GST FORM ANX-2

Invoices uploaded by the supplier in ANX 1 will be auto populated in ANX 2 for Receiver in real time basis.

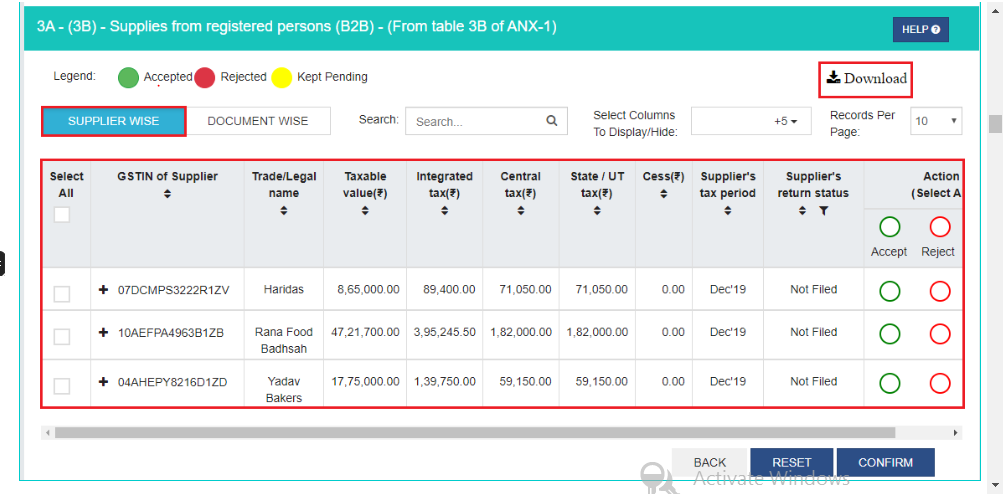

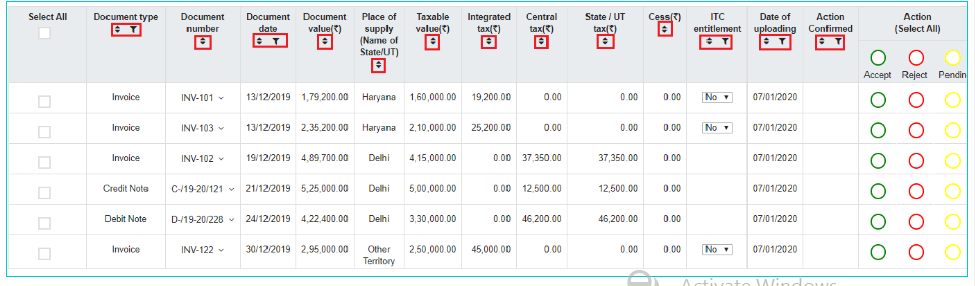

Receiver can be verify invoices and can be taken action accept, reject and pending on invoices.

You can sort and filter any column name with provided icons below the column names.

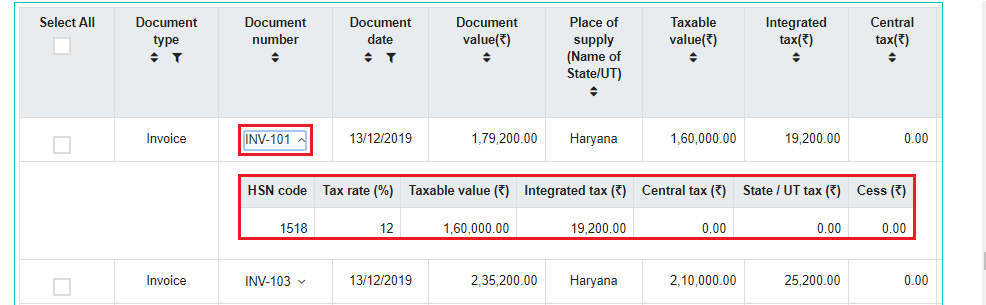

In the document number column, click on expand button you can view the item details.

You can select all invoice, click on all select option Accept, Reject or Pending check box.

- Take Accept action if document is correct and ITC can be availed on the document.

- Take Reject action if document is incorrect, then the document will flow into ANX-1 of the supplier for correction.

- Take Pending action if ITC cannot be availed in the current tax period due to any reasons such as supplies not yet received etc.

- If RET-1 is filed without taking any actions on any such invoices in ANX-2 then documents will be deemed accepted for claiming ITC.

Select Yes or No for ITC entitlement

- For Inter-State Supply where place of supply different from your registered state you can select for ITC entitlement as Yes, By default it is No.

You can take actions and confirm them from the Document wise or Supplier Wise Tab

You can Reset your selection of actions then can make new selections.