Automate E-Way Bills, Shorter delivery of goods, Auto population of GSTR1

Create GST compliant e-invoices, high volume e-invoice automation with single click import

Build your own GST and EWB compliance application through GSTrobo enriched APIs

Business Insights beyond return filing, understand your sales and marketing budget, probability of audit based on potential sales and expenses for the coming year.

Many tools based on open API provided by GSTN network such as GSTN Search, HSN Code search, GST return status etc.

750

Satisfied Customers

6092491

e-Invoices Generated

2129199

e-Way bills Generated

5232

Returns Filed

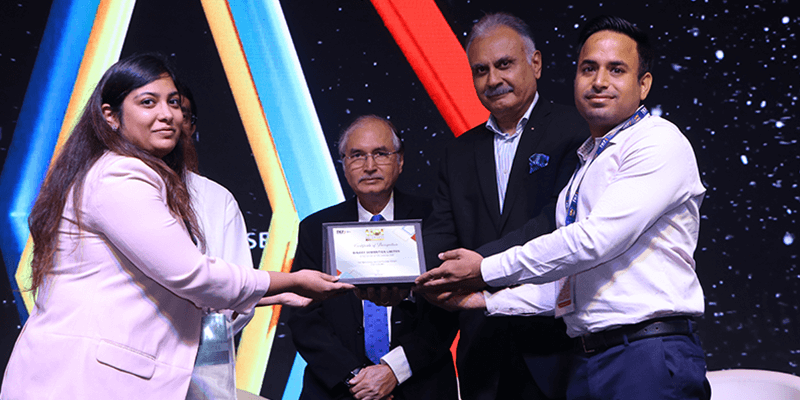

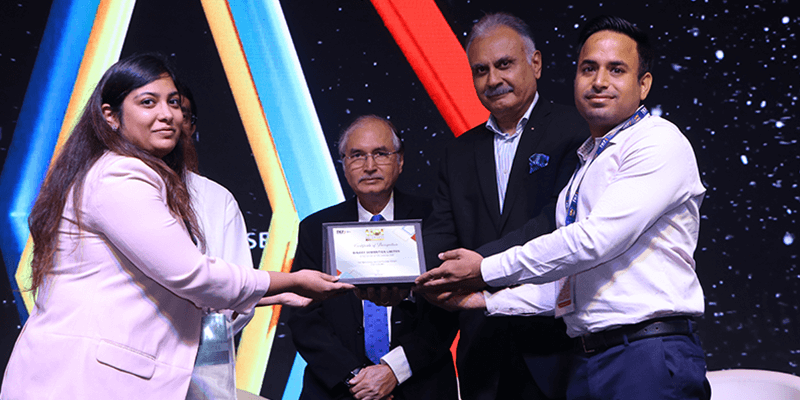

GSTrobo won Jury Award for "Tax Tech Service Provider" at 3rd TIOL National Taxation Awards, 2022

GSTrobo won Silver Award for "Tax Tech Service Provider" at 4th TIOL National Taxation Awards, 2023

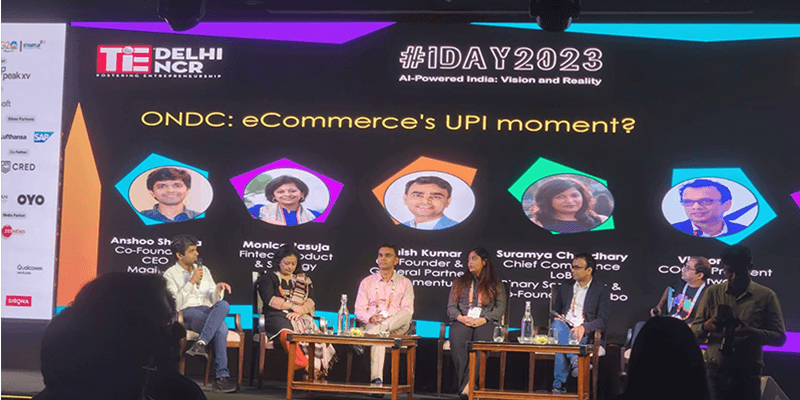

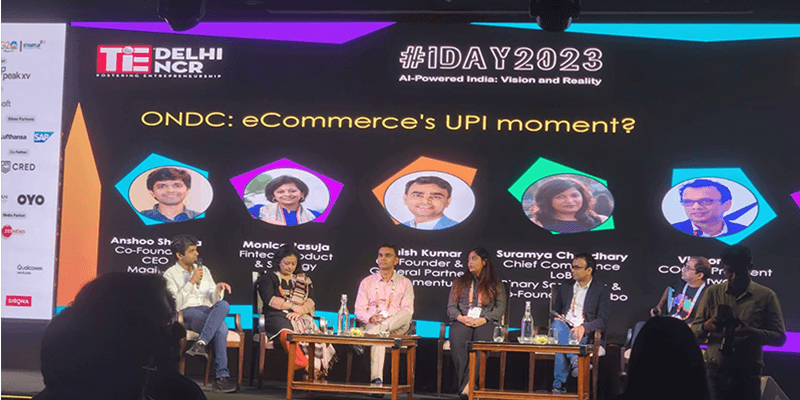

Driving The Dialogue - Presence At The Finance Realms

GSTrobo won Jury Award for "Tax Tech Service Provider" at 3rd TIOL National Taxation Awards, 2023

GSTrobo won Silver Award for "Tax Tech Service Provider" at 4th TIOL National Taxation Awards, 2023

Driving The Dialogue - Presence At The Finance Realms

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration.

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration.

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration.

We have been using different products of Binary Semantics such as Fleetrobo and DMS. Before GSTRobo, we were doing lots of tasks manually such as e-way bill generation and GST reconciliation. Thanks to their software we have saved a lot of manual work and man-hours. This has reduced our cost and GST-compliance risk.

We chose GSTrobo due to its easy-to-use interface & ability to handle a large number of transactions seamlessly. The main benefit of using GSTrobo is that it saves time & you are assured of its accuracy. Moreover, it was a good experience while working with the support team of GSTrobo as they solve any issues within minutes.

Manual generation of E-way bills during the April-2018 implementation was time-consuming and error-prone. GSTrobo allows us to automate the process and save time and manpower. There is only relevant information in it, and it is easy to understand and use. Furthermore, the Manual e-Way Bill Window allows you to generate a Manual E-Way Bill very quickly by using the same address as consignor.

We did not have proper back-end support & AMC service is also a bit expensive. GSTrobo is well-known tax compliance software. It provided us with excellent pricing options according to our requirements, with adequate back-end support. My experience with GSTrobo was pleasant, solving all my problems by providing end-to-end solutions. GSTrobo software & other utilities help us to comply with deadlines in an efficient & effective manner.