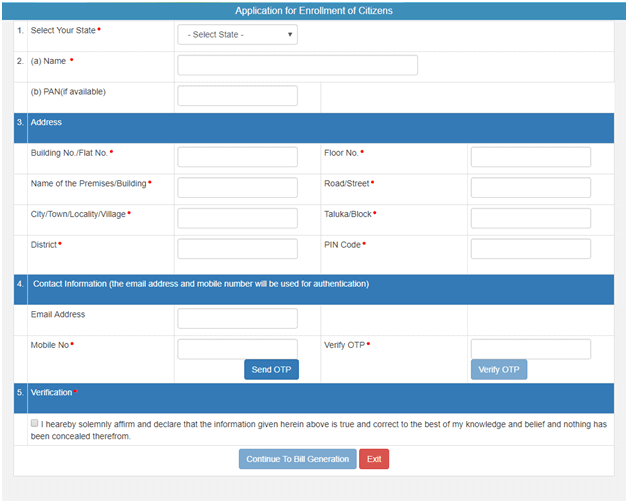

Step 4: Furnish all the required details for e-way bill registration such as:

- State

- Name

- Address

- Contact Details

Step 5: Enter the OTP received on the mobile number added in the contact information and verify OTP.

Step 6: Click on the verification box to Continue to Bill Generation.

Step 7: Now enter the mandatory consignment and vehicle details:

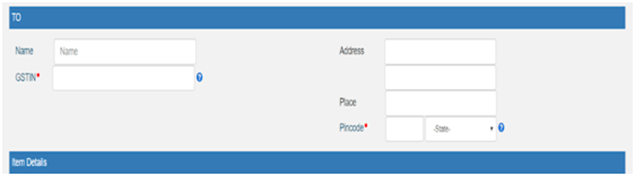

1. The Mandatory field in the ‘To’ section

GSTIN: In this field enter the GSTIN or URP in case of an unregistered person.

PIN and State: Pin of the place where goods are being sent to.

2. The Mandatory field in ‘From’ section:

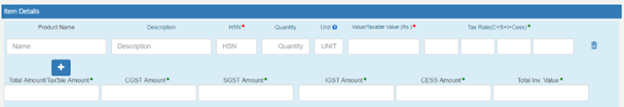

i. Product name and description

ii. HSN code

iii. Quantity

iv. Taxable value

v. GST break-up

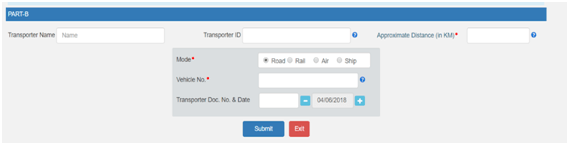

3. The Mandatory fields in Part B of E-way bill form

i. Approximate Distance

ii. Mode of conveyance

iii. Vehicle number

iv. Transporter’s details

Step 8: Click on the Submit button to generate a 12-digit e-way bill number.

Step 9: The unregistered buyer can also print the generated e-way bill by clicking on the Print EWB option.

Note: As an unregistered buyer always carry a copy of generated e-way bill while transporting the consignment of goods.

One Reply to “How to Generate E-way Bill for Unregistered Buyer?”

when supplier is URP then which types invoice will be generated to consignee

taxable amount will be show or without taxable amount invoice will be generated to consignee ???